Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 18 September 2018 00:00 - - {{hitsCtrl.values.hits}}

By Audrey Goh

It is understandable that bond investors are worried as the economic cycle matures, especially in the US, and as the Fed continues to hike interest rates gradually. Conceptually, as we head towards the late stage of an economic cycle, corporate profitability (and their ability to repay bond holders) typically peaks. Meanwhile, rising policy rates in the US may often act as a headwind for bonds, especially longer tenor bonds, which are more sensitive to rising interest rates.

These risks appear accentuated by historically high valuations in some bond markets and the possibility of rising inflation, after years of calm, eating away still-meagre bond yields.

Given the risks, the typical response by some bond investors is to either 1) shift to shorter tenor bonds, or even to cash, or 2) take on more credit risks by investing in corporate bonds, which tend to do better when growth is still accelerating and interest rates are gradually rising.

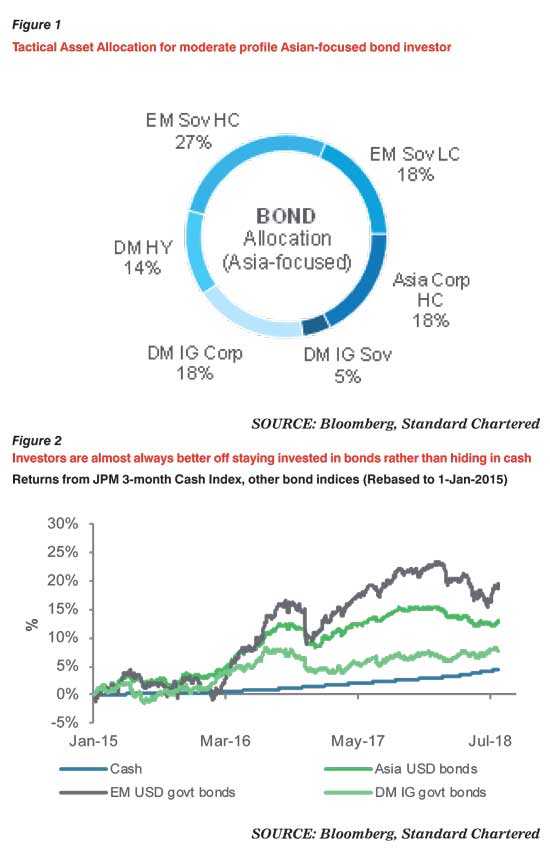

We believe neither of the approaches on its own is prudent. In the first case, investors ignore the longer-term benefits of staying the course. In the second, the focus is too much on the interest rate cycle, but not enough on the credit cycle. Since the two cycles are related, one way to address the seemingly conflicting risks is to adopt a diversified bond allocation (Figure 1).

Let’s take the pitfalls of the first approach. Shifting lock-stock-and-barrel to extremely short-tenor bonds due to their lower sensitivity to interest rates may not be the optimal decision, because such a move will expose the allocation to the so-called reinvestment risk – the risk of having to invest the proceeds of a maturing bond into debt instruments offering lower yields as the economy eventually slows down. We believe, maintaining a bond allocation with an average tenor of around five years would help to mitigate the reinvestment risk.

By staying the course and sticking with a moderate maturity allocation profile, investors will be reinvesting the coupons received from existing bond holdings into bonds offering higher yields as interest rates rise. The rising yields earned over time are likely to make up for the initial capital loss suffered on a bond as a result of the rise in yields (Figure 2).

The second approach ignores the credit cycle, while focussing too much on the interest rate cycle. Under this scenario, investors tend to take on excessive credit risk.

The prudent course here would be to follow a diversified allocation that allows an investor to take on selective credit risks (for instance, in Developed Market (DM) high yield bonds or Emerging Market (EM) government or corporate bonds) without betting the farm on these markets. These bonds tend to do well when growth is still accelerating in the late stage of an economic cycle and global interest rates are rising gradually.

For sure, there are challenges confronting select EMs, notably those with high fiscal and current account deficits and with low foreign exchange reserves in relation to their short-term debt obligations. However, we believe fundamentals in the broader EM universe remain robust, especially in Asia ex-Japan. Hence, it may still make sense to take on some risk in EM USD government bonds in the current environment. EM USD bonds offer attractive value and a yield in excess of 6%. They tend to do well when economic growth is accelerating and when the Fed is in a gradual rate hiking mode.

However, make no mistake that higher US policy rates will eventually lead to a slowdown in growth and unwind the credit cycle. Thus, balancing pro-growth exposure with higher quality corporate bonds (we prefer Investment Grade bonds in Asia and also in DMs), and even a small allocation to government bonds, can help mitigate risks late in the cycle. The higher yields on offer from EM and corporate bonds can help buttress some of the bond price drawdown caused by rising yields; but, by limiting the exposure through a diversified allocation, we can ensure investors do not take on excessive credit risk towards the end of an economic cycle.

We invest in bonds primarily with the objective of preserving our savings and earning some income. Hence, while higher yields may act as a headwind, investors who stay the course on their diversified bond strategy are likely to be better off in riding through a late-cycle, rising-rates environment.

(Audrey Goh is Senior Cross-Asset Strategist at Standard Chartered Private Bank.)