Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 13 May 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury bond auctions conducted yesterday recorded a strong outcome as its total accepted amount was seen exceeding 90% for only the third time during the course of the past eight auctions conducted during the year 2021. The total accepted amount across two maturities was 97.50% as the 01.05.2025 maturity of Rs.10 billion was fully subscribed at its 1st phase of the auction while the 01.05.2028 drew Rs.9.50 billion in successful bids at its 1st and 2nd phase against its offered amount of Rs.10 billion.

The Treasury bond auctions conducted yesterday recorded a strong outcome as its total accepted amount was seen exceeding 90% for only the third time during the course of the past eight auctions conducted during the year 2021. The total accepted amount across two maturities was 97.50% as the 01.05.2025 maturity of Rs.10 billion was fully subscribed at its 1st phase of the auction while the 01.05.2028 drew Rs.9.50 billion in successful bids at its 1st and 2nd phase against its offered amount of Rs.10 billion.

The maturity of 01.05.2025 recorded a weighted average rate of 7.04%, below its stipulated cut off rate of 7.07% while the maturity of 01.05.2028 fetched a weighted average rate of 7.97%, against its stipulated cut off rate of 7.98%. The bids to offer ratio of 2.08:1 was the highest over the past eight bond auctions.

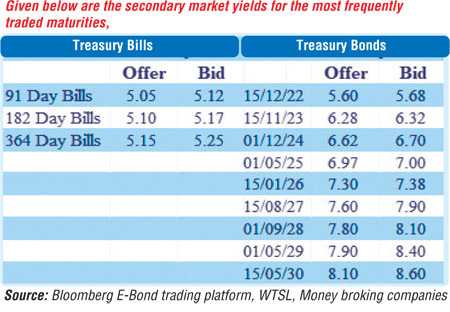

In secondary bond markets, activity remained moderate with limited trades seen on the 01.10.22, 15.01.23, 01.09.23, 01.10.23, 15.11.23 and 01.08.26 maturities at yields of 5.62%, 5.70% to 5.72%, 6.21%, 6.25%, 6.30% and 7.54% to 7.55% respectively. The 01.05.25 maturity was seen changing hands at 7.00% subsequent to its auction outcome. In secondary bills, July and August 2021 maturities changed hands at levels of 5.04% and 5.11% to 5.12% respectively.

The total secondary market Treasury bond/bill transacted volume for 11th of May 2021 was Rs.16.62 billion. In the money market, overnight net surplus liquidity decreased to Rs.132.67 billion yesterday while the weighted average rates on overnight call money and repo was registered at 4.66% and 4.69% respectively.

USD/LKR

The Forex market continued to remain inactive yesterday. The USD/LKR on 01 Month forward contracts saw continued buying interest at Rs.199.90.

The total USD/LKR traded volume for 11th May 2021 was US $ 74.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)