Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 21 September 2018 00:00 - - {{hitsCtrl.values.hits}}

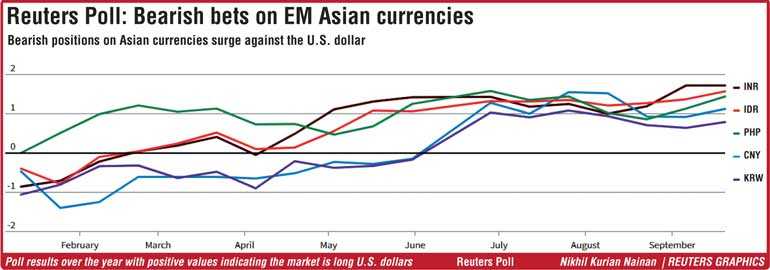

Reuters: Bets that most Asian currencies will continue to come under pressure from a strong dollar and the intensifying Sino-US trade war have risen over the last two weeks, a Reuters poll showed.

Reuters: Bets that most Asian currencies will continue to come under pressure from a strong dollar and the intensifying Sino-US trade war have risen over the last two weeks, a Reuters poll showed.

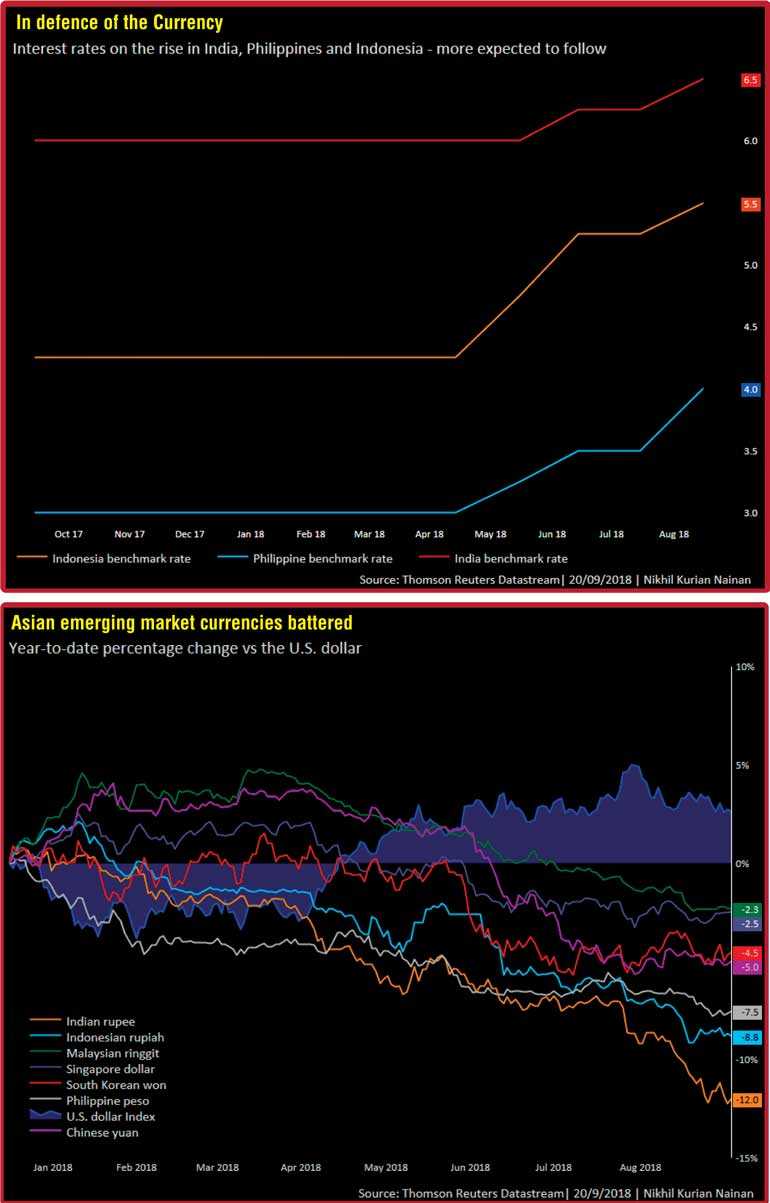

An environment of heightened volatility has gripped some of Asia’s largest economies, especially those with large current account deficits and also highly susceptible to foreign outflows, in stark contrast to the United States, where buoyant economic conditions have proved to be a magnet.

All in all, despite pockets of hope that global trade tensions or their influence on markets may ease, these frictions have only served to enhance the concerns that domestic economies face, causing their respective currencies to weaken.

“When the US President announced the latest round of tariffs on Chinese imports this week, markets didn’t do an awful lot. Like many episodic market drivers, there comes a point when incremental changes cease to have much economic impact,” ING said in a note.

Among the worst hit has been the beleaguered Indonesian rupiah, in which most of the 10 respondents in the poll upped their short positions to their highest since 2013.

Several attempts to rein in the rupiah have fallen short. Even hawkish intervention from the central bank, coupled with measures taken by the government seem unable to stem the rupiah’s decline, making it the second-worst performer in the region.

Tariffs have seemingly become the new normal as countries shift towards protectionism. Southeast Asia’s largest economy, which has one of the region’s most active central banks, is no different. Earlier this month, it imposed tariffs on 1,000-plus goods to curtail imports, while rates have been hiked four times so far this year.

Indonesia is not alone in raising rates to curb inflation and stem outflows. The Philippines has upped its rates by 100 basis points over three hikes, while India has done so twice.

In the case of the Indian rupee, which shed about 12 percent this year, investors have remained ambivalent since the last poll on Sept. 6, when bearish bets on the currency were at their highest in five years.

The rupee has hit successive record lows over the last few weeks, raising expectations that the Reserve Bank of India (RBI) will need to hike rates at least two more times this year to shore up Asia’s worst performer, given that earlier efforts failed to instil confidence. The RBI meets next on Oct. 5.

“There is a perception that measures thus far to promote capital inflows are not as strong as those introduced in 2013 during the depths of the taper tantrum,” said Wei Liang Chang, FX strategist at Mizuho Bank, referring to the Federal Reserve’s move to reduce the amount of money it was introducing into the economy.

Without a more forceful RBI, the rupee could weaken further, and a rate hike is necessary to stabilise sentiment, but its impact may be diminished somewhat as oil prices keep rising, he added.

In the Philippines, short positions on the peso have risen to highs not seen since June as the country continues to reel under emerging market stress.

Inflation, one of its key challenges, is well above the central bank’s target range, sitting at 6.4 percent in August with policymakers signalling the need for a fourth rate hike, which could come as early as its Sept. 27 meeting.

Bangko Sentral ng Pilipinas Governor Nestor Espenilla said bringing inflation back to the 2-4 percent target range was his most urgent task.

Meanwhile, after a brief retreat by bearish market participants, short positions on the Chinese yuan have risen to their highest in a month as the trade war with the United States shows no signs of abating.

Despite Premier Li Keqiang on Wednesday assuring investors that China would not stoop to competitive devaluation, fears remain that Beijing is running out of room to respond to any further US tariffs on a dollar-for-dollar basis.

The Asian currency positioning poll is focused on what analysts and fund managers believe are the current market positions in nine Asian emerging market currencies: Chinese yuan, South Korean won, Singapore dollar, Indonesian rupiah, Taiwan dollar, Indian rupee, Philippine peso, Malaysian ringgit and the Thai baht.

The poll uses estimates of net long or short positions on a scale of minus 3 to plus 3. A score of plus 3 indicates the market is significantly long US dollars.

The figures include positions held through non-deliverable forwards (NDFs).