Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 2 July 2019 00:00 - - {{hitsCtrl.values.hits}}

Key insights to how the banking sector performed in 2018 as well trends and challenges going forward are highlighted in the KPMG’s just released third Sri Lanka Banking Report.

“The banking industry in Sri Lanka tells a story of resilience and strength as the 2018 year came to a close,” states KPMG Head of Banking Services and Markets, Deputy Head of Audit Ranjani Joseph in her foreword to the report.

The geopolitics of the country have changed in unexpected and unforeseen ways during the year, as well as external pressures on operations such as Fed rate hikes and a sovereign downgrade by external credit rating agencies, amidst the challenges of implementing SLFRS 9 as well as complying with BASEL III requirements. Bankers had to deal with challenges from multiple fronts, social, economic and technological, during the year which would continue in the coming year as well and dynamic resilience is needed to navigate through these significant challenges/opportunities. Looking ahead would be a story of reconciliation, rebuilding and resilience as Sri Lankans, and the banking sector would have a vital role to play in this, Joseph noted.

According to her, the proliferation of fintech and technology is a double edged sword which would give banks the necessary wherewithal to increase ever-thinning margins, but would need regulatory and supervisory oversight to be safe and sustainable in the long term.

In this latest Report, KPMG addresses the ever changing role of the banking boards in the future, as well as an interview with the Governor of the Central Bank of Sri Lanka to understand the regulatory perspective. It also features discussions with the CEOs of the two largest private banks in the country in an effort to understand first hand their views on the future of banking.

Overall, with tables and graphs, the report analyses a host of key performance indicators of the banking sector and discusses in detail the key issues which KPMG feels could have an impact on the sector this year. Following are some highlights.

Executive Summary

Sri Lanka’s economic growth continued to be slower than potential in 2018 despite slight recovery in the agricultural sector and improved service sector performance – overshadowed by modest industrial sector performance due to contraction in construction and manufacturing activity.

Fiscal discipline and monetary policy tightening had a short term impact on growth, as the Government of Sri Lanka (GoSL) and monetary authorities attempted to improve economic fundamentals and guide the economy to a sustainable path of growth. The policy stance taken by Central Bank of Sri Lanka (CBSL) in strengthening the fundamentals of the economy should be commended.

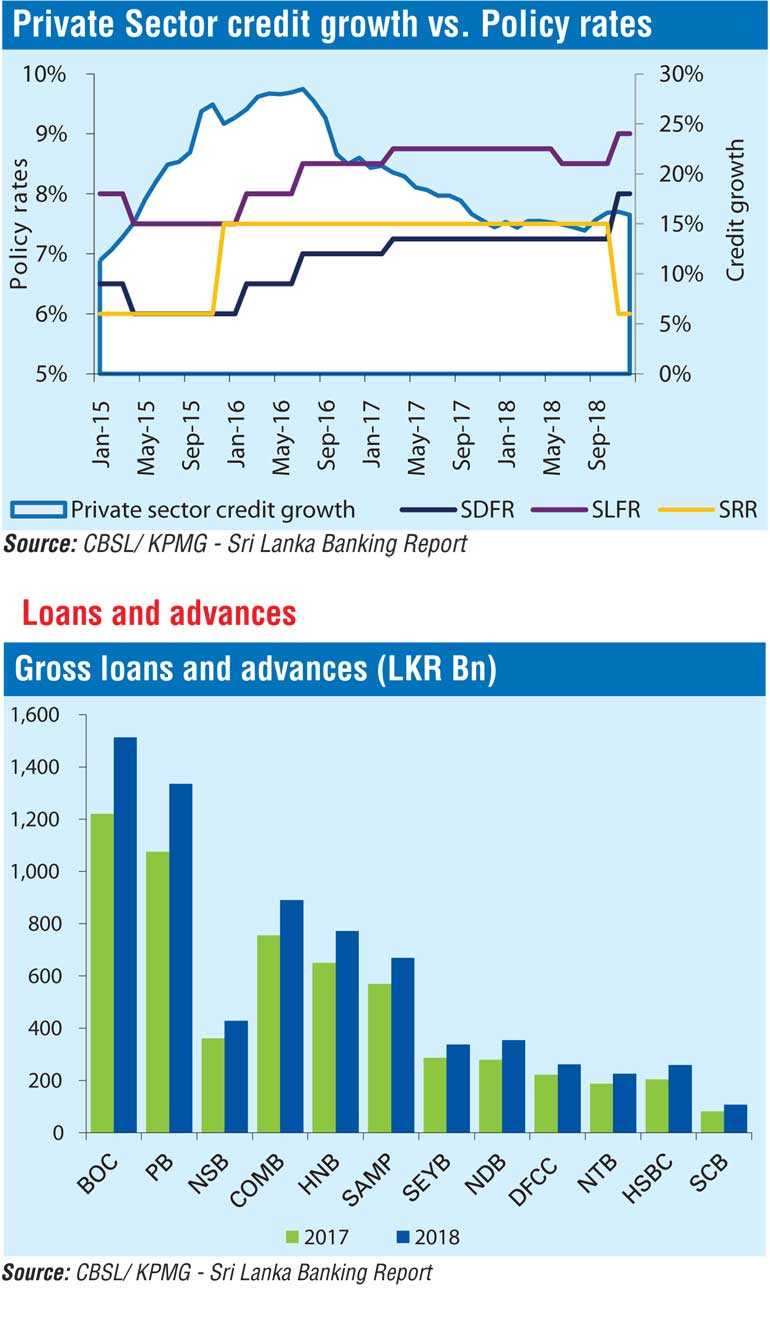

The effects of this transition phase was felt throughout the banking sector as private sector credit growth slowed, leading to industry wide slowdown in loans and advances.

CBSL resorted to a “wait and see approach”, regularly exercising a neutral stance on policy rates. However, due to sluggish economic activity and rising lending rates, the CBSL was forced to inject liquidity to keep market rates suppressed.

The implementation of SLFRS 9 and Basel III to improve the quality of the banking sector in the long term, proved challenging especially with the steep increase in Non-Performing Loans (NPLs) in the short/medium term. The banks of the future would need to increasingly consider automation and consolidation of operations to reduce operating costs to improve profitability in a business world which is moving towards digital transformation and digital disruption to be a way of life.

In this context, the challenge for bank CEOs in the next decade would increasingly be talent management to fit the changing face of banking. This would include realigning the existing skill sets of the talent pool by upskilling them in the shortest time possible while focusing on recruiting the right talent for long term succession. Culture of the organisation would need to be managed to fit the changes in the skills required and this would be a challenge to the people standing at the helm of the ship.

In the last two years, Sri Lankan capital markets saw increased activity as the banking sector issued several capital calls to meet Basel III requirements. In addition, introduction of the Debt Repayment Levy (DRL) exacerbated the situation as banking sector Return on Equity (ROE) declined.

Potential recovery in private sector credit growth and lower market lending rates are positive signs and are expected to ease pressure on the sector. Normalised impact from impairments, steady recovery in agriculture, construction and manufacturing sectors should see banking profitability improve. External sector risk profile will depend on ability to service upcoming debt repayments. Strict fiscal discipline and timely monetary policy is of utmost importance as it can ensure a smooth transition to a sustainable path of growth. The last few weeks has seen turbulence in a scale that was unprecedented but as an economy and a country we need to bounce back once again. Towards this there are several relief measures provided by the GoSL which include temporary debt moratorium and subsidised working capital for the tourism sector and relief in classification of loans to SME sector (within a stipulated threshold). We estimate the impact of these measures to be considerable for the Banking sector as a whole. Fiscal discipline and monetary policy in the near term would also need to consider these disaster recovery initiatives.

Banking sector outlook

Turbulent economic and geopolitical conditions, transition to SLFRS 9 and Basel III requirements made 2018 a reasonably challenging year for the banking sector. Sri Lanka’s economic growth remained below expectation with a moderate GDP growth of 3.2% in 2018. The agricultural sector was handicapped by adverse weather conditions, the industrial sector was docked with higher production costs due to depreciation of LKR and rising global commodity prices due to a brewing trade war between US and China. These indirectly exerted pressure on bankers bottom-line due to growing impairment. Monetary and fiscal policies continue to be mired as their importance was understood in the context.

The CBSL maintained its tightening policy stance during 2017. In support of ongoing fiscal consolidation, CBSL tightened monetary policy during 2018. However, following the favourable reduction in inflation levels and widening output gap, CBSL decided to revise the trend through reducing the Standing Lending Facility Rate (SLFR) by 25 basis points to 8.50% in April 2018.

The rate cut was also supported by an increase in short term interest rates and corresponding volatility. Market liquidity declined following attempts by CBSL to accumulate foreign reserves and reduce private sector credit growth to desirable levels, leading to upward pressure on market lending rates despite efforts made by the regulator to keep rates down. However, in maintaining neutral policy stance, Standing Deposit Facility Rate (SDFR) was raised by 75 basis points to 8.0% and the Standing Lending Facility Rate (SLFR) by 50 basis points to 9.0% by the end of 2018. In November 2018, the Statutory Reserve Ratio (SRR) applicable on all rupee deposits was reduced from 7.5% to 6.0% to increase market liquidity and artificially reduce market rates.

Monetary tightening in advanced economies led to significant outflows from emerging markets in the latter half of 2018.

The impact on the LKR was exacerbated by a cluster of upcoming debt repayments in 2019. Rapid depreciation of the exchange rate and imminent import curtailing policies announced by the regulator prompted higher private sector credit growth in September 2018. The events that transpired in late October 2018, effectively derailed GoSL efforts in improving economic fundamentals and investor confidence. International credit agencies downgraded sovereign debt spiralling the economy into deeper crisis.

Deteriorating investor confidence led to further fund outflows from the country. In addition, the ongoing Extended Fund Facility (EFF) program with IMF which has been a key pillar in all reforms made over the past 3 years was suspended due to the political crisis, later reinstated in March 2019.

Although CBSL maintained its tight monetary policy stance for much of the year, it resorted to Open Market Operations (OMO) to control market liquidity.

Market interest rates consolidated at higher levels for majority of the year. As a result, credit extended to the private sector by commercial banks decelerated in 2018. In May 2018, private sector credit recorded 15.0% growth, achieving desired levels of CBSL and further declined to 14.3% in August 2018. In 2H 2018, with the objective of curtailing excessive import expenditure, 200.0% LC margin on vehicle imports was imposed while lowering the Loan to Value (LTV) ratio of the same. In addition, 100.0% cash margin requirement was imposed on imports of selected consumer durable goods from October 2018. The anticipation of these policies prompted acceleration of credit growth which increased to 16.2% in November 2018 and closed 2018 at 15.9%.

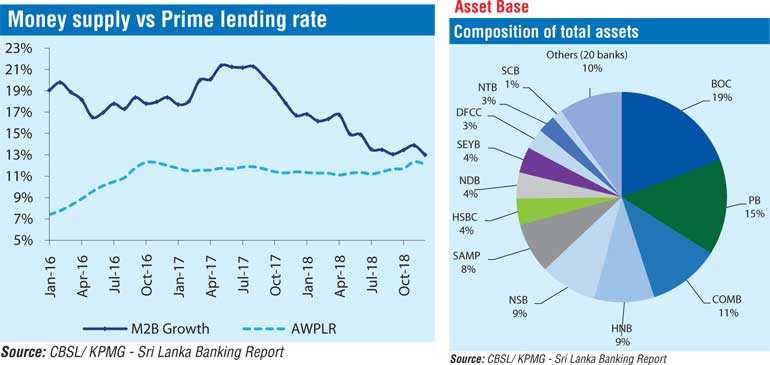

In order to maintain the current trend in credit growth, the CBSL is likely to either reduce benchmark policy rates or reduce the margin between benchmark rates and the average prime lending rate (AWPLR). However given the current trends in global financial markets, trade balance and well anchored inflation and inflation expectations it is more likely that CBSL would opt for a policy interest rate reduction in the period ahead.

In 2018, directions were issued on the adoption of SLFRS 9 and Basel III requirements where pillar 1 requires banks to comply with increased minimum capital requirements and buffers. Licensed Commercial Banks (LCBs) with assets over Rs. 500 b should have Common Equity Tier (CET) I, Tier I and Tier I + II capital ratios of 8.5%, 10.0% and 14.0% respectively as at 01 January 2019. LCB’s with assets less than LKR 500Bn should maintain CET I, Tier I and Tier I + II capital ratios at 7.0%, 8.5% and 12.5% respectively as at 01 January 2019.

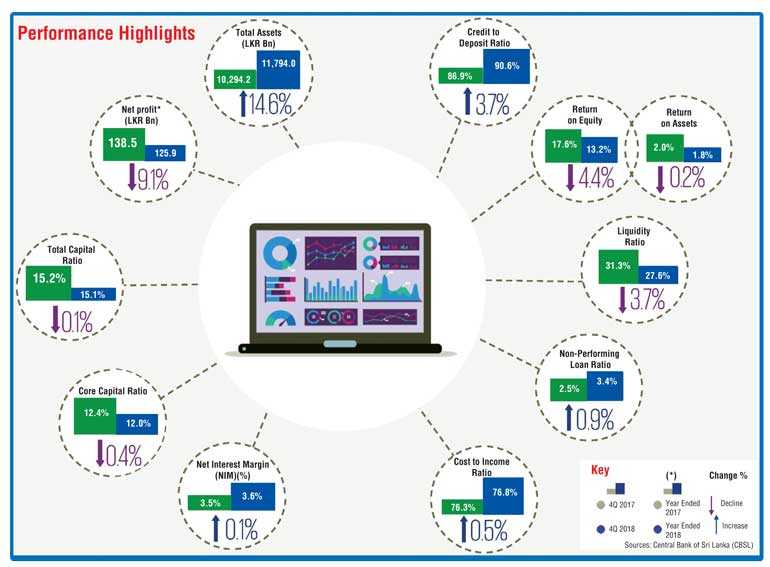

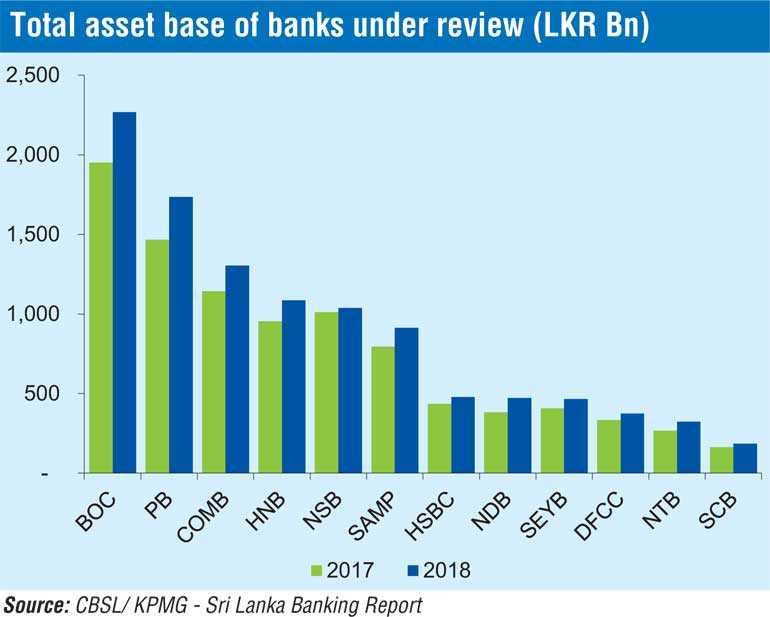

Amidst the pressure from external factors, the total assets of the banking sector expanded by 14.6% in 2018 to Rs. 11.8 t, reflecting convincing growth in comparison to 13.8% growth in 2017. Gross loans and advances grew by 19.6% in 2018 compared to 16.1% in 2017 mainly due to growth in term loans and overdrafts.

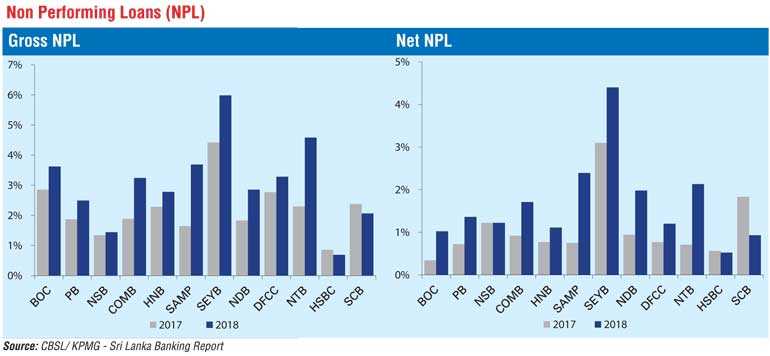

Nevertheless, the banking sector experienced significant deterioration in asset quality during the year evident by the increase in gross and net non-performing loan (NPL) ratios to 3.4% and 2.0% respectively from 2.5% and 1.3% a year ago.

NPL ratio of 5.3% was reported from agriculture, forestry and fishing, 5.2% from manufacturing, 4.7% from tourism, 4.7% from wholesale retail trade and 4.6% from information technology and communication services as at end 2018.

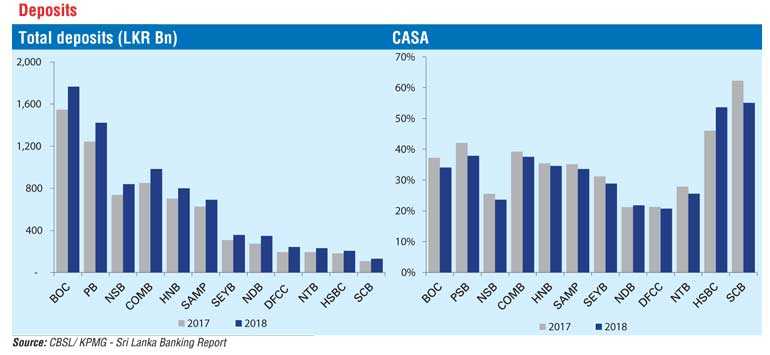

Banking sector deposit growth moderated to 14.8% in 2018 from 17.5% in 2017. Due to the widening interest rate gap between current accounts and savings accounts (CASA) compared to time deposits, banking sector CASA ratio declined to 32.3% in 2018 from 34.4% in 2017.

Banking sector net interest income expanded by 16.3% in 2018 due to higher market interest rates growing at a faster pace than deposit rates.

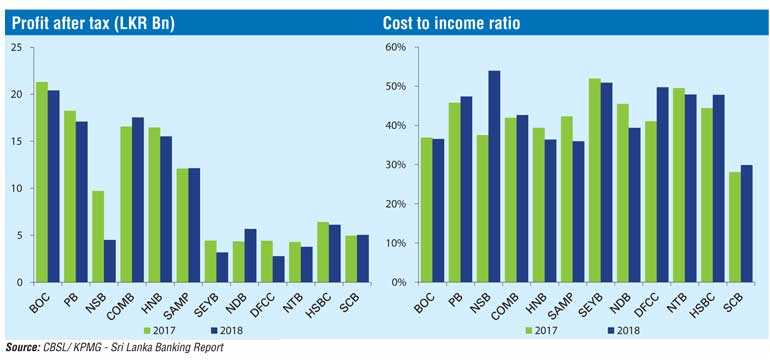

However, banking sector profits came under significant pressure from additional impairment provisions coupled with an increased tax burden from the implementation of the new Inland Revenue Act effective from April 2018 and the introduction of Debt Repayment Levy effective from October 2018. Overall, banking sector profits declined by 9.1% in 2018 compared to significant growth of 18.9% in 2017. Further the sector ROE’s are likely to remain subdued and unattractive to investors due to capital raising efforts made by banks in meeting and exceeding capital requirements.

The banking sector consisted of 25 Licensed Commercial Banks (LCBs), and seven Licensed Specialised Banks (LSBs) as at 31 December 2018. The growth in assets of the banking sector in 2018 outpaced that of the corresponding period in 2017.

The total asset base of the banking sector increased by 14.6% over the past year from Rs. 10.3 t in 2017 to Rs. 11.8 t by the end of 2018. Domestic Systemically Important Banks (DSIBs) held 62% of total sector assets as at the end of 2018.

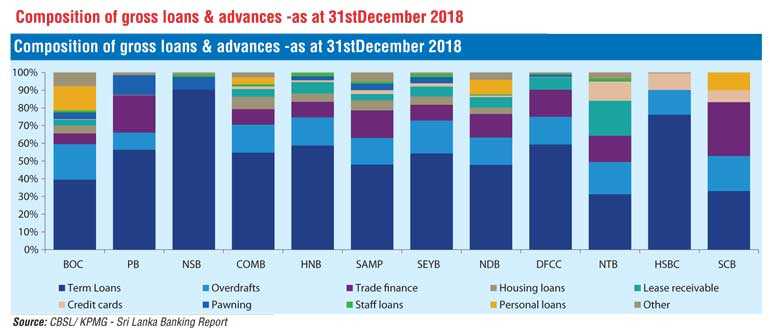

Total gross loans and advances of the banking sector grew by 19.6% to Rs. 7.6 t reflecting a significant increase from 16.1% growth in 2017. A major portion of the said increase was generated by the two large State banks.

Domestic currency loans and advances accounted for 80.0% of total loans and advances, growing at 17.2%. We expect sector loans and advances to grow at a slower pace in 2019 due to sluggish economic conditions and slower private sector credit growth.

Term loans and overdrafts contributed the most to credit growth. These loans accounted for 66% of total DSIB loans and advances amounting to Rs. 3.6 t.

Trade finance contributed an increased share of credit growth, accounting for 12% of DSIB loans and advances. The gross NPL ratio of the banking sector accelerated throughout the year in 2018. Gross NPL ratio increased to 3.4% in 2018 from 2.5% in 2017. This was largely arising from the construction industry related advances and implementation of SLFRS 9 standard.

We expect credit quality to remain under pressure as the economy struggles to post a turnaround in activity.

Total deposits of the banking sector increased by 14.8% in 2018 to Rs. 8.5 t. This reflects moderated growth compared to 17.5% observed in 2017. LKR deposits grew by 13.3% compared to 18.6% growth in 2017.

LKR time deposits accounted for 66.2% of total LKR deposits, an increase from 63.8% in 2017 –indicative of the higher market interest rates.

Foreign currency deposits increased with 22.8% growth, up from 12.2% growth in 2017, mainly driven by surge in time deposits.

Accordingly, with a transfer of deposits to high cost brackets like time deposits, banking sector CASA ratio declined to 32.3% in 2018 from 34.4% in 2017.

The overall banking sector saw Net Interest Income (NII) increase of 16.3% in 2018, resulting from a 14.0% increase in interest income and a 12.8% increase in interest expenses. The sector Net Interest Margins (NIMs) improved marginally to 3.6% in 2018 from 3.5% in 2017, amidst high interest rates during 2018.

Out of the banks under review, NDB, SAMP, NTB recorded the highest increments in NII in 2018 growing at 37.7%, 34.2% and 28.8% respectively. Timely repricing of asset and liability portfolios coupled with growth in loan books supported this growth. However, NSB saw its NII decline by 1.0% in 2018 as higher increase in interest expense over interest income exerted pressure on margins.

Profit after taxation (PAT) of the sector fell 9.1% in 2018 as a result of higher impairment provisions and increased tax burden from the new Inland Revenue Act weighing down on earnings.

The shift in provisioning models from ‘Incurred Credit Loss Model’ to ‘Expected Credit Loss Model’ as per SLFRS 9 -Financial Instruments, from January 2018 onwards saw the impairment expense of banks increasing significantly. Further, the deterioration of asset quality during the period added on to higher impairments.

The implementation of the Debt Repayment Levy from October 2018 on value added basis further dampened earnings of the sector.

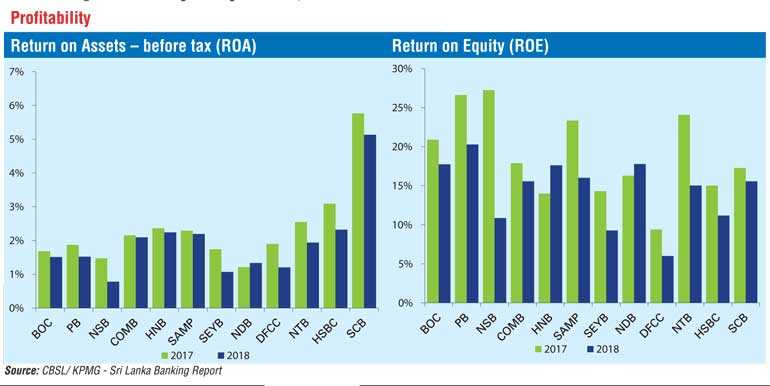

The fall in sector earnings coupled with the increase in asset bases of banks resulted in overall banking sector RoA (before tax) fell to 1.8% by end 2018 compared to 2.0% a year earlier.

On a similar note, the falling earnings coupled with increased equity bases (due to increased capital adequacy requirements) saw the sector RoE falling significantly to 13.2% as at end 2018 from 17.6% a year earlier.

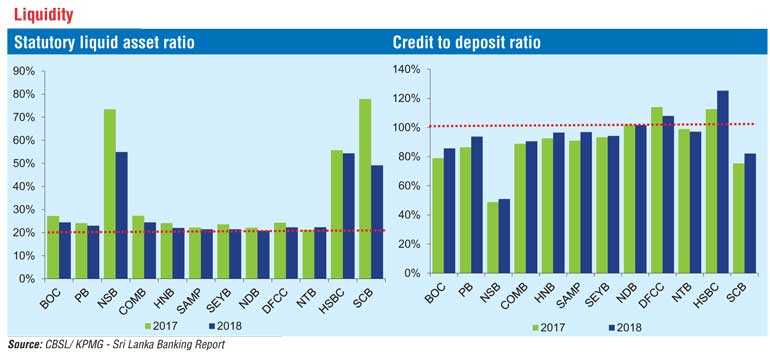

The statutory liquid Asset Ratio (SLAR) of domestic banking units reduced to 27.6% as at end 2018 from 31.3% as at end 2017. However the sector SLAR is still higher than the regulatory minimum of 20.0%.

The credit to deposit ratio of the sector increased to 90.6% as at end 2018 compared to 86.9% as at end 2017. Local banks excluding NDB and DFCC (which transformed from being development banks to LCBs) maintained credit to deposit ratios below 100%.