Monday Mar 09, 2026

Monday Mar 09, 2026

Wednesday, 30 October 2019 00:50 - - {{hitsCtrl.values.hits}}

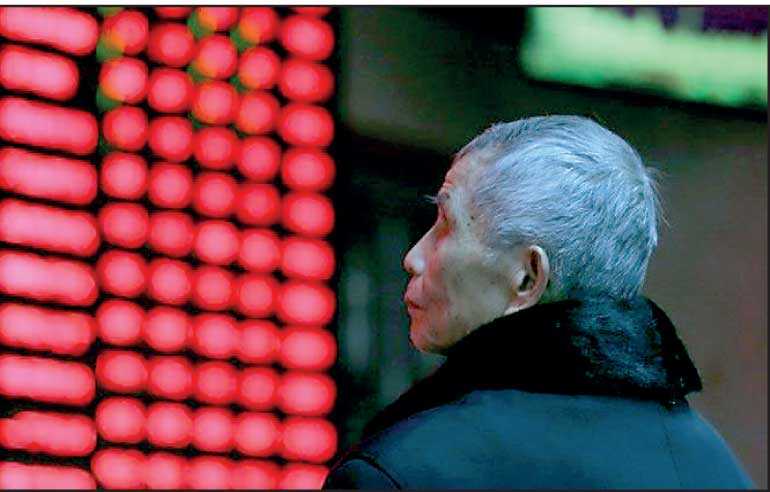

SYDNEY (Reuters): Asian shares scaled a three-month high on Tuesday after Wall Street hit all-time peaks amid hopes of progress in Sino-US trade talks and for another dose of policy stimulus from the Federal Reserve this week. Japan’s Nikkei led the way with a rise of 0.6% to reach ground last trod a full year ago. MSCI’s broadest index of Asia-Pacific shares outside Japan crept up 0.2% in early trade to its highest since late July.

SYDNEY (Reuters): Asian shares scaled a three-month high on Tuesday after Wall Street hit all-time peaks amid hopes of progress in Sino-US trade talks and for another dose of policy stimulus from the Federal Reserve this week. Japan’s Nikkei led the way with a rise of 0.6% to reach ground last trod a full year ago. MSCI’s broadest index of Asia-Pacific shares outside Japan crept up 0.2% in early trade to its highest since late July.

E-Mini futures for the S&P 500 ESc1 extended their gains by 0.1%.

US President Donald Trump said on Monday he expected to sign a significant part of the trade deal with China ahead of schedule but did not elaborate on the timing. The US trade representative also said they were studying whether to extend tariff suspensions on $34 billion of Chinese goods set to expire on 28 December this year.

“The market appears to be interpreting the improvement in trade talks as a positive sign that the US will suspend its planned tariffs on $160 billion of Chinese imports due to take place in December,” said Rodrigo Catril, a senior FX strategist at National Australia Bank.

Microsoft Corp climbed 2.46% after winning the Pentagon’s $10 billion cloud computing contract, beating out Amazon.com Inc.

Google parent Alphabet Inc slipped in late NY trade after missing analysts’ estimates for quarterly profit even though revenue growth topped expectations.

The embrace of risk left bonds out in the cold, and yields on two-year Treasury notes hit four-week highs at 1.667%.

Bond investors are still looking forward to a likely rate cut from the Federal Reserve on Wednesday, though they also suspect officials might sound cautious on moving yet further. Central banks in Japan and Canada also meet this week, with talk the former might ease further if only to prevent an export-sapping bounce in its currency.

The shift from safe havens was working to weaken the yen. The dollar was firm at 108.98 yen, having reached its highest in three months, and was eyeing a major top at 109.31. It fared less well on the euro, which edged up to $1.1097, and eased back on a basket of currencies to 97.756. Sterling firmed after the European Union agreed to a Brexit delay of up to three months, while Prime Minister Boris Johnson lost a vote to force an election on 12 December.

The pound was last at $1.2858, well above its low for the month at $1.2193.

Spot gold slipped back to $1,491.43 per ounce, and away from last week’s top around $1,517.