Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 12 January 2021 01:33 - - {{hitsCtrl.values.hits}}

Following a year of volatility, leading stockbroking firm Asia Securities Ltd. notes that the road ahead for Sri Lanka’s capital markets is optimistic, with the ASPI expected to reach 7,400-7,600 in 2021.

Following a year of volatility, leading stockbroking firm Asia Securities Ltd. notes that the road ahead for Sri Lanka’s capital markets is optimistic, with the ASPI expected to reach 7,400-7,600 in 2021.

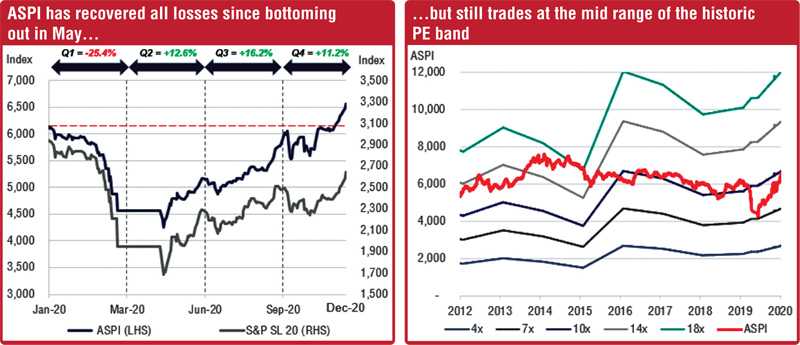

The Sri Lankan stock market marked a V-shaped recovery in 2020, seeing one of its strongest rallies to recover all losses suffered over the course of the coronavirus pandemic. The latest Asia Securities Sri Lanka: 2021 Equity Outlook report titled ‘Zero in on the Recovery’ highlights that the forces behind one of the fastest recoveries include a low interest rate environment, manufacturing-dominance led by protection for local firms, and renewed economic hopes and policy stability with both the Presidential and Parliamentary Elections now behind.

A strong bounce back from historic lows

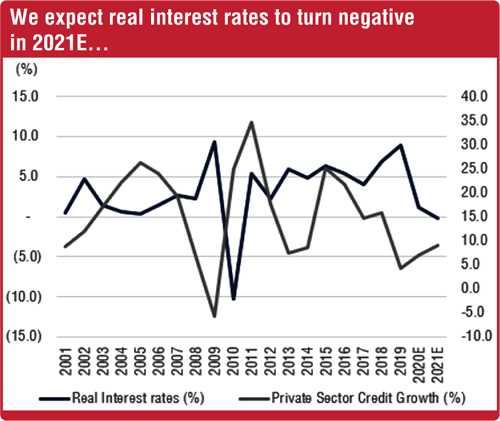

The report highlights that “Low interest rates locally continue to provide further impetus for the market to rally and local investors will continue to carry the mantle in 2021. Despite the likelihood of rates bottoming out once credit growth picks up, we expect equities to remain the more attractive asset class as rates will be recovering from a historic low.”

Further upside to ASPI amidst historically low interest rates

In addition to low interest rates, the strong trajectory for Sri Lanka equities is supported by an improvement in earnings (coming from a lower base), and large caps gaining momentum with earnings picking up. The Asia Securities report also forecasts a healthy pickup in corporate earnings in 2021 driven by consumption-related stimuli, and lower finance costs which will help the bottom line.

Emerging markets ready for primetime in 2021, however, Sri Lanka to see latent fund flows

Asia Securities Research said that the momentum in equities from this point forth will also be dependent on how certain global factors playout. Emerging markets are expected to take off again in 2021, breaking a decade-long trend of asset allocations towards developed markets amidst superior growth, a strengthening USD, and strong yields. Several factors will drive this shift, including:

Weaker USD in the medium-term

A weakening USD will push investors to rebalance their portfolios and spur capital flows into emerging markets. With lower currency risk, Asia Securities Research sees cheaper emerging market valuations being more appealing and rewarding for investors.

Emerging markets set for a 2021 takeoff

Faster growth than developed markets – Bloomberg consensus point at emerging markets growing (real GDP) at a faster 5.0% in 2021E, compared to 4.0% for developed markets. (2022E; emerging markets – 5.1%, developed markets – 3.1%). One of the main reasons for a faster emerging markets recovery is better management of the pandemic. With stronger growth prospects and low currency risks, Asia Securities Research notes that emerging markets are in a “sweet spot” in 2021.

Lower valuations – While emerging markets have underperformed the S&P 500 over the last decade, earnings expectations have been on the rise with hopes of a faster recovery.

Low interest rates – As it is still a struggle to find yield in government bonds amidst low interest rates, a risk-on approach with global recovery will drive funds to faster growing emerging market economies.

Trade – The election of Joe Biden represents a return to more predictable US politics. An easing of trade tensions between US and China can further aid recovery in the Asian markets.

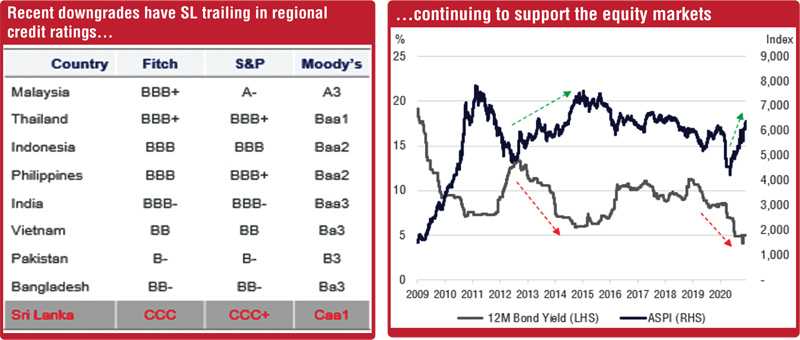

While a risk-on sentiment with vaccine deployment and global recovery will favour equities in 2021, Asia Securities Research highlighted that regional countries are likely attract foreign fund flows first, with Sri Lanka seeing latent fund flows. Concerns around Sri Lanka’s low credit rating mean that Sri Lankan equities can expect a very gradual improvement in foreign fund flows.

Asia Securities Research recommend rotation towards “COVID recovery” beneficiary stocks

Asia Securities’ key picks for 2021 are weighted towards consumer sector, as well as cyclical stocks that look attractive in a path to recovery. Corporate earnings will see a healthy pickup in 2021 driven by consumption-related stimuli, and lower finance costs which help the bottom line. In addition, free cash flow generation should remain strong, given that corporates will operate in an environment fuelled by tax cuts early in late 2019/early 2020.

Local manufacturing is also expected to see improved utilisation with higher protection. With an accommodative fiscal policy and consistent tax policies, the effects of the tax cuts (yet to materialise given the timing and impact of COVD-19) are also expected come to fruition in 2021.

(Asia Securities is a leading investment firm in Sri Lanka providing investment banking, research, equities and wealth management services to local and international corporate, institutional and individual clients. Asia Securities’ clients can access the full research report titled ‘Sri Lanka: 2021 Equity Outlook – Zero in on the Recovery’ via the online research portal or their investment adviser.)