Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 17 December 2021 02:36 - - {{hitsCtrl.values.hits}}

By Iresha Jayakodi

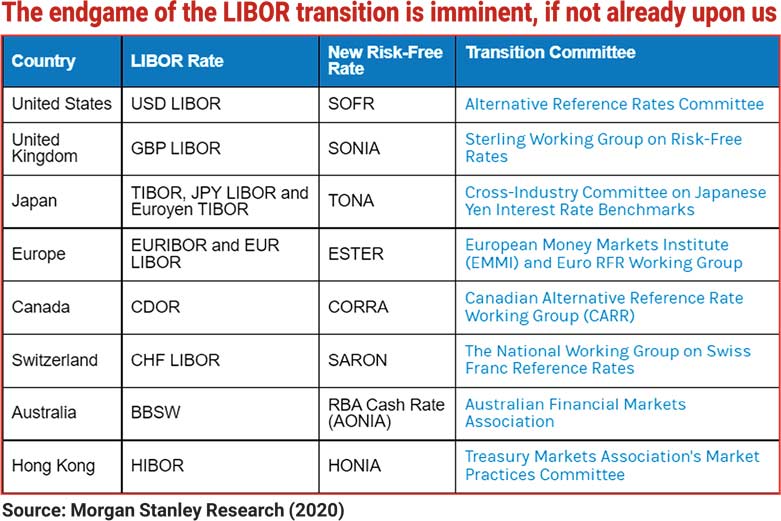

Transitioning from LIBOR is not an activity to be taken lightly. LIBOR is the world’s most widely used benchmark for short-term rates, but its era of influence is slated to end by 2022. We have almost two to three weeks to go. The endgame of the LIBOR transition is imminent, if not already upon us.

In 2017 the Financial Conduct Authority (FCA) in the UK announced the benchmark LIBOR will cease for all currencies other than USD on 31 December 2021. We hardly had seen communication and discussions on LIBOR transition in Sri Lanka. Ready or not, loan market participants need to deal with it.

LIBOR currently underpins approximately $ 400 trillion in financial contracts for derivatives, bonds, mortgages, commercial and retail loans, representing an enormous challenge.

The London Interbank Offered Rate (LIBOR) is a well-known name in financial markets which measures the average rate at which banks are willing to borrow wholesale unsecured funds. It is estimated that current outstanding contracts referencing USD LIBOR, including corporate loans, adjustable-rate mortgages, floating rate notes (FRNs), securitised products and a wide range of derivatives products, total nearly $ 200 trillion, roughly equivalent to 10 times US Gross Domestic Product. While financial providers may show a lack of urgency in their transition plans, hence we should be prepared and take steps to accelerate transition efforts.

Business entities and financial institutions should assess the risks and costs of servicing remaining LIBOR products in a shrinking market. This scenario is akin to a business wind-down, in which continuing operations may be prohibitive. Any upside to keeping LIBOR products on the books would be offset by the possible costs of maintaining a segregated operating model, the higher capital charges to LIBOR products with limited price points, and interest rate gaps and mismatches. In short, the risks of an untimely transition from LIBOR outweigh potential benefit.

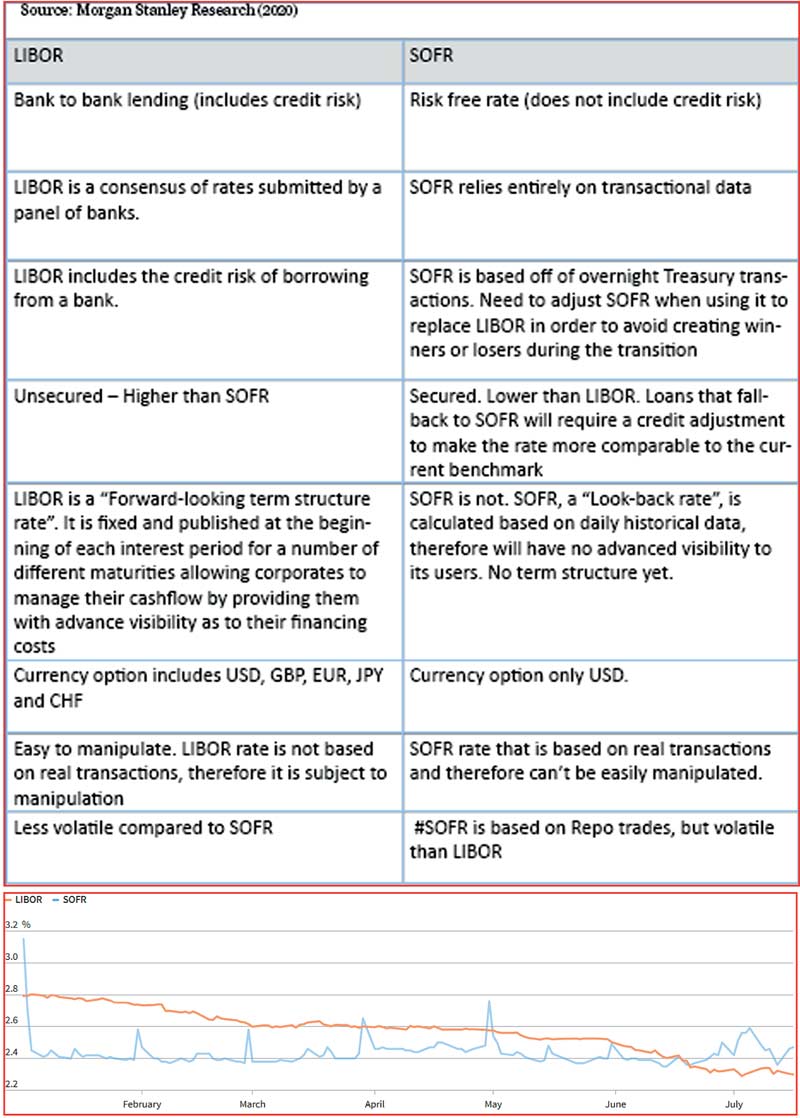

There are five major globally accepted Risk free Alternative Reference (ARRs) which have been proposed to replace the respective LIBOR rates for each major currency (i.e. Sterling, US dollars, Japanese Yen, Swiss Franc, and Euro). Secured Overnight Funding Rate (SOFR) for US dollars and Sterling Overnight Index Average (SONIA) for Sterling have emerged as frontrunners. In the context of Sri Lanka, SOFR will be the main ARR of interest due to the dominance of US$ denominated instruments. The main difference between SOFR and LIBOR is how the rates are produced.

While LIBOR is based on panel bank input, SOFR is a broad measure of the cost of borrowing cash overnight collateralised by US. It is worth noting that other countries are introducing their own local-currency-denominated alternative reference rates for short-term lending, but SOFR is expected to supplant USD LIBOR as the dominant global benchmark rate.

Is your bank ready to transition? 8 steps to transition away from LIBOR (Source: Crowe 2020).

The multiphase process to transition away from LIBOR will involve different stakeholders across each bank. The necessary steps require time and thoughtful deliberations to minimise risk to customer satisfaction, net interest margin, and interest rate sensitivity, among other considerations. Institutions should continue working their plans (or establish one if they haven’t already!) to get themselves well-positioned for the end of LIBOR in its current form at the end of 2021.

For banks to make the transition from LIBOR to SOFR, especially for contracts already referencing LIBOR, they need to calculate a spread component that measures the difference in risk between the two rates.

This spread calculation will have a large impact on a financial firm’s risk profile, and its impact will be felt in asset liability mismatch, hedging strategies, risk modelling, valuation tools, product design and customer communication.

The wide-reaching impact stresses the importance of the LIBOR-SOFR spread calculation for financial institutions.

The most widely suggested approach for calculating the LIBOR-SOFR spread is the five-year median. It is recommended by ARRC and the International Swaps and Derivatives Association (ISDA) and appears to be the leading market preference. Utilising a median has the advantage of avoiding market fluctuations. However, depending on the market conditions at the time of determining the spread, a median could be artificially low or high and be subject to higher variance during times of economic stress. In addition, official SOFR rates have been published since 2018, although the Federal Reserve (the Fed) has released pre-production SOFR estimates from August 2014 using the same underlying methodology and data, which results in a shorter than five-year median in the near term. Financial firms can also consider a point-in-time spread in moving from LIBOR to SOFR. Static spreads are the easiest in terms of communication and implementation in existing contracts.

In this situation, customers will have a clear understanding of how the transition affects their existing contracts. However, financial institutions that choose to utilise a static spread will not be able to accurately reflect market conditions prevailing at the time, especially during times of volatility and stress, and are at risk of not pricing instruments properly.

The transition away from LIBOR involves at least eight key steps:

Assessing the accounting, tax, and financial reporting implications of the transition.

The writer is an ex-banker by profession and covers areas in economics, banking, current affairs and is involved as a research assistant mainly on socio-economic research studies.