Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 1 November 2018 01:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

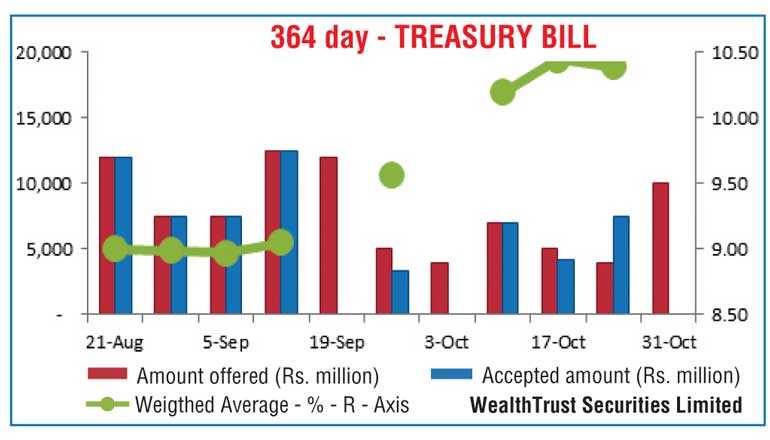

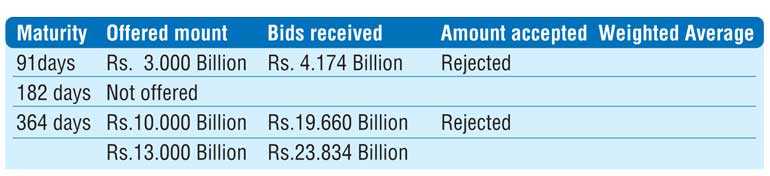

All bids received for yesterday’s weekly Treasury bill auction were rejected once again following three consecutive successful weeks as market participants were seen demanding higher yields. Furthermore, the bids received to offer ratio was seen dipping to a three week low of 1.83:1 as well.

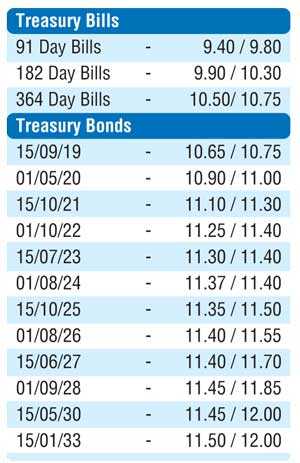

Activity in the secondary bond market was seen picking up only during the second half of the day yesterday and following the outcome of the weekly bill auction. Yields on the short end maturities of 15.09.19 and 01.05.20 were seen dipping to intraday lows of 10.65% and 10.95% respectively against its highs of10.80% and 11.05% amidst continued foreign selling. In addition, foreign selling on the 01.05.21, 01.07.22 and 15.05.23 maturities saw limited volumes change hands within the range of 11.20% to 11.30%, 11.35% to 11.48% and 11.40% to 11.45% as well.

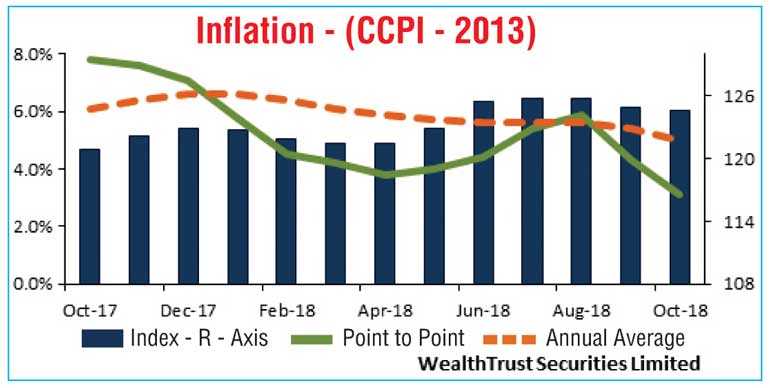

Meanwhile, inflation for the month of October was seen decreasing further to hit a 31-month low of 3.1% on its point to point while its annual average decreased to a low of 5.0%.

The total secondary market Treasury bond/bill transacted volume for 30 October was Rs.9.95 billion.

In the money market, overnight call money and repo rates remained mostly unchanged to average 8.44% each with the net liquidity shortage in the system reducing to Rs.17.46 billion yesterday. The Open Market Operations (OMO) Department of Central Bank of Sri Lanka was seen injecting an amount of Rs.12.00 billion on an overnight basis at a weighted average of 8.47%, while an additional amount of Rs.8.25 billion was injected for 14 days at a weighted average rate of 8.47%, valued today.

Rupee hits Rs.175.65

The USD/LKR rate on spot contracts hit a fresh low of Rs.175.65 yesterday before closing at Rs.175.60/80 against its previous day’s closing levels of Rs.174.50/80 on the back of continued importer demand, a globally strengthening dollar and foreign outflows from the capital market.

The total USD/LKR traded volume for 30 October was $ 93.35 million.

Some forward USD/LKR rates that prevailed in the market: 1 month - 176.60/00; 3 months - 178.60/00; 6 months - 181.60/00.