Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 10 February 2020 00:38 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

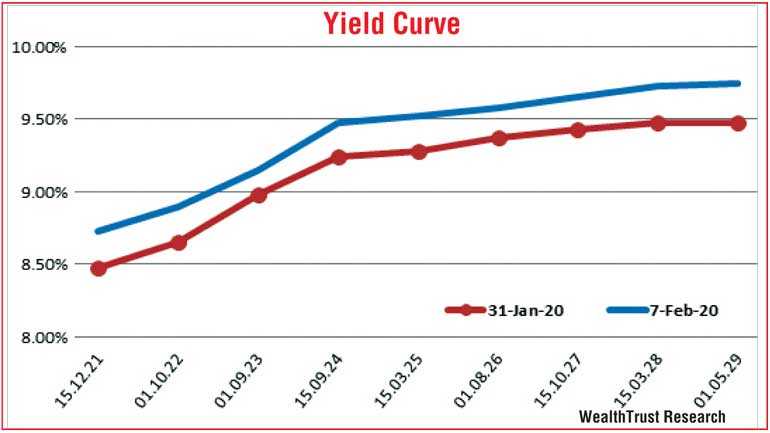

The secondary market bond yields increased sharply over the shortened trading week ending 7 February to record a parallel upward shift of the yield curve week on week due to aggressive selling interest which was fuelled further by liquidity turning negative in the banking system.

Yields on the 2023’s (i.e. 15.03.23, 15.07.23, 01.09.23 & 15.12.23), 2024’s (i.e. 15.06.24 & 15.09.24) and 15.10.27 were seen hitting pre policy cut levels and weekly highs of 9.10%, 9.22%, 9.25% each, 9.55%, 9.50% and 9.70%, respectively, against its previous weeks closing levels of 8.90/00, 8.92/00, 8.95/00, 8.98/05, 9.22/26 each and 9.40/45.

Nonetheless, yields in the secondary bill market was seen moving in opposite directions as maturities up to five months saw yields decreasing while eleven month maturities saw its yields increasing. Buying interest on the maturities of May, June and July 2020 saw it yields decreasing to lows of 7.30%, 7.65% and 7.95%, respectively, against its weeks opening highs of 7.73%, 8.05% and 8.10% while selling interest on January 2021 maturities saw its yield increase to a high of 8.47% from its opening low of 8.25%.

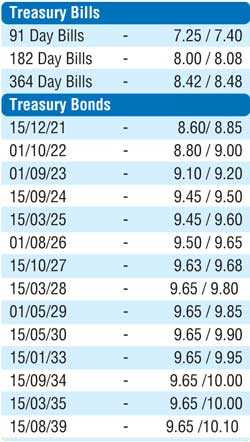

Meanwhile, the foreign component in rupee bonds dipped for a second consecutive week to record an outflow of Rs. 1.12 billion for the week ending 5 February while the weighted averages at the weekly Treasury bill auction were seen decreasing across the board for the first time in eleven weeks.

The daily secondary market Treasury bond/bills transacted volume for the first three days of the week averaged Rs. 16.13 billion.

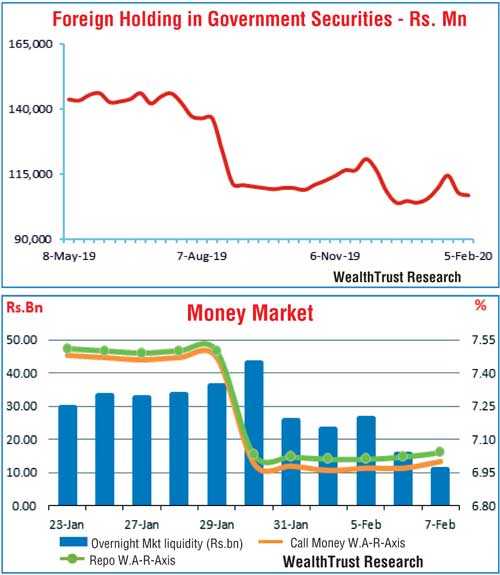

In money markets, overall surplus liquidity was seen turning negative for the first time in three weeks to register a deficit of Rs. 5.47 billion against its previous week’s surplus of Rs. 5.85 billion. Overnight call money and repo rates averaged at 6.98% and 7.02%, respectively, for the week as the Domestic Operations Department (DOD) of the Central Bank was seen injecting liquidity during the latter part of the week by way of overnight Reverse Repo auctions at weighted averages ranging from 6.96% to 6.97%.

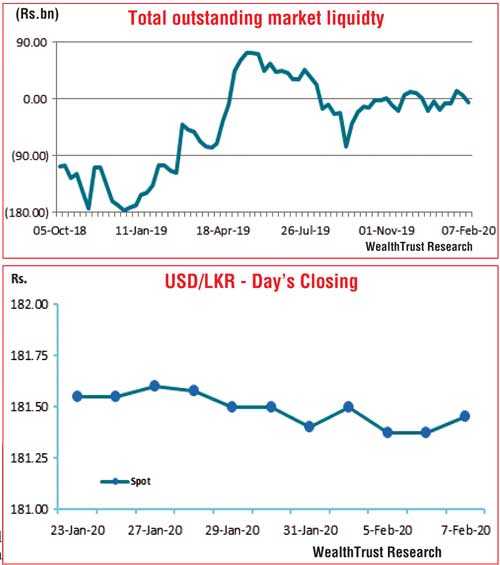

Rupee remains mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts was seen closing the week mostly unchanged at Rs. 181.40/50 subsequent to trading within the range of Rs. 181.30 to Rs. 181.52 during the week.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 92.51 million.

Given are some forward dollar rates that prevailed in the market: one month – 181.90/00; three months – 182.90/05; six months – 184.40/70.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies.)