Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 6 January 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market recorded limited activity yesterday with trades seen only on the duration of 2022 which consisted of the maturities of 01.10.22 and 15.12.22 at levels of 5.57% and 5.63% respectively. February bills changed hands 4.53% while short tenure bonds of 01.05.21 and 01.08.21 changed hands at 4.70% and 4.77% respectively.

The secondary bond market recorded limited activity yesterday with trades seen only on the duration of 2022 which consisted of the maturities of 01.10.22 and 15.12.22 at levels of 5.57% and 5.63% respectively. February bills changed hands 4.53% while short tenure bonds of 01.05.21 and 01.08.21 changed hands at 4.70% and 4.77% respectively.

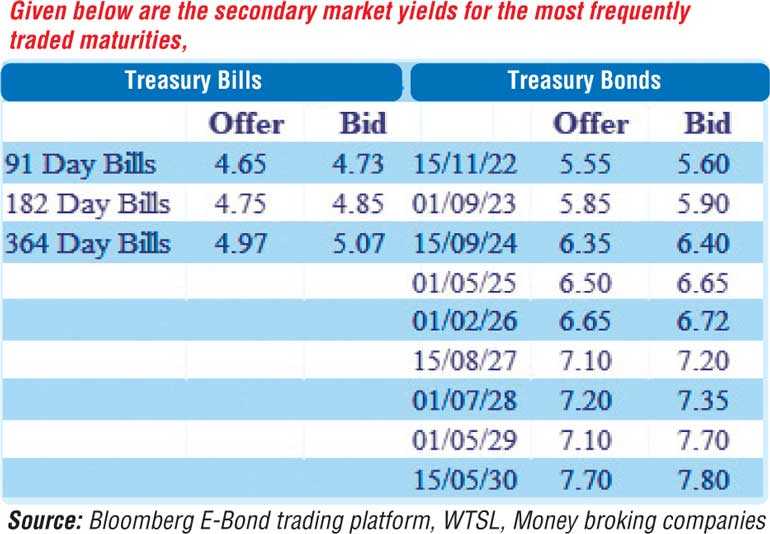

Today’s bill auction will see Rs. 40 billion on offer, consisting of Rs.10 billion on the 91 day, Rs. 5 billion on the 182 day and a further Rs. 25 billion on the 364 day maturities. The stipulated cut off rate on the 91 day bill was increased by 2 basis points to 4.71% while the 182 day and 364 day remained unchanged at 4.80% and 5.05% respectively. The total secondary market Treasury bond/bill transacted volumes for 4 January was Rs. 3.65 billion.

The overnight surplus liquidity stood at a high of Rs.248.98 billion yesterday as call money and repo averaged 4.54% and 4.56% respectively.

Rupee steady

The activity in the forex market continued on its one month forward yesterday as it closed the day at a wide quote of Rs. 190.00/192.50 against its previous day’s closing of Rs. 191.50/192.50.

The total USD/LKR traded volume for 4 January was $ 47.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Money broking companies)