Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 6 July 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

Activity in the secondary bond market remained dull yesterday ahead of today’s monetary policy announcement, the fourth for 2018, due at 7.30 a.m.

The Central Bank of Sri Lanka kept policy rates unchanged at its previous announcement on 11 May 2018.

Limited trades were seen on the 01.07.19, 15.09.19, 01.05.21, 01.10.22, 15.03.23, 01.01.24 and 01.09.28 at levels of 9.45%, 9.50%, 10.10%, 10.40%, 10.47%, 10.60% to 10.70% and 10.75% respectively.

The total volume of bonds transacted in the secondary market on 4 July 2018 was Rs. 5.81 billion.

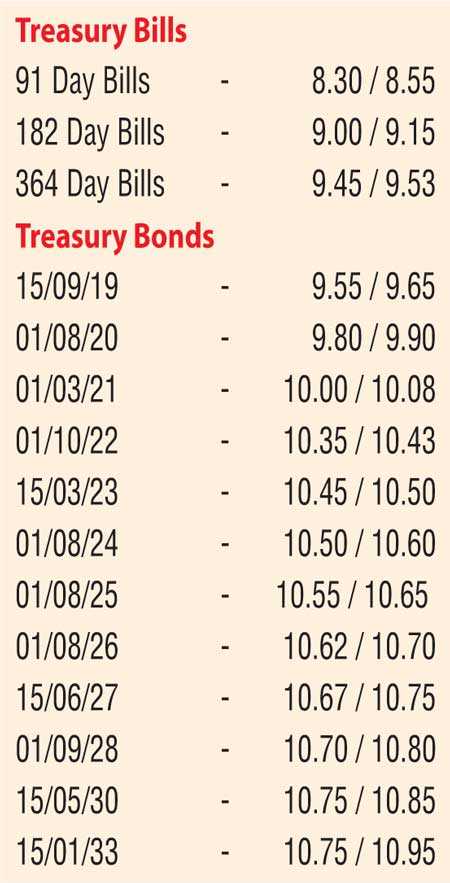

Given below are the closing, secondary market yields of the most frequently traded T-bills and bonds.

Meanwhile, in money markets, the OMO Department of Sri Lanka was seen injecting an amount of Rs. 40 billion on an overnight basis by way of a reverse repo auction at a weighted average of 8.38% as the net liquidity shortage stood at Rs. 37.46 billion yesterday with a further amount of Rs. 17.60 billion being drawn down from its Standing Lending Facility at 8.50% against an amount of Rs. 20.14 billion, which has been deposited at CBSL’s Standing Deposit Facility (SDF) at the rate of 7.25%.

The overnight call money and repo rates averaged 8.48% and 8.47% respectively.

Rupee continues

to slide

The USD/LKR rate on spot contracts were seen depreciating further yesterday to close the day at Rs. 158.90/00 against its previous day’s closing of Rs. 158.65/80 on the back of continued importer demand outpacing export conversions.

The total USD/LKR traded volume for 4 July 2018 was $ 42.25 million.

Given below are some of the forward USD/LKR rates that prevailed in the market.

1 Month - 159.70/90

3 Months - 161.35/55

6 Months - 163.85/05