Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 11 December 2018 00:50 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

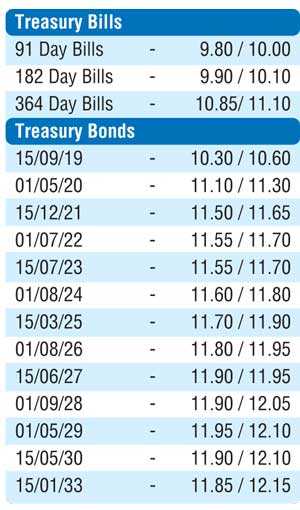

Activity in the secondary bond market moderated once again yesterday as the sentiment turned bearish due to a ‘wait and see policy’ adopted by most market participants. Limited trades were witnessed of the 15.09.19 and 01.05.21 maturities at levels of 10.45% to 10.50% and 11.45% respectively while in the secondary bill market, the March and May 2019 maturities changed hands at 10.00% to 10.05%.

The total secondary market Treasury bond/bill transacted volumes for 7 December was Rs. 4.1 billion.

In the money market, the overnight call money and repo rates were seen averaging 8.92% and 9.00% respectively as the net liquidity shortfall reduced to Rs. 69.05 billion. The OMO Department of the Central Bank conducted two reverse repo auctions for durations of overnight and seven days for successful amounts of Rs. 15 billion and Rs. 18.7 billion at weighted averages of 8.64% and 8.68% respectively. In the meantime, all bids received for the five outright purchases of Treasury bills totaling Rs. 20 billion were rejected.

Rupee loses marginally

The continued political uncertainty coupled with buying interest by banks over seasonal inflows resulted in the USD/LKR rate on spot contracts losing once again to close the day at Rs. 179.00/25 against its previous day’s closing levels of Rs. 178.60/90.

The total USD/LKR traded volume for 7 December was US $ 78.92 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 180.10/35; 3 months - 182.15/45 and 6 months - 185.25/50.