Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 26 March 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

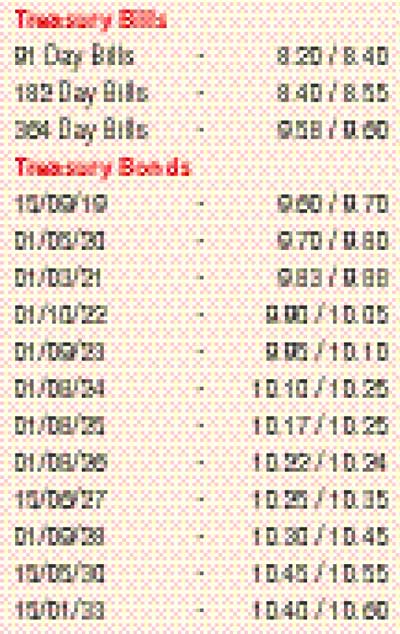

Activity in the secondary bond market slowed down considerably during the week ending 23 March 2018. A limited amount of trades were seen taking place on the 2019 maturities and the 2021 maturities within the range of 9.60% to 9.75% and 9.82% to 9.90% respectively.

Nevertheless, the primary and secondary bill markets reflected a more bullish sentiment due to continued buying interest as its yields was seen edging down during the week. At the weekly primary auction, the weighted averages on the 91 day and 364 day bills were seen dipping by 15 and 04 basis points respectively to 8.17% and 9.66% while in the secondary market the 364 day bill was seen dipping to an low of 9.60%, subsequent to the auction.

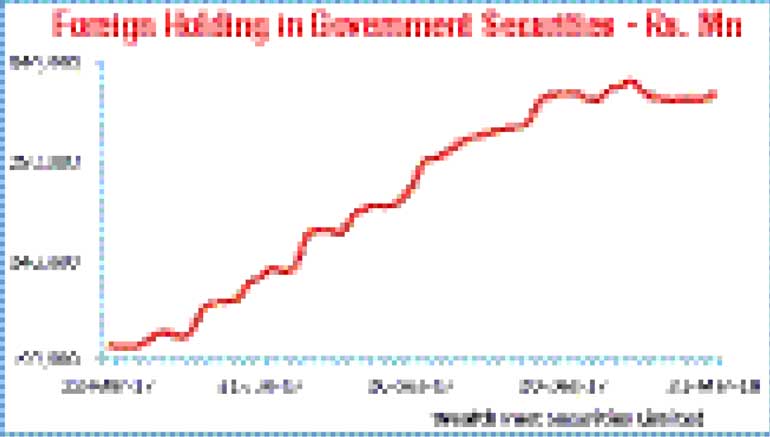

Furthermore, the foreign holding in Rupee bonds was seen recording a healthy inflow once again to the tune of Rs. 2.85 billion for the week ending 21 March 2018. The US Federal Reserve was seen increasing its policy rates by 0.25% during the week as well.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 5.98 billion.

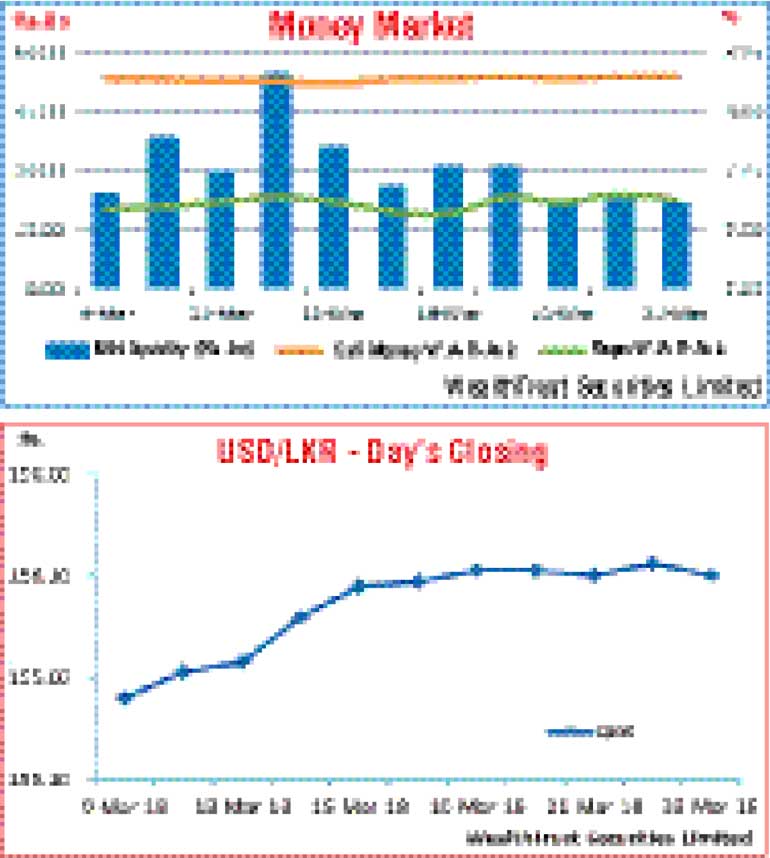

In money markets, the overnight call money and Repo rates averaged 8.15% and 7.62% respectively for the week as the average surplus liquidity stood at Rs. 25.68 billion. The OMO department of Central Bank was seen mopping up liquidity throughout the week on an overnight basis at a weighted average ranging from 7.26% to 7.28%.

A volatile rupee witnessed during the week

The USD/LKR on spot contracts witnessed volatility during the week within the range of Rs. 155.85 to Rs. 156.20 before closing the week mostly unchanged at Rs. 156.05/15 in comparison to its previous week.

The daily USD/LKR average traded volume for the four days of the week stood at $ 72.38 million.

Some of the forward dollar rates that prevailed in the market were one month – 156.75/85; three months – 158.35/45 and six months – 160.70/85.