Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 2 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth

Trust Securities

Activity in the secondary bond market increased during the week ending 29 December 2017, with yields initially decreasing leading up to the Treasury bond auction which was held on 28/12/2017.

The liquid maturities of 01.03.21, 01.08.26, 15.06.27 and 15.05.30 hit weekly lows of 9.62%, 10.02%, 10.05% and 10.40% respectively against its opening highs of 9.70%, 10.15%, 10.25% and 10.45%.

However, subsequent to the auction, where the weighted average yields of the 2.11 year maturity of 15.12.20 and the 8.05 year maturity of 01.06.26 recorded 9.55% and 10.06% respectively, considerable selling pressure, drove yields up again to 10.08% to 10.12% on the 01.06.26. Furthermore, the 01.08.26 and 15.06.27 maturities were traded at levels of 10.07% and 10.10% respectively, post auction.

In the meantime, the weighted average yields of the weekly Treasury bill auction continued to decrease for a sixth consecutive week, while the foreign buying of Rupee bonds persisted with an inflow of Rs.0.3 billion during the week ending 27th December.

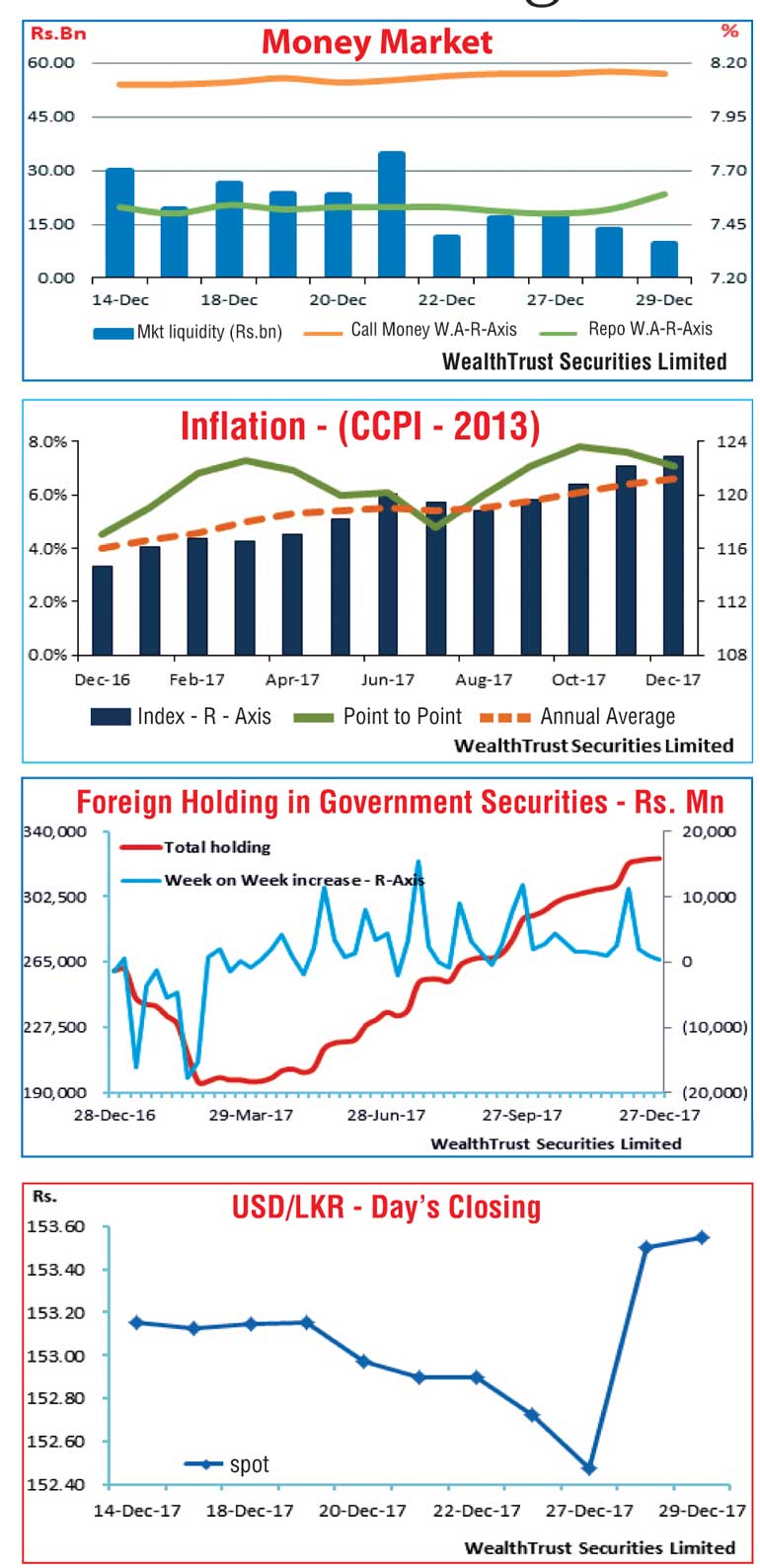

The inflation figure for the month of December reflected a further decrease for the second consecutive month, to 7.1% on the point to point when compared against the previous month’s figure of 7.6%. However, the annual average increased to 6.6%.

The Central Bank of Sri Lanka, at its eighth monitory policy announcement held during the week kept policy rates unchanged at 7.25% and 8.75%

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs.3.94 billion.

In money markets, the Open Market Operations (OMO) Department, drained out liquidity throughout the week on an overnight basis at a weighted average of 7.25% as the average net surplus liquidity in the system stood at Rs.14.42 billion. The overnight call money and repo rates averaged 8.15% and 7.53% respectively.

Rupee fluctuates during the week

The USD/LKR rate on spot contracts appreciated to an intraweek high of Rs.152.50 during the early part of the week against its previous weeks closing levels of Rs.152.85/95 before losing once again to hit lows of Rs.153.50 and closing the week at Rs.153.50/60, on the back of renewed importer demand.

The daily USD/LKR average traded volume for the three days of the week stood at $ 76.90 million.

Some of the forward dollar rates that prevailed in the market were one month – 154.50/75; three months – 156.30/50; and six months – 159.00/10.