Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 13 July 2021 03:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fresh trading week commenced with activity in the secondary bond market at a complete standstill as most market participants opted to be on the sidelines. A solitary trade on the 01.09.23 maturity was witnessed at 6.16%.

The fresh trading week commenced with activity in the secondary bond market at a complete standstill as most market participants opted to be on the sidelines. A solitary trade on the 01.09.23 maturity was witnessed at 6.16%.

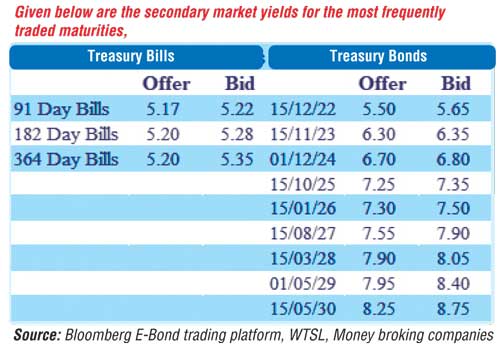

Today’s auction will have on offer an amount of Rs. 50 billion in total, consisting of Rs. 27.5 billion of the 15.11.2023 maturity and Rs. 22.5 billion of the 01.07.2028 maturity. The maximum yield rate for acceptance for the said maturities was published at 6.40% and 8.06% respectively. The weighted average yields at the bond auctions conducted on 29 June were 7.30% and 7.99% for the maturities of 15.10.2025 and 15.03.2028 respectively, while its maximum yield rate for acceptance was at 7.31% and 8.00%. The second phase of an auctioned maturity was opened at the 29 June auction, following two rounds or four maturities of full subscription during the month of June.

The total secondary market Treasury bond/bill transacted volume for 9 July was Rs. 5.13 billion.

In money markets, the overnight net liquidity surplus was seen decreasing marginally yesterday to Rs. 81.03 billion as an amount of Rs. 131.40 billion was deposited at Central Banks SLDR of 4.50% against an amount of Rs. 50.38 billion withdrawn from Central Banks SLFR of 5.50%. The weighted average rates on overnight call money and repo remained steady at 4.95% and 4.97% respectively.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday. The total USD/LKR traded volume for 9 July was $ 54 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)