Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Thursday, 20 May 2021 02:46 - - {{hitsCtrl.values.hits}}

By Wealth trust Securities

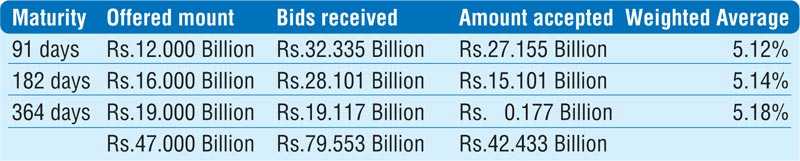

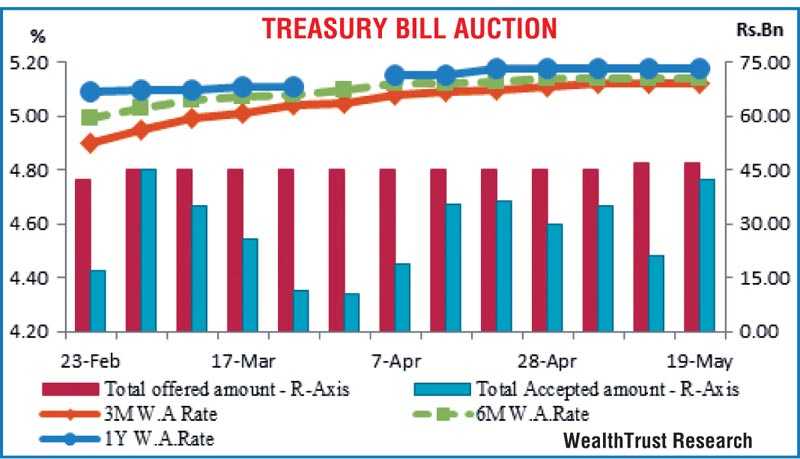

The total accepted amount at yesterday’s bill auction was seen increasing once again to a high of 90.28% of its total offered amount as its bids to offer ratio increased to a five-week high of 1.69:1. A total amount of Rs. 42.43 billion was accepted against its last week’s Rs. 21.01 billion and against a total offered amount of Rs. 47 billion each week. The 91-day bill recommenced its dominance at the auction, as it represented 64% of the total accepted amount while its weighted average rate remained unchanged for a third consecutive week at 5.12%. The weighted average rates of 182-day and 364-day maturities too remained unchanged at 5.14% and 5.18% respectively.

The total accepted amount at yesterday’s bill auction was seen increasing once again to a high of 90.28% of its total offered amount as its bids to offer ratio increased to a five-week high of 1.69:1. A total amount of Rs. 42.43 billion was accepted against its last week’s Rs. 21.01 billion and against a total offered amount of Rs. 47 billion each week. The 91-day bill recommenced its dominance at the auction, as it represented 64% of the total accepted amount while its weighted average rate remained unchanged for a third consecutive week at 5.12%. The weighted average rates of 182-day and 364-day maturities too remained unchanged at 5.14% and 5.18% respectively.

The secondary market bond yields were seen increasing marginally yesterday ahead of today’s monetary policy announcement. Activity mainly surrounded on the 2023’s (i.e. 15.07.23, 01.09.23 and 15.11.23) maturities as its yields were seen hitting intraday highs of 6.15%, 6.20% and 6.25% respectively against its previous day’s closing levels of 6.12/20, 6.15/23 and 6.22/25. In addition, 15.01.26 maturity traded at level of 7.30% as well. Meanwhile in secondary market bills, 13 August 2021 and 1 October 2021 changed hands at levels of 5.11% to 5.15%.

This was ahead of today’s monitory policy announcement due at 7:30 a.m., the fourth for the year 2021. The monetary board of the Central Bank of Sri Lanka, at its last announcement made on 8 April 2021 kept its policy rates of Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) steady at 4.50% and 5.50% respectively for a sixth consecutive announcement. The total secondary market Treasury bond/bill transacted volume for 18 May 2021 was Rs. 8.85 billion.

In the money market, overnight surplus liquidity increased further to Rs. 124.95 billion yesterday while the weighted average rates on call money and repo was registered at 4.67% and 4.68% respectively.

USD/LKR

In Forex markets, the USD/LKR rate on one-month forward contracts saw continued buying interest at Rs. 199.90 while overall market continued to remain inactive.

The total USD/LKR traded volume for 18 May 2021 was $ 129.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)