Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 15 August 2019 00:00 - - {{hitsCtrl.values.hits}}

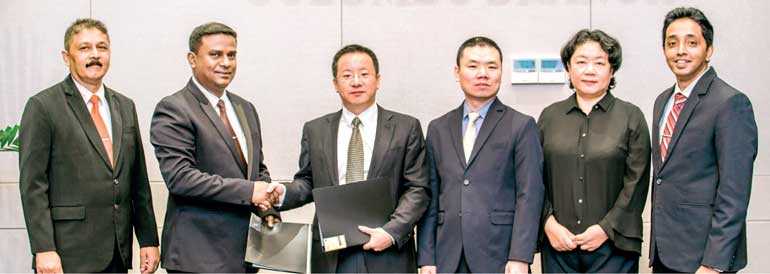

AB Securitas, Sri Lanka’s largest Cash In Transit (CIT) and Cash/ATM Management organisation, recently entered into an agreement with the Bank of China Colombo branch to offer Total Cash Management (TCM) Solutions for the bank. The Bank of China, which is among the top five largest banks in the world, recently opened their Colombo branch.

“We are privileged to enter into an agreement to provide TCM solutions to a world-renowned bank like Bank of China. Being the only CIT company in Sri Lanka to possess three fully-fledged Cash Centres in Sri Lanka to cater to the north and east as well the southern region, we are excited to win the approval of BOC. I am sure that the unmatched infrastructure and the knowhow, with the cutting edge technology that AB Securitas possesses, BOC shall also be benefited in reducing its cost on transits, minimum turnaround time ensuring optimum usage of currency, reduction in cost of cash and secure cash warehousing leading to a decrease in the insurance costs,” AB Securitas Director/General Manager Retired Wing Commander Pradeep Kannangara during the signing ceremony held at the BOC Head Office at the iconic Cargills Building in Colombo Fort.

AB Securitas (ABS) was founded in 1994 as a Static Security Service Provider, and has now grown into a leading total Loss Prevention Solution Provider with over 25 years of industry experience in Cash in Transit (CIT), Total Cash Management (TCM) and ATM Management including Cash Processing Warehousing, etc.

Revolutionising Sri Lanka’s Currency Management industry, AB Securitas was the first to introduce innovative solutions such as ‘Remote Customer Collection Reporting’ and ‘Cash Chests’. ABS has invested significantly in the automation of Currency Management in Sri Lanka by introducing Cobra, G & D and K-5 automated cash processing machines throughout the past decade. Improving on par with its counterparts in other countries, ABS added CPS 1800 fully automatic 16 pockets High Speed Cash Processor to its inventory that presently enhances its turnaround capacity.

ABS is the only CIT/Loss Prevention Solution Provider in Sri Lanka to win the National Quality Award in 2015 under Service – Large Scale category with ISO 9001:2015 certification for Quality Management and OHSAS 45001:2018 certification for Health and Safety, and the Global Performance Excellent Award by Asia Pacific Quality Organisation in 2016.