Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 17 September 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

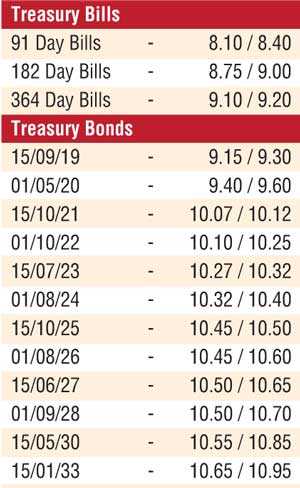

The secondary market bond yields increased across the yield curve during the week ending 14 September, driven by the outcome of the primary Treasury bills and bond auctions. Firstly, the weekly Treasury bill auctions saw the weighted average of the 364 day bill increase to 9.05% while the weighted average on the 91 day increased as well to 8.07%. This was followed by the Treasury bond auctions, at where the three year maturity of 15.10.2021 and the seven year maturity of 15.10.2025 recorded weighted averages of 10.03% and 10.32% respectively.

The liquid maturities of 15.10.21, 15.07.23, 01.08.24 and 15.10.25 increased by 47, 30, 23 and 30 basis points respectively week on week to intra week’s highs of 10.10%, 10.30%, 10.35% and 10.48% as activity remained high during the week with considerable volumes changing hands. Furthermore, selling interest of T-bills in the secondary market resulted in the latest 01 year bill changing hands at levels of 9.15% to 9.20%. This led to an upward adjustment on the overall yields curve on a week on week basis.

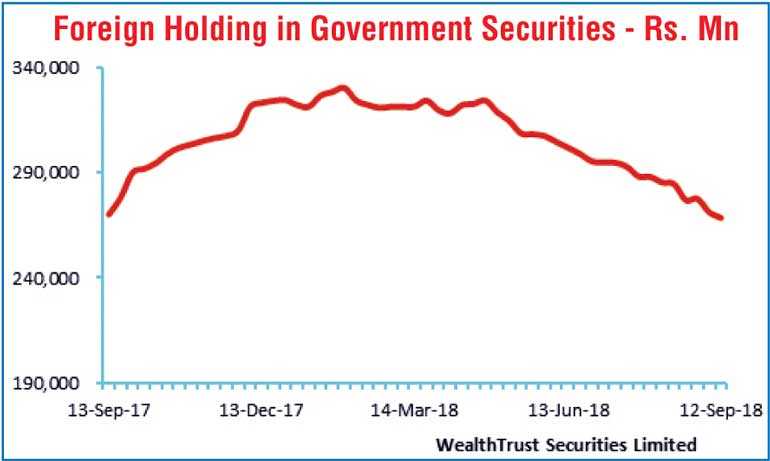

Meanwhile, the foreign holding in Rupee bonds was seen reducing by a further Rs. 2.59 billion for the week ending 12 September 2018.

The daily secondary market Treasury bond/bill transacted volume through the first four days of the week averaged Rs. 7.26 billion.

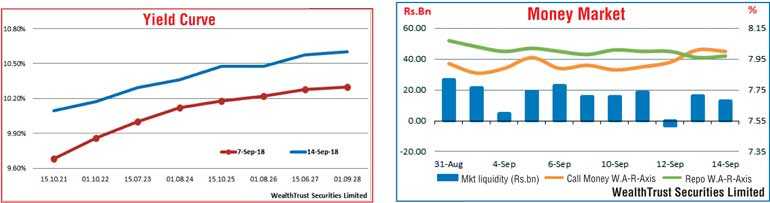

In money markets, the average net liquidity during the week was seen dipping to a surplus of Rs. 12.02 billion against its previous weeks average of 16.79 billion as the Open Market Operations (OMO) Department of the Central Bank infused liquidity by way of reverse repo auctions at weighted averages ranging from 7.89% to 8.00% for period of 7 to 14 days during the week. This intern steadied the call money and repo rates to average at 7.94% and 7.99% respectively for the week.

Rupee dips to a fresh low

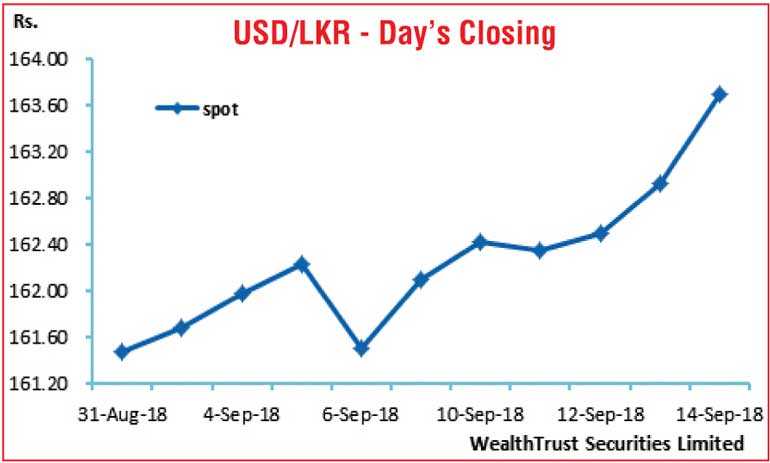

In the Forex market, the downward trend on the rupee continued during the week to record a fresh low of Rs. 163.60 and close the week at Rs. 163.60/80 against its previous weeks closing levels of 162.00/20.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 81.56 million.

Given are some forward dollar rates that prevailed in the market: One month – 164.40/70; three months – 166.10/40; six months – 168.50/80.