Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 26 April 2016 00:38 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

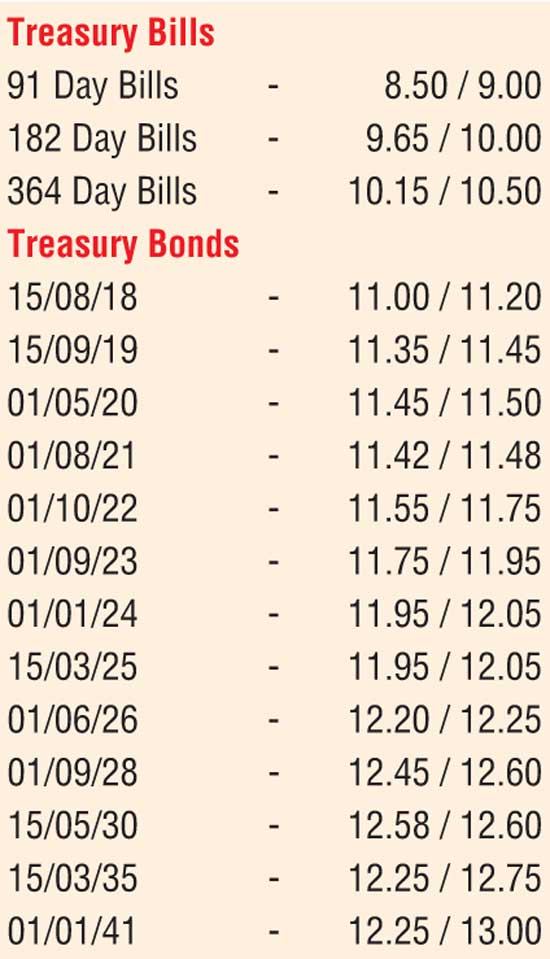

The secondary market bond yields on the very short end of the yield curve were seen increasing yesterday on the back of considerable selling interest ahead of today’s monitory policy announcement due at 5.00 pm. Selling interest on a 157 day bond maturity of 01.10.2016 saw it change hands within the range of 9.95% to 10.05% while 2017 bond maturities of 01.01.2017 to 15.06.2017 were seen changing hands within the range of 10.55% to 10.85%. In addition, 2018 and 2019 maturities changed hands within the range of 11.00% to 11.10% and 11.35% to 11.45% respectively as well. On the long end of the curve, the 01.06.2026 and 15.05.2030 maturities were seen changing hands within a thin range of 12.20% to 12.22% and 12.58% to 12.60%.

Meanwhile in money markets, liquidity was seen reversing to a net deficit of Rs. 0.668 billion once again yesterday as no reverse repo auctions were conducted by the Open Market Operation (OMO) department of the Central Bank for the first time in fourteen (14) trading days. Call money and repo rates remained steady to average 8.15% and 8.05% respectively.

Rupee broadly steady

The USD/LKR rate on the active spot next contract was seen closing the day broadly steady at Rs 146.30/60 yesterday. The total USD/LKR traded volume for 22 April was US $ 94.51 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 147.20/60; 3 Months - 149.00/50 and 6 Months - 151.60/00.