Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 14 February 2022 02:54 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The trading activity in the secondary bond market stood at a bare minimum during the first four trading days of the week ending 11 February before increasing on Friday following the two bond auctions.

The trading activity in the secondary bond market stood at a bare minimum during the first four trading days of the week ending 11 February before increasing on Friday following the two bond auctions.

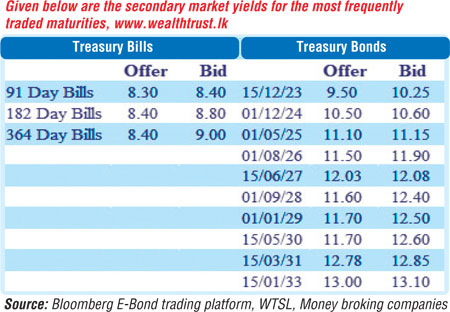

At the bond auctions, the maturities of 15.06.2027 and 01.12.2031 recorded weighted average rates of 11.92% and 12.70% respectively while a total amount of Rs. 38.23 billion was accepted against a total offered amount of Rs. 50 billion.

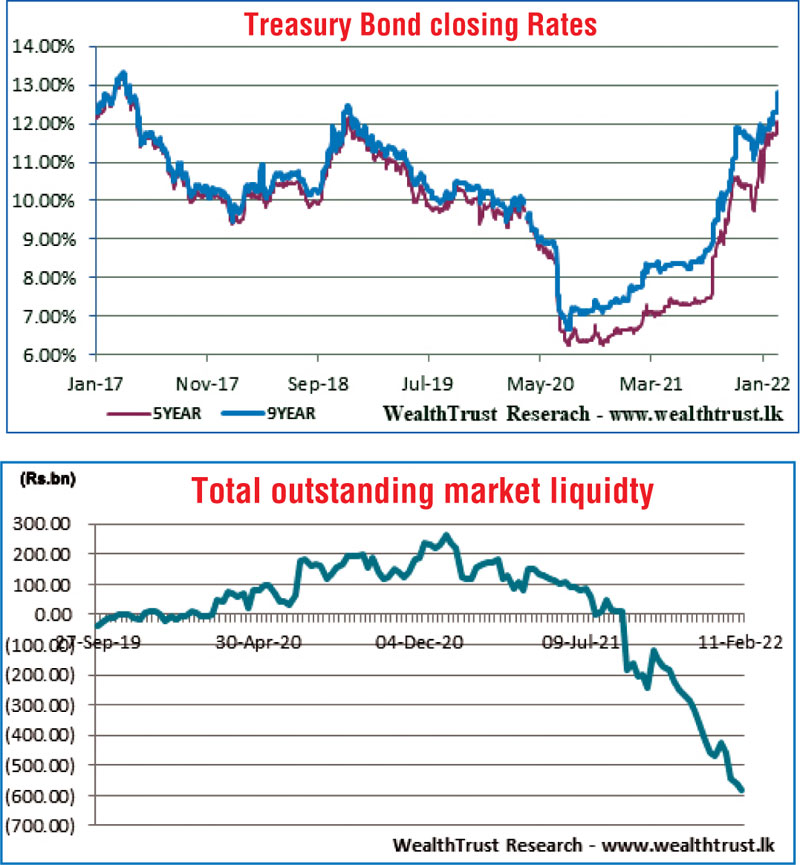

In secondary market trading, the five year or 15.06.27 maturity was traded above 12.00% for the first time since November 2018 while the nine year maturity of 01.12.31 was traded at 12.80% for the first time since April 2017.

The second phase of the auction was opened on both maturities while the bids to offer ratio stood at 2.12:1.

However, a total offered volume of Rs. 77 billion was fully taken up at the weekly Treasury bill auction while the weighted average rates decreased by 07 and 01 basis points on the 91 day and 182 day maturities respectively to 8.52% and 8.54% with investor appetite continuing solely on the 91 day bill.

The secondary bond market trading during the rest of the week saw limited trades witnessed on the 15.01.33 maturity as its yield was seen increasing during the week to weekly highs of 13.05% against its previous weeks closing level of 12.96/00.

In addition, maturities of 15.12.22 and 2025’s (i.e. 01.05.25 & 01.08.25) traded at levels of 8.80%, 10.95% and 11.00% respectively as well.

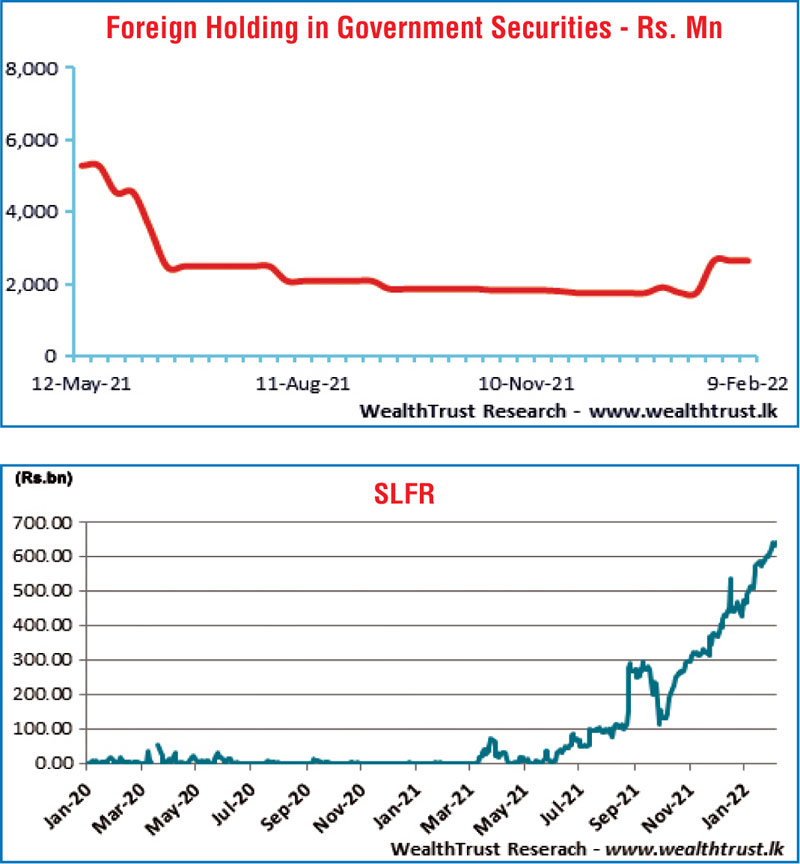

The foreign holding in rupee bonds remained mostly unchanged at Rs. 2.65 billion for the week ending 09 February while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 16.51 billion.

In money markets, the total outstanding liquidity deficit increased during the week to register a historically high volume of Rs. 617.99 billion by the end of the week against its previous weeks Rs. 579.36 billion.

However, the weighted average rates on call money and repo remained mostly unchanged at 6.48% and 6.50% respectively for the week as a high volume exceeding Rs. 621 billion was withdrawn on a daily basis during the week from Central Banks SLFR (Standard Lending Facility Rate) of 6.50%.

The Domestic Operations Department (DOD) of Central Bank was seen draining out liquidity during the week by way of overnight repo auctions at a weighted average yield of 6.49% in addition to an average of Rs. 64.59 billion been deposited throughout the week at Central Banks SDFR (Standard Deposit Facility Rate) of 5.50%.

The CBSL’s holding of Gov. Securities decreased to Rs. 1,541.13 billion against its previous weeks of Rs.1,566.13 billion.

Forex market

In Forex markets, overall activity continued to remain moderate during the week while limited trades were witnessed on the USD/LKR spot contracts at a level of Rs. 203.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 65.35 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)