Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 16 January 2020 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

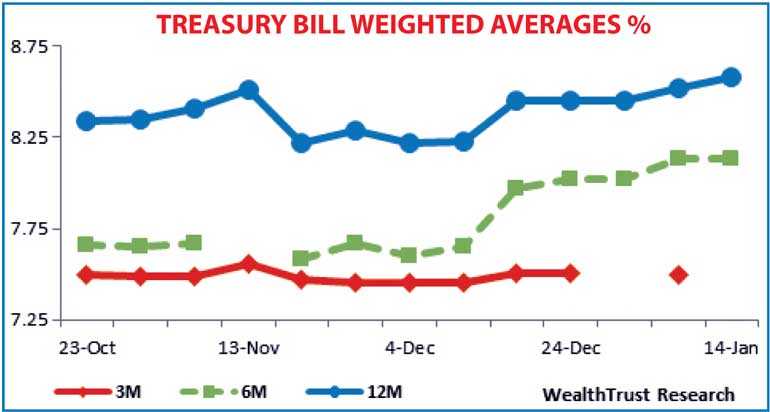

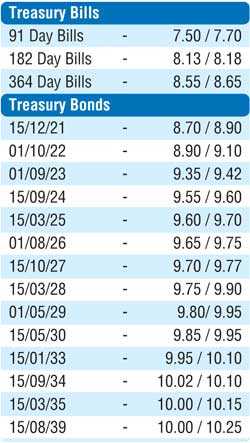

The 364-day bill weighted average yield increased for a second consecutive week at Tuesday's primary auction, recording a six basis point jump to 8.58% while the yield of the 182 day maturity remained steady at 8.13%.

All bids received for the 91-day bill were rejected. Nevertheless, the total offered amount of Rs. 25 billion was successfully subscribed for with an additional volume being accepted on the 364-day maturity and the bids to offer ratio increasing to 2.23:1.

In the secondary bond market, continued buying interest resulted in yields of the liquid maturities of 01.09.23 and the two 2024’s (i.e.15.06.24 and 15.09.24) decreasing further to intraday lows of 9.30% and 9.52% each in comparison to the previous day’s closing levels 9.35/42, 9.55/60 and 9.58/62.

However, subsequent to the bill auction buying interest came to a halt with the two-way quotes increasing marginally. Furthermore, the 01.08.24, two 2027’s (i.e. 15.06.27 and 15.10.27), 01.05.29, 15.05.30 and 15.09.34 traded at levels of 9.65%, 9.72% to 9.78%, 9.94%, 9.90% and 10.05% to 10.07% respectively.

The total secondary market Treasury bond/bill transacted volume for 13 January was Rs. 9.97 billion. In money markets, the weighted average yield of the overnight call money and repo rates stood at 7.42% and 7.48% respectively on Tuesday with the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka draining an amount of Rs. 8.93 billion on an overnight basis by way of a Repo auction at a weighted average yield of 7.45%. The overnight net liquidity surplus in the system stood at Rs. 31.99 billion.

Rupee remains steady

In the Forex market trading on Tuesday, the USD/LKR rate on spot contracts was seen trading within a high of Rs. 181.45 and a low of Rs. 181.63 before closing the day steadily at Rs. 181.50/60.

The total USD/LKR traded volume for 13 January was $ 102.61 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month – 182.00/20; 3 months – 183.00/20 and 6 months – 184.50/80.