Sunday Mar 08, 2026

Sunday Mar 08, 2026

Thursday, 31 December 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

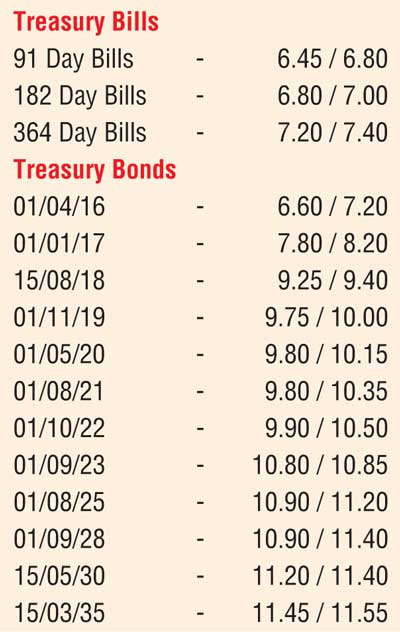

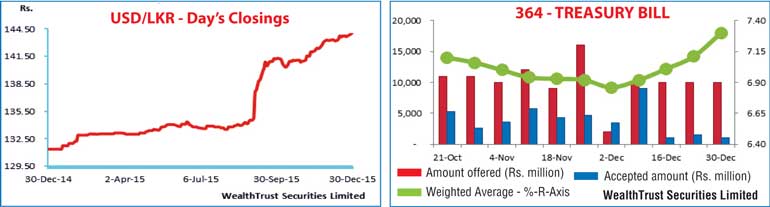

The prevailing upward momentum in primary market rates continued at yesterday’s weekly Treasury bill auction as well with the weighted average of the 364 day maturity increasing to a forty-two week high of 7.30%, marginally below this year’s high of 7.37%. The 364 day bill recorded the sharpest increase of 19 basis points, closely followed by the 182 day bill by 14 basis points to 6.83% and the 91 day bill by 7 basis points to 6.45%. Interestingly, the accepted amount on the 91 day bill was Rs.1.2 billion above its offered amount of Rs.4 billion while the overall accepted amount was below the total offered amount of Rs.22 billion by Rs.14.5 billion.

In secondary bond markets yesterday, a limited amount of activity was witnessed during morning hours of trading prior to the release of the auction results on the long end and short end of the yield curve. On the short end, the 01.04.2018 and 15.08.2018 maturities were seen changing hands within the range of 9.25% to 9.40% while on the long end the 15.05.2030 and 15.03.2035 was seen changing hands within the range of 11.20% to 11.30% and 11.45% to 11.55% respectively.

In money markets, the overnight call money and repo rates remained mostly unchanged to average 6.40% and 6.22% respectively as surplus liquidity increased to Rs.83.35 billion yesterday.

Rupee hits a fresh low

The deprecating trend in the value of the rupee continued yesterday as well to hit a fresh low of Rs.144.25 and closed the day at Rs.144.15/25 against its previous day’s closing level of Rs.143.90/05. The total USD/LKR traded volume for the 29th of December 2015 was US $ 90.45 million. Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.80/00; 3 Months - 146.05/25 and 6 Months - 147.40/70.