Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 1 February 2018 00:00 - - {{hitsCtrl.values.hits}}

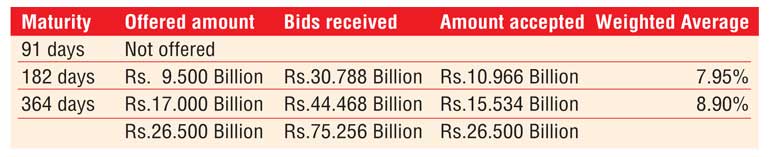

By Wealth Trust Securities

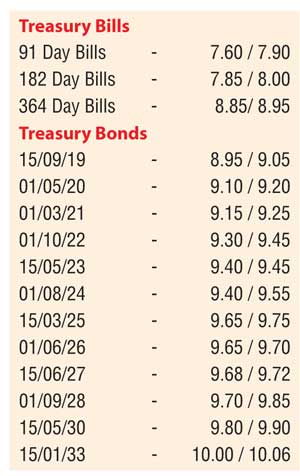

The 364 day bill weighted average held steady at 8.90% at its weekly auction conducted on 30 January, capping two consecutive weeks of increases. The 182 day bill continued to trickle downwards to record a weighted average of 7.95% against its previous week of 7.96%. The exact offered amount of Rs. 26.5 billion was accepted in total as the bid to offer ratio increased to a three-week high of 2.84:1.The secondary bond markets remained active as yields were seen increasing marginally, mainly on the belly end of the yield curve. Selling interest leading to the bill auction saw yields on the liquid two 2026’s (i.e. 01.06.26 and 01.08.26) and 15.06.27 maturities increase to intraday highs of 9.67% and 9.75% respectively against its days opening lows of 9.64% and 9.65%. However, buying interest subsequent to auction results curtailed any further upward movement. In addition, demand for short tenure maturities of 2018, 2019, 2021 and 2023 saw it change hands at levels of 7.84%, 8.95% to 9.00%, 9.26% and 9.33% to 9.42% respectively.

Meanwhile, the Colombo Consumer Price Index (CCPI) for the month of January reflected a further decrease for a third consecutive month, to hit a six month low of 5.8% on its point to point. The annual average remained steady at 6.6%. The CCPI Core inflation was seen decreasing as well on both its point to point and annualized average to record 3.5% and 5.6% respectively.

The total secondary market Treasury bond/bill transacted volumes for 29 January was Rs. 11.36 billion.

Meanwhile in money markets, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka drained out an amount of Rs. 12.39 billion by way of two repo auctions at weighted average of 7.26% for overnight and 7.27% for 3 days as the net surplus liquidity in the system stood at Rs. 39.72 billion on 30 January. Furthermore it drained out an amount of Rs. 2.00 billion by way of two auctions for outright sales of Treasury bills at weighted average yields of 7.58% and 7.60% respectively for the periods of 50 days and 57 days, valued today. The overnight call money and repo rates averaged 8.15% and 7.51% respectively.

Rupee losses further

In the Forex market, the USD/LKR rate on the spot rate depreciated further to close the day at Rs. 154.00/10 against its previous day’s closing levels of Rs. 153.75/80 on the back continued buying interest from banks.

The total USD/LKR traded volume for 27 January was $ 127.10 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 154.75/90; 3 Months - 156.65/75 and 6 Months - 159.00/10.