Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 3 January 2019 02:11 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

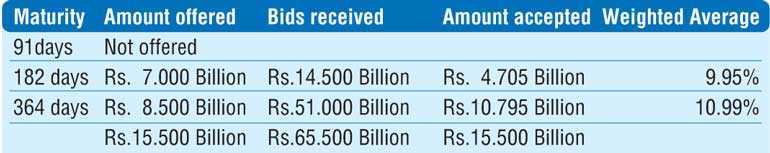

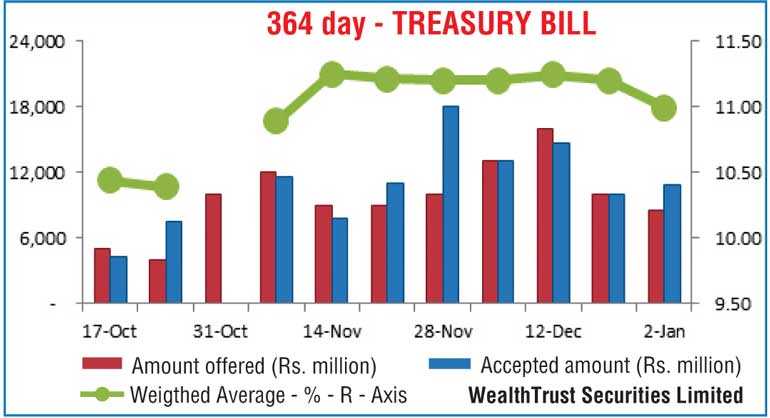

The first Treasury bill auction for the year 2019 saw the 364 day bill weighted average record a steep dip to fall below the psychological level of 11.00% for the first time in seven weeks. The decrease of 21 basis points saw the 364 day bill record a weighted average of 10.99% while the 182 day bill dipped by 04 basis points to 9.95%. The auction had on offer a total amount of Rs. 15.5 billion which was successfully subscribed as the bid to offer ratio increased to nine week high of 4.23:1.

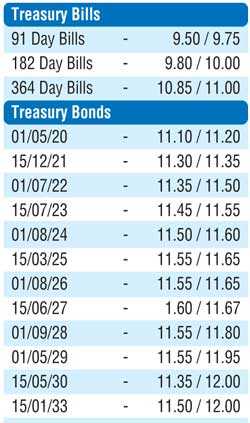

Activity in the secondary bond market increased yesterday as yields were seen decreasing, mainly on the 15.12.21 and 01.08.26 maturities to lows of 11.25% and 11.55% respectively against its previous day’s closing levels of 11.43/47 and 11.67/70. In addition, the maturities of 01.05.20 and 2021’s (01.03.21, 01.08.21 and 15.10.21) was seen changing hands at levels of 10.90% to 11.20% and 11.25% to 11.35% respectively while the 15.06.27 maturity changed hands within the range of 11.62% to 11.75%.

The total secondary market Treasury bond/bills transacted volume for 1 January was Rs. 6.00 billion.

In the money market, the overnight call money rate averaged 8.98% as the OMO Department of the Central Bank infused liquidity by way of an overnight and a seven day term reverse repo auction for successful amounts of Rs. 20 billion and 10 billion, at weighted average yields of 8.99% and 9.00%. The net liquidity shortfall stood at Rs. 103.93 billion.

Rupee remains mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts remained mostly unchanged yesterday to close the day at Rs. 182.85/00 as the market was trading at equilibrium. The total USD/LKR traded volume for 2 January was $ 72.98 million.

Some of forward USD/LKR rates that prevailed in the market were 1 Month - 183 70/00; 3 Months - 185.65/05 and 6 Months - 188.65/05.