Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 27 February 2020 00:00 - - {{hitsCtrl.values.hits}}

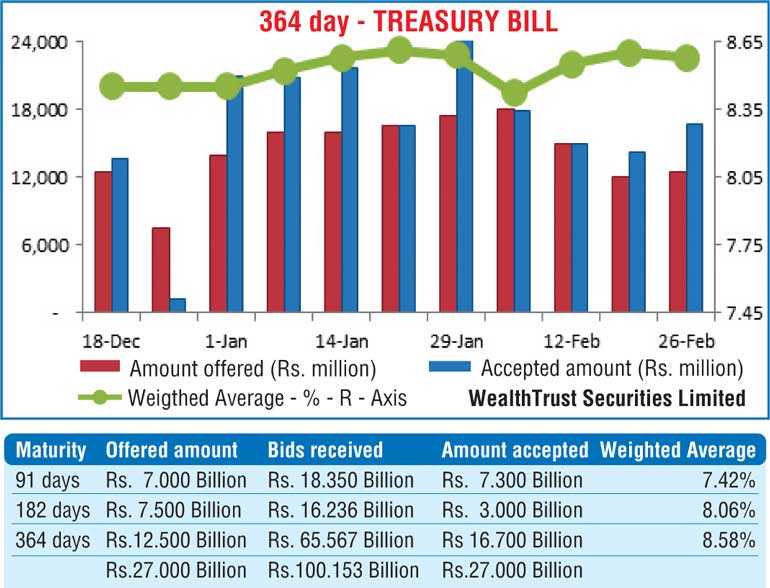

By Wealth Trust Securities

The weighted average (W.A.) yield on the market favourite 364 day maturity was seen dipping for the first time in three weeks at its weekly Treasury bill auction conducted yesterday, recording a drop of 02 basis points to 8.58%. The 91 day maturity recorded a drop of 02 basis points as well to 7.42% while  the 182 day bill remained steady at 8.06%. The total offered amount of Rs. 27 billion was successfully subscribed to as the bids to offer ratio increased to a 14 week high of 3.7:1.

the 182 day bill remained steady at 8.06%. The total offered amount of Rs. 27 billion was successfully subscribed to as the bids to offer ratio increased to a 14 week high of 3.7:1.

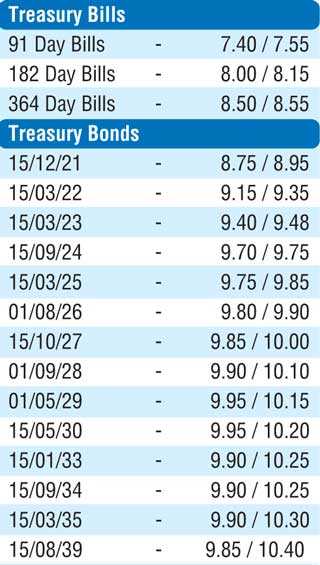

Activity in the secondary bond market continued at a moderate pace with two way quotes decreasing marginally following the outcome of the weekly bill auction. Limited trades were seen on the 01.09.23 and five 2024’s (i.e. 01.01.24, 15.03.24, 15.06.24, 01.08.24 & 15.09.24) at levels of 9.50% and 9.70% to 9.77% respectively. In the secondary bill market, February 2020 bills were seen changing hands from a high of 8.57% pre-auction to a low of 8.45% post auction.

The total secondary market Treasury bond/bill transacted volume for 25 February was Rs. 9.81 billion.

In money markets, the overnight call money and repo rates averaged at 6.98% and 7.03% respectively as the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 10.00 billion at a weighted average of 6.99% by way of an overnight repo auction. The overnight net liquidity surplus in the system stood at Rs. 34.56 billion.

Rupee remains stable for second consecutive day

In the Forex market, the USD/LKR rate on spot contracts remained mostly unchanged for a second consecutive day to close the day at Rs. 181.65/70 on the back of an equilibrium market.

The total USD/LKR traded volume for 25 February was $ 100.00 million. Some of the forward USD/LKR rates that prevailed in the market were: one month - 182.20/35; three months - 183.20/40 and six months - 184.75/05.