Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 23 July 2020 00:34 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

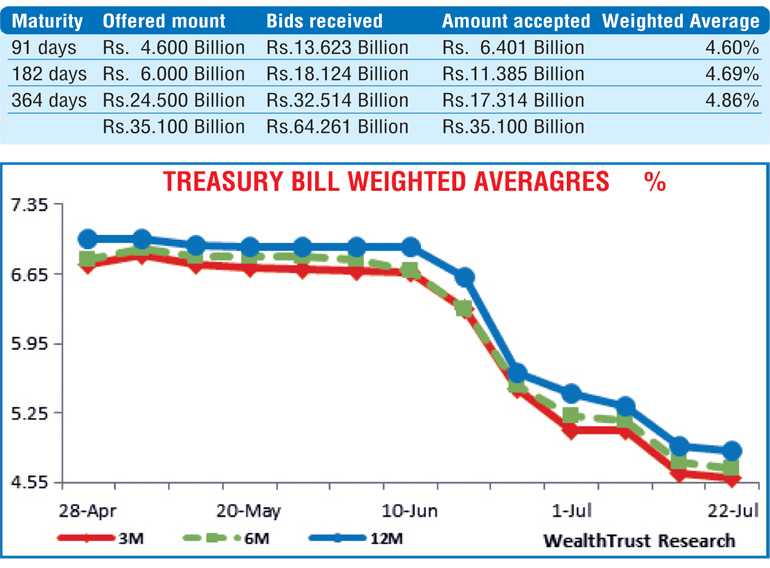

The 364 day maturity was undersubscribed for the first time six weeks at its auction held yesterday, as only an amount of Rs. 17.31 billion was accepted against its offered amount of Rs. 24.5 billion. However, the total offered volume of Rs. 35.1 billion was successfully raised at the auctions due to additional volumes been accepted on the 91 day and 182 day maturities.

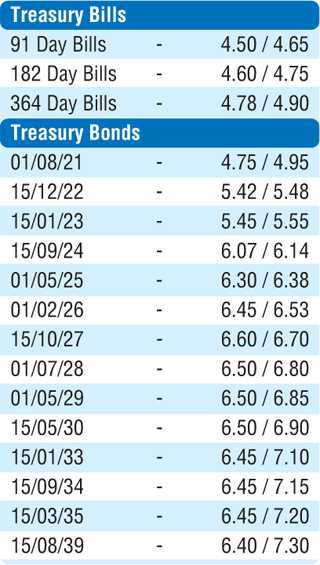

At the same time, weighted average rates were seen declining for a seventh consecutive week, registering drops of 05, 06 and 05 basis points respectively to 4.60%, 4.69% and 4.86% while the bids to offer ratio dipped to a six week low of 1.83:1. Selling interest witnessed in the secondary bond market over the previous day continued yesterday as well, with yields edging up in thin trade. The maturities of 15.12.22, 2023’s (i.e. 15.01.23, 15.03.23 and 01.09.23), 2024’s (i.e. 15.03.24, 15.06.24 and 15.09.24) and 01.02.26 changed hands within the range of 5.44% to 5.46%, 5.49% to 5.50%, 5.60%, 5.76%, 6.03%, 6.10%, 6.08% to 6.10% and 6.47% to 6.50% respectively with quotes widening towards the later part of the day.

The total secondary market Treasury bond/bill transacted volumes for 21 July was Rs. 6.1 billion.

In money markets, the weighted averages on overnight call money and repo rates were recorded at 4.53% and 4.55% respectively yesterday as the liquidity surplus in the system increased to Rs. 130.74 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts were seen closing the day unchanged at Rs. 185/75/85 yesterday, subsequent to trading at levels of Rs. 185.78 to Rs. 185.80 on the back of an equilibrium market. The total USD/LKR traded volume for 21 July was $ 53.20 million. (References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)