Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 5 December 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

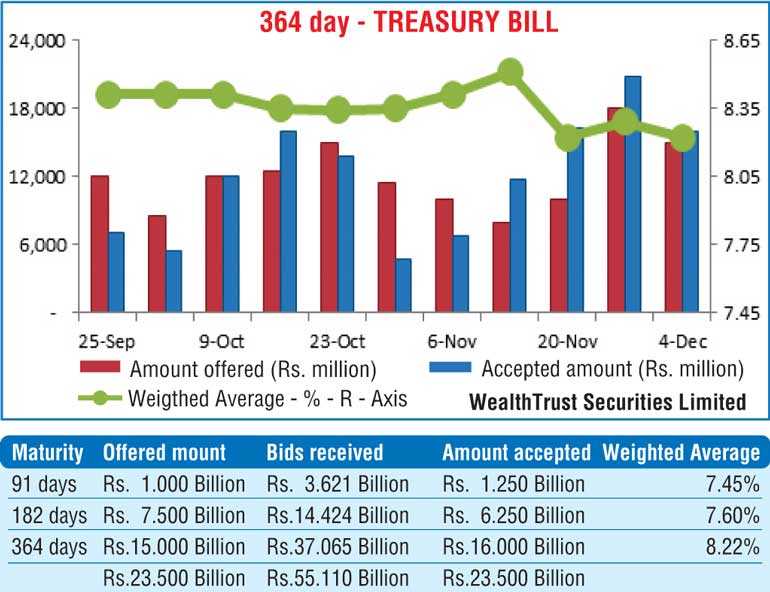

At yesterday’s weekly Treasury bill auction, the weighted average yield of the 364 day maturity was seen decreasing once again, reversing the upward movement witnessed during the previous week,  recording a drop of seven basis points to 8.22%.

recording a drop of seven basis points to 8.22%.

The 182 day bill too went on to record a drop of seven basis points to 7.60% with the weighted average yield of the 91 day maturity remaining steady at 7.45%.

The total offered amount of Rs. 23.5 billion was successfully accepted at the said auction with the bids to offer ratio increasing to 2.35:1.

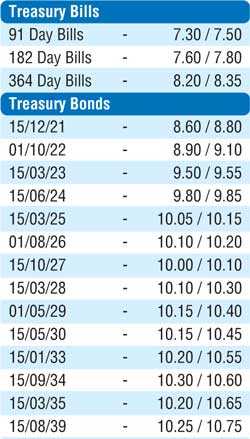

Subsequent to the bill auction, yields in the secondary bond market decreased marginally consisting of the liquid maturities of 2023s (i.e. 15.3.23 and 15.7.23) and 2024s (i.e. 15.6.24 and 15.9.24) to lows of 9.50%, 9.55% and 9.82% respectively against its previous day’s closing levels of 9.50/55, 9.55/62 and 9.85/90. Furthermore, the 1.5.20, two 2024s (i.e. 1.1.24 and 1.8.24), 15.3.25 and the two 2026s (i.e. 1.6.26 and 1.8.26) changed hands at levels of 7.80%, 10.00% to 10.02%, 10.12% to 10.17% and 10.12% to 10.26% respectively.

In the secondary Treasury bill market, November 2020 bills were seen trading at levels of 8.22% to 8.30%.

The total secondary market Treasury bond transacted volume for 3 December 2019 was Rs. 8.74 billion.

In money markets, the overnight call money and repo rates averaged 7.53% and 7.55% respectively as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka injected an amount of Rs. 15 billion on an overnight basis by way of a Reverse Repo auction at a weighted average yield of 7.52%. It further injected an amount of Rs. 1.76 billion for Standalone Primary Dealers by way of an overnight reverse repo auction at a weighted average rate of 7.56%. The net overnight liquidity in the system stood at a surplus of Rs. 16.41 billion.

Rupee appreciates marginally

The rupee rate on spot contracts was seen appreciating marginally to close the day at Rs. 181.30/40 against its previous day’s closing levels of Rs. 181.50/60 on the back of selling interest by banks.

The total USD/LKR traded volume for 3 December 2019 was $ 72.43 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 181.70/90; three months - 182.65/95 and six months - 184.50/90.