Monday Mar 02, 2026

Monday Mar 02, 2026

Thursday, 21 May 2020 00:43 - - {{hitsCtrl.values.hits}}

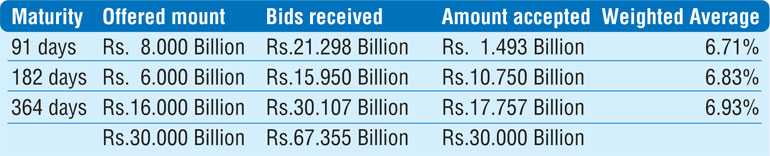

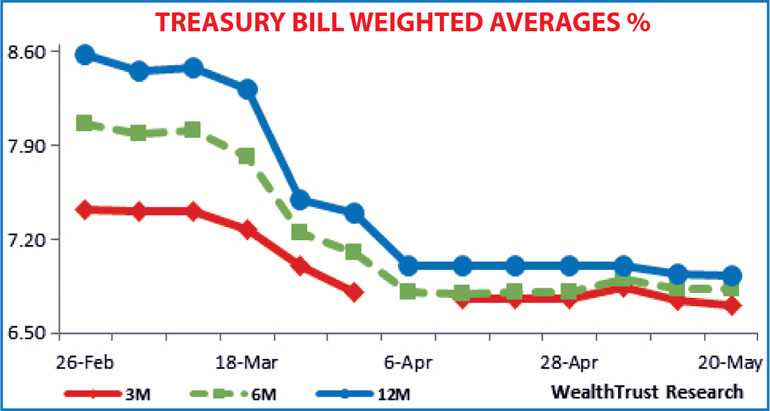

The 364 day bill weighted average yield at the weekly Treasury bill auction held yesterday decreased by 01 basis point for a second consecutive week to 6.93%, whilst its accepted amount exceeded its offered amount for the first time in 11 weeks as well.

The total offered amount of Rs. 30 billion was successfully met at the auction as the weighted average yield on the 91 day bill decreased as well, recording 03 basis points to 6.71%. The weighted average yield on the 182 day bill remained steady at 6.83% while the bids to offer ratio increased further to 2.25:1.

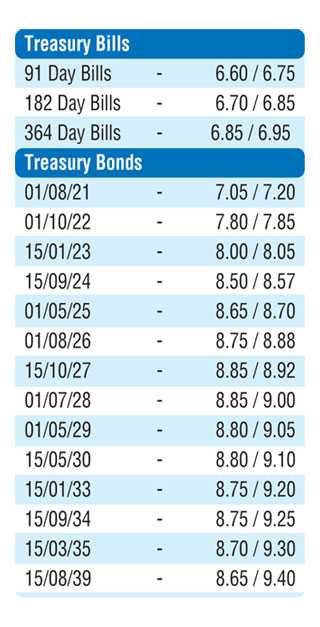

In the secondary bond market, moderate trades were witnessed on the maturities of 01.10.22, 15.01.23 and 01.05.25 at intraday lows of 7.82%, 8.06% and 8.65% respectively against its previous day’s closing levels of 7.80/90, 8.05/10 and 8.65/70. In addition 15.10.27 maturity changed hands at levels of 8.90% to 8.91% as well.

In secondary bills, June bill maturities continued to trade at level of 6.53% while October and December maturities changed hands within the range of 6.79% to 6.86%.

The total secondary market Treasury bond/bill transacted volume for 19 May was Rs. 5.74 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 5.90% and 5.97% respectively as the overnight net liquidity surplus in the system stood at Rs. 130.45 billion yesterday.

The Domestic Operations Department (DOD) of Central Bank injected an amount of Rs. 4.5 billion by way of a 14 day reverse repo auction at a weighted average rate of 6.00%, subsequent to offering Rs. 25 billion, valued yesterday. It further injected an amount of Rs. 5.46 billion for Standalone Primary Dealers by way of a 14 day reverse repo auction at a weighted average rate of 6.35%, valued yesterday.

Moreover it injected liquidity by way of outright purchases of Treasury bonds for a total successful volume of Rs. 12.199 billion on the maturities of 15.03.24, 15.06.24, 15.09.24 and 01.05.25 respectively at weighted averages of 8.48%, 8.52%, 8.55% and 8.66%, valued today.

Upward mom entum in rupee continues

The Appreciating trend on the rupee continued as the USD/LKR rate on spot contracts was seen closing the day at levels of Rs. 187.00/20 against its previous day’s closing levels of Rs. 187.40/50, on the back of selling interest by banks.

The total USD/LKR traded volume for 19 April was $ 21.75 million.