Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 4 January 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

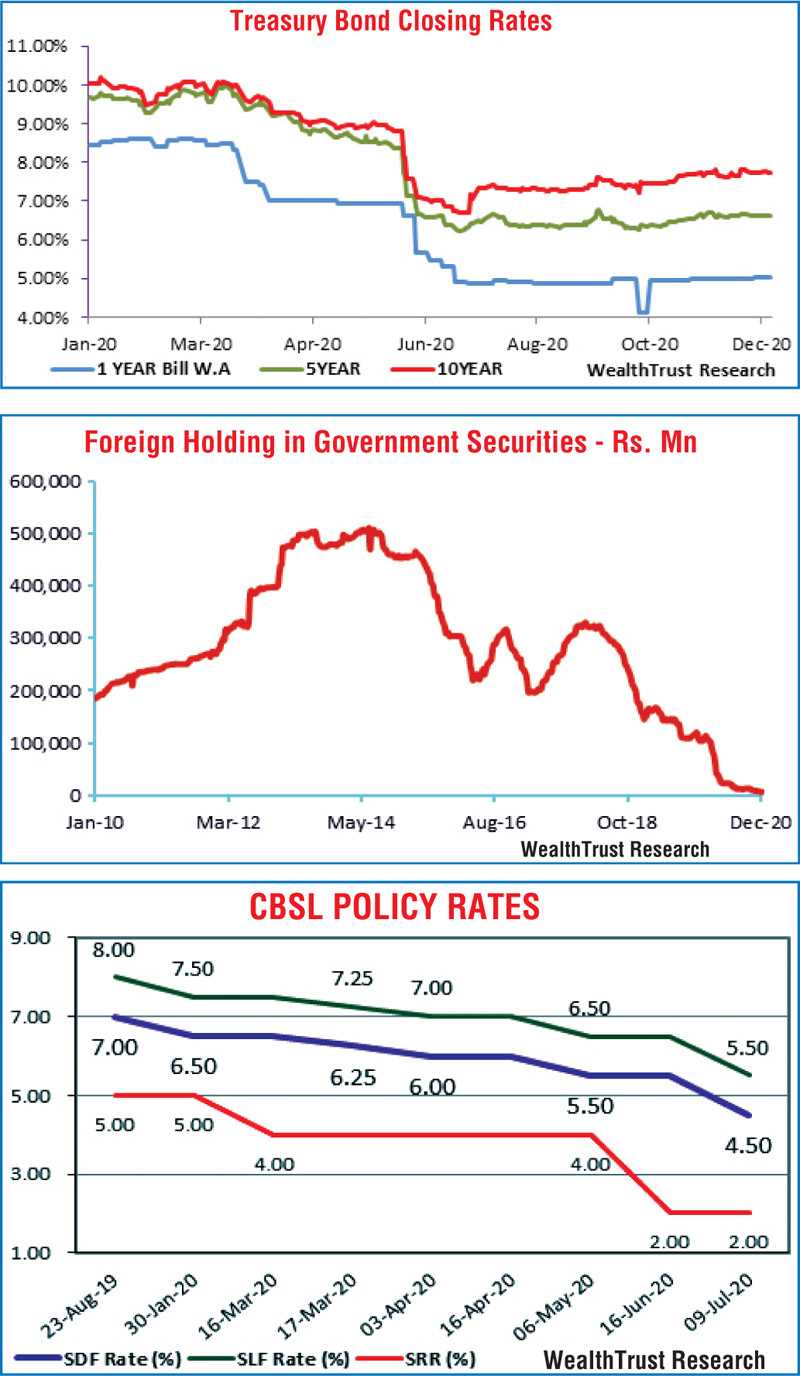

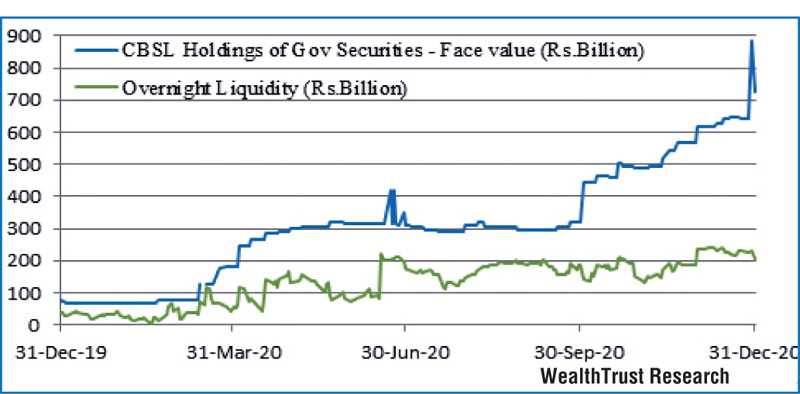

The Treasury bill and bond market ended the year 2020 as one of its most bullish years on record as yields decreased sharply throughout the year to historically low levels. The Central Bank of Sri Lanka slashed policy rates by 250 basis points each on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility (SLFR) during the year while the Statutory Reserve Ratio (SRR) accounted for a drop of 300 basis points over the year as the COVID-19 pandemic took centre stage in the country.

The Treasury bill and bond market ended the year 2020 as one of its most bullish years on record as yields decreased sharply throughout the year to historically low levels. The Central Bank of Sri Lanka slashed policy rates by 250 basis points each on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility (SLFR) during the year while the Statutory Reserve Ratio (SRR) accounted for a drop of 300 basis points over the year as the COVID-19 pandemic took centre stage in the country.

The easing to accommodative monitory policy stance of Central Bank during the year saw the one-year Treasury bill weighted average rate along with the 5-year and 10-year secondary market Treasury bond closing yields decrease to historic lows of 4.13%, 6.24% and 6.70% respectively against its year’s opening highs of 8.45%, 9.68% and 10.05% while trading activity and volumes hit all-time highs.

Meanwhile, Overnight money market liquidity which started the year at a net surplus of Rs. 36.69 billion was seen peaking to over a 17-year high surplus of Rs. 242.91 billion to close the year at Rs. 206.75 billion. The weighted average on call money and repo which started the year at 7.50% and 7.53% respectively was seen closing the year at 4.55% and 4.57%. The Central Bank stock holding of Treasury bills and bonds skyrocketed to an historic high of Rs. 725.19 billion by the end of the year in comparison to its year’s opening level of Rs. 75.02 billion.

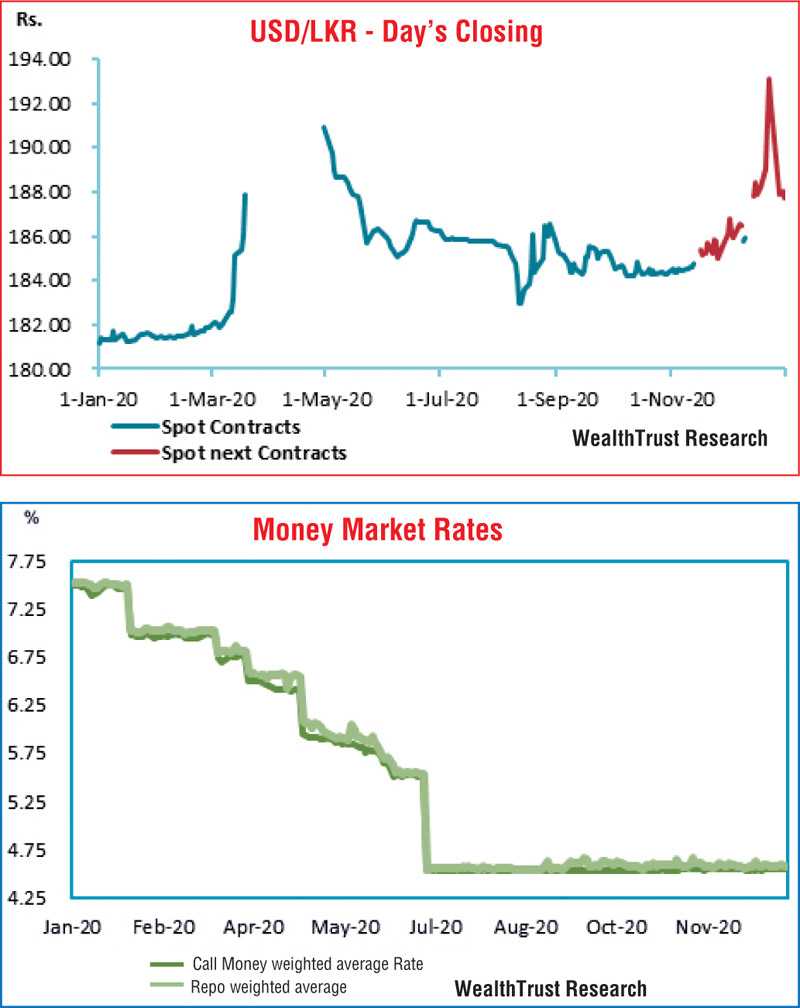

Furthermore, foreign holding in Rupee bonds recorded a net outflow of Rs. 97.15 billion during the year to close the year at Rs. 6.88 billion, its lowest level since the 2010.

The Rupee against the U.S dollar or USD/LKR rate on spot next contracts was seen depreciating during the year to close the year at Rs. 187.00/188.50 in comparison to its year’s opening spot level of Rs. 181.15/25.

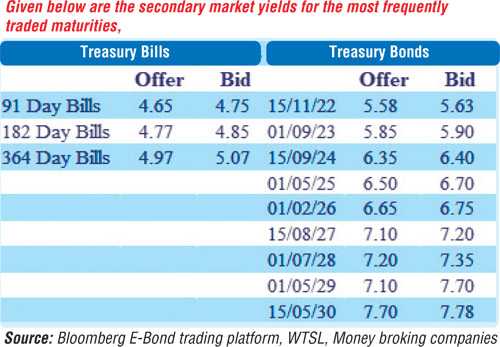

The year 2021 commenced on a bullish note as well with secondary market bond yields dipping on Friday to close the week ending 1 January 2021 lower in comparison to its previous weeks closings while activity picked up following consecutive weeks of very moderate activity. Buying interest, mainly on the short end of the yield curve saw yields on the 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23 and 01.10.23) and 2024’s (i.e. 15.06.24 and 15.09.24) dip to weekly lows of 5.60%, 5.62%, 5.70%, 5.90%, 6.38% and 6.40% respectively against its previous weeks closing of 5.65/75, 5.70/75, 5.73/80, 6.00/05, 6.37/47 and 6.40/48. In addition, 01.02.26 and 15.08.27 changed hands at lows of 6.75% and 7.18% respectively as well. The weekly Treasury bill auction went undersubscribed yet again with the total accepted amount falling short of the total offered amount by Rs. 21.23 billion or 53.08%.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 7.87 billion.

Liquidity increases week on week

In the money market during the week ending 1 January, total outstanding market liquidity was registered at a surplus of Rs. 266.52 billion against a surplus of Rs. 231.10 recorded the previous week.

Rupee appreciates during the week

In the Forex market, USD/LKR rate on more active one-month forward contracts were seen appreciating during the week to close the week at Rs. 188.50/189.50 in comparison to its spot next closing of Rs. 191.00/93 the previous week.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 50.83 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)