Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 14 March 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

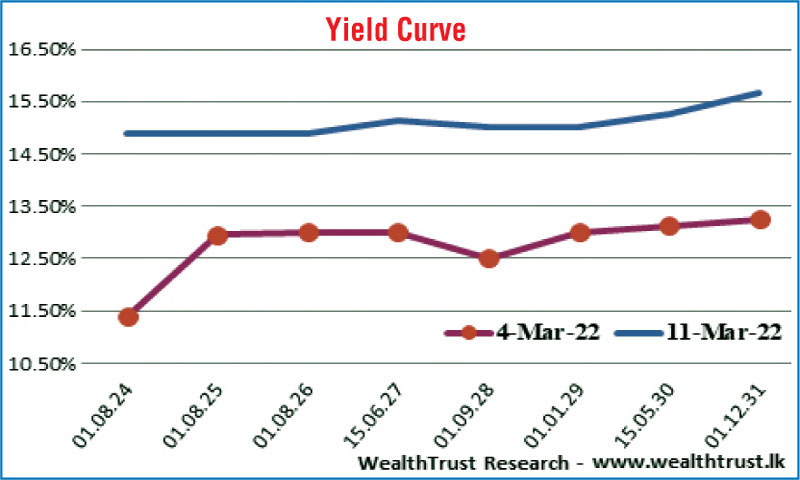

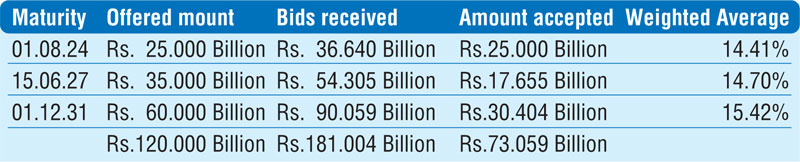

The 2-year and 5-year bond yield were seen crossing 14.00% and 15.00% respectively for the first time since April-May 2009 at its auctions conducted on Friday and against a pre-auction rate of 11.50/12.50 and 12.75/13.75 respectively. The very steep increase in yields at the Treasury bond auctions conducted on Friday saw the 2-year, 5-year and the 9-year maturities record weighted average yields of 14.41%, 14.70% and 15.42% respectively leading to a steep shift upwards of the overall yield curve. Only a total amount of Rs. 73.06 billion was accepted against a total offered amount of Rs. 120 billion.

The 2-year and 5-year bond yield were seen crossing 14.00% and 15.00% respectively for the first time since April-May 2009 at its auctions conducted on Friday and against a pre-auction rate of 11.50/12.50 and 12.75/13.75 respectively. The very steep increase in yields at the Treasury bond auctions conducted on Friday saw the 2-year, 5-year and the 9-year maturities record weighted average yields of 14.41%, 14.70% and 15.42% respectively leading to a steep shift upwards of the overall yield curve. Only a total amount of Rs. 73.06 billion was accepted against a total offered amount of Rs. 120 billion.

The second phase of the auction was opened on the 15.06.2027 and 01.12.2031 maturities while a direct issuance window of 20% of opened on the 01.08.2024 maturity until close of business of the day prior to settlement (i.e. 4 p.m. on 14.03.2022).

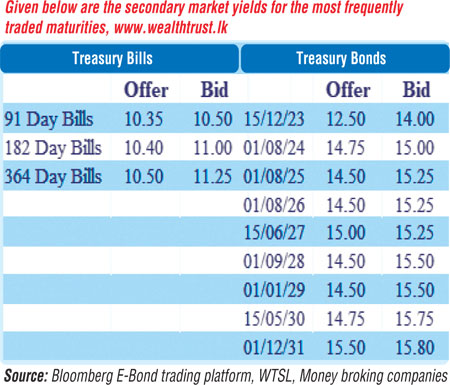

Meanwhile, the secondary bond market was inactive during the week baring a few trades on the 01.08.25 maturity at levels of 13.00% to 13.05%, pre-auction while in the secondary bill market, June 2022 maturities were seen changing hands at level of 9.80% to 9.85% and 10.34% to 10.40% respectively pre and post bill auction sessions.

The foreign holding in rupee bonds remained steady at Rs. 2.65 billion for the week ending 9 March while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 13.82 billion.

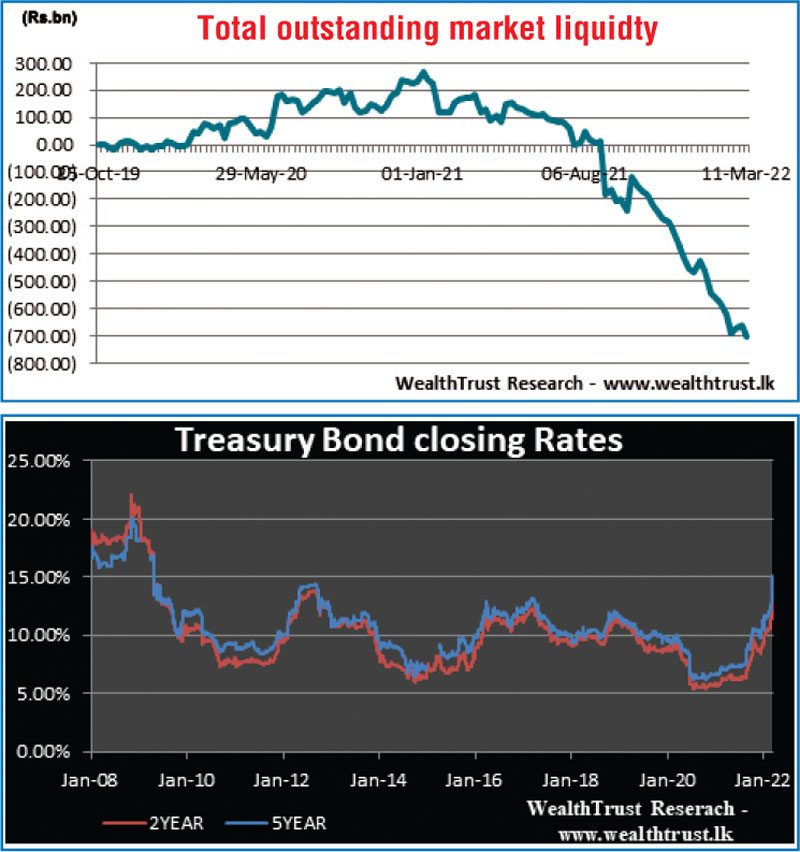

In money markets, the total outstanding liquidity deficit increased to Rs. 703.57 billion by the end of the week against its previous weeks Rs. 664.67 billion while CBSL’s holding of Govt. Securities decreased to Rs. 1,521.70 billion against its previous weeks of Rs. 1529.19 billion. The weighted average rates on overnight call money and repo were 7.49% and 7.50% respectively for the week.

Forex market

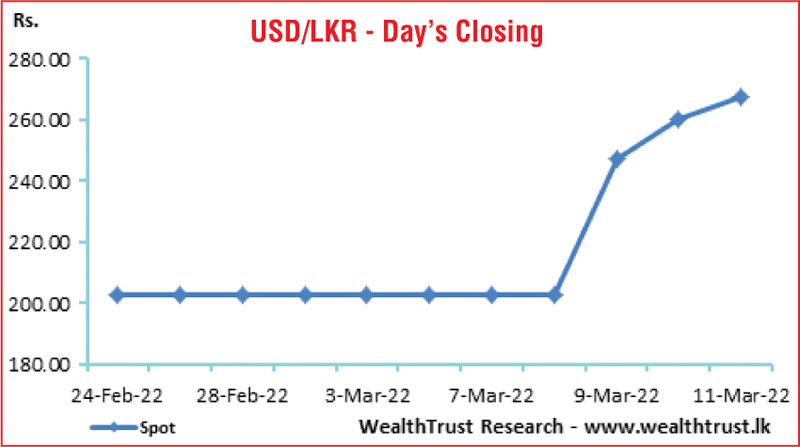

The Rupee or USD/LKR rate following the float was seen closing the week at Rs. 260/75 in comparison to its previous week’s close of Rs. 203.00 while it traded from a low of Rs. 203 to a high of Rs. 260.

The daily USD/LKR average traded volume for the four trading days of the week stood at $ 51.51 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)