Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 6 December 2018 00:58 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

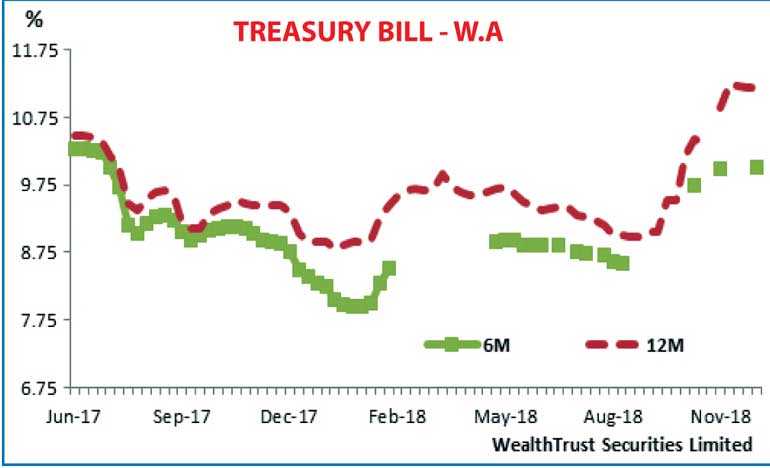

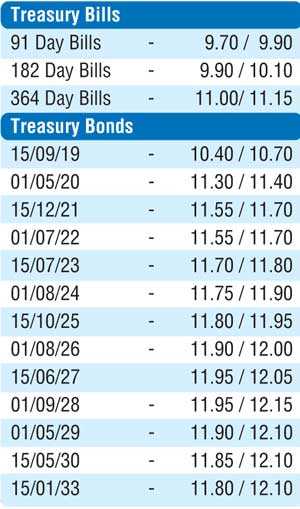

The 182-day bill weighted average yield, at yesterday’s weekly Treasury bill auction, increased above 10%, for the first time in 16 months, while the yield of the 364-day maturity remained unchanged at 11.20%, reversing a downward trend witnessed over the past two weeks.

The total offered amount of Rs. 19 billion was successfully accepted at the auction as the bid to offer ratio stood at 3.07:1.

In the meantime, the secondary bond market remained active yesterday, with continued local buying interest resulting in yields dipping across the curve for a second consecutive day. The liquid maturities of 15.05.23, 01.08.26 and 15.06.27 saw its yields dip to intraday lows of 11.80%, 11.95% and 12.02%, respectively, in comparison to the previous day’s closing levels of 11.80/88, 11.95/10 and 12.10/15.

The total secondary market Treasury bond/bill transacted volumes for 4 December was Rs. 4.79 billion.

In the money market, the overnight call money and repo rates averaged 8.95% and 8.90%, respectively as the overnight net liquidity shortfall increased further to Rs. 79.63 billion. The OMO Department of the Central Bank infused a total amount of Rs. 45 billion at weighted average yields of 8.56% for overnight and 8.58% for seven days.

Rupee loses further

The USD/LKR rate on spot contracts was seen depreciating further yesterday, to close the day at Rs. 179.20/35 against its previous day’s closing levels of Rs. 179/20 on the back continued importer dollar demand.

The total USD/LKR traded volume for 4 December was $ 68.38 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month – 180.30/70, 3 months – 182.25/65, and 6 months – 185.20/60.