Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 17 April 2019 00:00 - - {{hitsCtrl.values.hits}}

By Charitha Ratwatte

In early 2018, a group young interns (all graduates with first class degrees), senior analysts and specialists at the Policy Development Office of the Prime Minister’s Office were discussing the issue of youth unemployment in Sri Lanka. This has been a perennial concern in Sri Lanka and as a person who cut his teeth on the country’s youth program, I am personally aware that it is has always been a matter which worries policymakers at the highest level, even today.

|

Sandaru Bag – Thurunu Diriya entrepreneur Sandamali Somaratne from Kegalle |

One analyst expressed the view that in Sri Lanka there was a unique category of educated unemployed youth, who could only be described as, in the words of a visiting expatriate economist, those who are “Aspirationally Unemployed”.

In other words, there is a group of educated young people who aspire for a certain type of job and until they can achieve that, are content to remain unemployed or do some part time or casual work, way below their capability, while all the while using every trick in the basket of using ‘undue influence’ to get into the type of job they aspire to. The basket of undue influence ranges from long queues of job seekers in front of politicians’ offices, the politicians’ chit system of the past, and the notorious ‘Rest House’ appointments of a bygone era.

A further complication which was brought up was the critical shortages faced by certain manufacturing industries or blue-collar workers, such as construction, plantations and industry, together with the allegation that driving three-wheelers for hire, driving for Uber or PickMe, or riding delivery for Uber Eats, McDonalds, Kentucky Fried Chicken, Pizza Hut or Chinese Dragon, etc. was the attraction that was drawing away youngsters, who should be doing the hard work in construction and industrial sectors and on the plantations.

Being young, they probably appreciate the freedom of choice which this type of work allows, being able to be choosy and select pickups and deliveries, flexible working hours, bikers’ fellowship and camaraderie, etc. A visit to a tea or rubber plantation and a view of the number of three-wheelers parked near the workers’ quarters seem to strengthen this argument!

Fortunately, a recent study by IPS laid one aspect of that that theory to rest, by finding that the majority of three-wheeler drivers were middle aged and those who had worked in another sector earlier, such as in foreign employment. The issue of the low birth rate of the last few decades and the reality of construction workers and foundry workers being imported from other countries was also mentioned.

Startup and sustainability challenges

In this rather depressing scenario, the interns referred to a few of their batch mates, who after qualifying had dared to venture to set up their own businesses and enterprises and the difficulties they faced to sustain their business. An analyst at this point referred to a research study done in a number of countries, which showed that a very high percentage of startup businesses by young people could not survive beyond the third or fourth year due to the inability to expand the business. Sri Lanka was one country covered by the study.

The research showed that to get started the young entrepreneur “begged or borrowed” funds from a relative or friend working in West Asia, or a money lender or pawn broker, for example, and might have a sufficient income and turn over to sustain the business. But the enterprise has to expand to be sustainable, and obtaining resources for this was virtually impossible.

In Sri Lanka, the inability of the commercial banking system, in particular, and the financial service providers, generally to lend at reasonable interest rates based on project financing, based on the inherent viability of the business, rather than taking the conventional, traditional, safe, path of Government servant guarantors’ security or collateral security, compounds the problem.

In Sri Lanka the virtual love affair the State banks have with Government servant guarantors combined with the havoc CRIB has created in the medium, small and micro enterprise sectors, guarantors have created a specific series of problematic issues. People are simply reluctant to guarantee other peoples’ loans.

The group then switched the discussion on how to solve this specific problem. What if a special loan scheme was designed for, (i.) young qualified people, (ii.) who have started up and run an enterprise for, say three to four years, (iv.) with loans available at a reasonable interest rate, (v.) which would not require, collateral or government servant guarantors. Instead guaranteed by parents, a relative and an account holder of that specific bank branch? Do such entrepreneurs exist? How would you find them? Would the banking sector support such a loan scheme? Would such young entrepreneurs have a demonstration effect on other young people, to draw them away from the “Aspirational Unemployed” syndrome?

‘Thurunu Diriya’ begins

After much debate, argument and counter argument, a concept paper was prepared. The subject was broached with Central Bank Governor Dr. Indrajit Coomaraswamy, who referred us to CB Assistant Governor Asoka Handagama. Handgama was supportive and agreed to have the Governor place this on the agenda of the monthly meeting of Bank CEOs at the CBSL.

Member of the Monetary Board Chrisantha Perera passed down the information that the then recently-appointed General Manager of the Bank of Ceylon was a “banker with a difference” who seemed to have a “developing banking” attitude, and had had expressed an interest in the concept at a private discussion after the CEO meeting.

A meeting was requested with Bandara, GM of the BoC. Before the meeting, the support of Ranel Wijesinha, Senior Chartered Accountant and Member of the Board of Directors of BoC, at that time, was canvassed. Wijesinha was supportive enough to attend the meeting with Bandara and senior Bank of Ceylon staff and PMO/PDO analysts and specialists.

After much argument and counter argument, the parameters of a pilot loan scheme were worked out. Entrepreneurs should be under 35 years, have a professional qualification, be in business for a minimum of three years verified by a letter from the Grama Niladhari of the area, be able to produce a certified (not audited) set of accounts for 12 months, submit a business plan acceptable to the Manager of the BoC branch on how he or she would use the borrowed money to expand the business.

The Small Enterprise Development Division of the Ministry of National Policies, Economic Affairs, Rehabilitation and Resettlement, Northern Province Development and Youth Affairs (set up by the PM, when he was Minister of Youth Affairs and Employment in the 1980s) which has an islandwide network, was commissioned to assist with the preparation of the business expansion plan.

The Bank of Ceylon communication experts decided to brand the loan scheme as ‘Thurunu Diriya,’ which translates into English roughly as “young people with courage and guts” – somewhat like, and in the same spirit, of the British Army’s Special Air Service Commando’s Motto of ‘Who Dares Wins’.

The BoC issued its first circular instruction to branches in March 2018.

The PDO/PMO decided to set up an implementation monitoring unit in collaboration with the Central Program Management Unit (CPMU) of the Ministry of National Policies, Economic Affairs, Resettlement and Rehabilitation, Northern Province Development and Youth Affairs.

An inspired suggestion from one of the specialists at the CPMU was that the Divisional Secretariat be made the Unit at which level the ‘Thurunu Diriya’ will be monitored and that we should request the Divisional Secretary to nominate a specific officer, who will liaise on the program with CPMU. In hindsight, this was indeed very practical, as, to quote one Divisional Secretary, who mentioned that she has over 100 field officers (Os), attached to her Division, with acronyms covering virtually the whole English Alphabet – AO to ZO and more!

All the Divisional Secretaries were requested to nominate a contact person for the implementation and monitoring purpose for ‘Thurunu Diriya’ program. An initial round of awareness programs were conducted at provincial level with nominated officers. Further, a second round of provincial progress review meetings were conducted with the participation of officials from the Provincial Council, National Apprentice and Industrial Training Authority (NAITA), National Youth Services Council (NYSC).

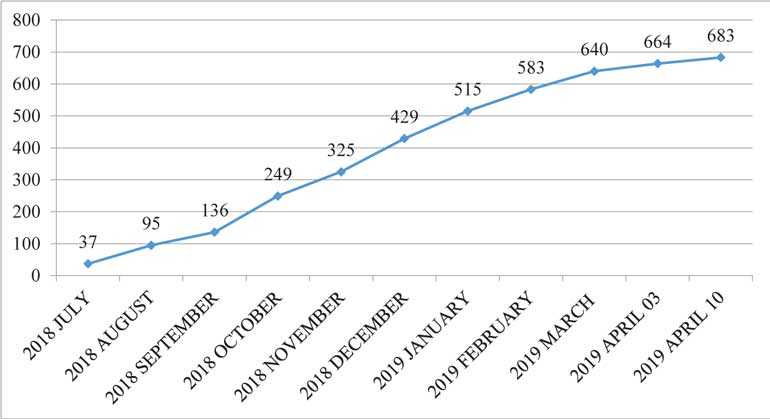

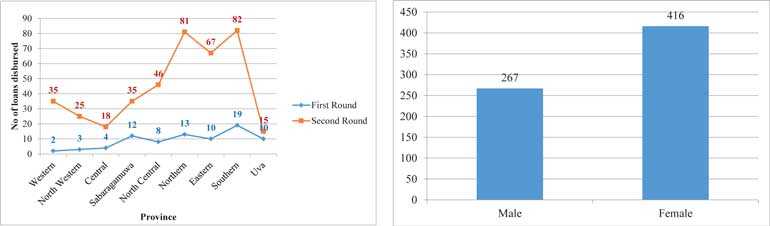

A marked improvement was seen, as is evident from the graph, between the first and second rounds.

‘Thurunu Diriya’ has received unqualified support from all levels of Government from the National, Provincial, District to D.S. Division and GN Division. The provincial reviews strengthens the need for program managers to go out into the field and communicate face to face with implementing officers at the grassroots. Remember that that old adage of the plantation managers of yesteryear – “The best fertiliser for your field, is the sole of your boot.” You have to “walk the talk”. An air-conditioned cubicle in Colombo is not the best place to monitor the implementation of a field program!

For example, the feedback received form field operatives, the nominated officers, the BoC Provincial hierarchy, was critical in modifying ‘Thurunu Diriya’ in practical, implementable terms. The age limit was changed from 35 to 40, on the feedback that most young entrepreneurs got going in their early 30s. The flexibility to accept any reasonable certification, not only NVQ or Vidatha, even from private institutions, the Grama Niladhari certificate on the three-year existence, instead of business registration document were all suggestions made at provincial meetings. It was reported at a provincial meeting that getting a Business Registration Certificate for this type of entrepreneur was an exercise in bureaucratic futility!

Some BoC branch managers, it was reported, were insisting that the professional qualification must have a link to the type of business the entrepreneur wanted to expand. This issue was settled when one potential borrower asked caustically: “Madam Manager, I distil lemon grass oil, do you want me to have a Degree in Lemon Grass Oil Distillation?” I also pointed out, in this case, that a lawyer and development administrator was promoting entrepreneurship, development banking and project lending!

In June 2018, the Ministry of Finance launched the ‘Enterprise Sri Lanka’ loan scheme. The consent was obtained from the Minister of Finance to bring ‘Thurunu Diriya,’ for promotional purposes, informally, within the ‘Enterprise Sri Lanka’ umbrella.

As at 10 April this year, loans worth of Rs. 281,829,628 had been disbursed among 683 young entrepreneurs. The first ‘Thurunu Diriya’ loan was disbursed by the Ankumbura branch of BoC in April 2018.

Educated female unemployment is the critical problem Sri Lanka is facing. This is compounded by the statistically low numbers of female participation in the economy. For a nation, which, unlike our South Asian neighbours, has put in substantial resources into female education and healthcare, this is a real problem.

‘Thurunu Diriya’ has become a helping hand for a large number of young qualified female entrepreneurs who work courageously for the wellbeing of their families. As at 10 April, 416 females (60.9 %) were fortunate to benefit from this loan scheme.

According to the analysis of entrepreneurs participating in ‘Thurunu Diriya,’ beauty culture, tailoring, electric work, welding and agriculture, especially plant nurseries, are identified as the highly-in-demand business fields. Further, all the borrowers are vocationally qualified with NVQ, Vidatha or private sector certification.

E.D.A.T. Gunadasa, a young entrepreneur in denim textiles industry from Ankumbura, was the first to receive a loan under ‘Thurunu Diriya’ in April 2018. S. Akinthan from Vavuniya and K.M.I.R. Konara from Monaragala are the 50th and 100th loan beneficiaries respectively.

Cutting the umbilical cord-like connection between BoC branch managers and Government servant guarantors has not been easy, but substantial progress has been made with the unstinting support of BoC’s Head Office and regional staff.

The demand for the ‘Thurunu Diriya’ Enterprise Sri Lanka program has been increasing day by day with entrepreneurs’ dreams of being successful to reach the peak in their own business. Hence, it is planned to further promote the program to fulfil the self needs of young people in Sri Lanka.

The support received from Bank of Ceylon staff and administrative officials at all levels has been critical for the success of the scheme. Wide publicity was given to ‘Thurunu Diriya,’ in fact, some borrowers have said that they first read of the program in the newspapers.

(The writer is a Senior Advisor to the Prime Minister.)