Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 6 August 2015 00:00 - - {{hitsCtrl.values.hits}}

The large role of government in the economy is such that the August election is bound to have a significant impact on the opportunities and risks that investors face over the next six years.

A key ingredient of investing is having confidence in the future. Financial markets hate uncertainty and as a result investors prefer governments that do not constantly change direction or go in the wrong direction. This is vital, as frequent changes in the rules will make new investments riskier, calling for regular alterations to the investment portfolio.

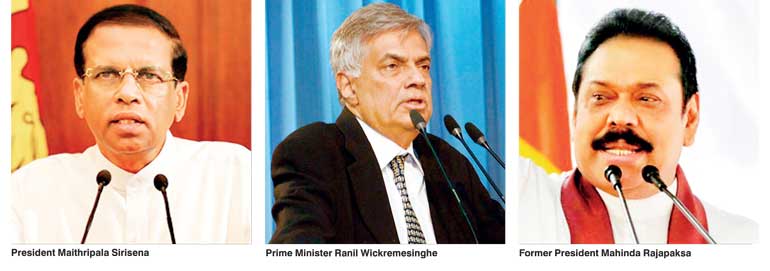

Now, that we know President Sirisena is firmly in place, it is time to think about who will form the next government. The former President Mahinda Rajapaksa-driven United People’s Freedom Alliance (UPFA) is trying to win ground after his surprise defeat early this year. However, accusations of corruption, nepotism and dictatorship during the Rajapaksa rule still linger a dark cloud over the chances of the UPFA.

Conversely, despite the long tenure in the Opposition benches, the Premier Wickremesinghe-led United National Party (UNP) now could feel that they have a strong case to form the government on 18 August.

The 100 day interim Government led by the UNP and fractions loyal to President Sirisena delivered certain key promises such as the reduction of prices of essential goods and passing of the 19th Amendment to the Constitution. However, despite the rhetoric with regards to the commencement of investigations on the corrupt activities of the previous Government, no such individual has still been found guilty of corruption and malpractice. The key infrastructure projects initiated by the previous regime were put on hold and a significant rise has been witnessed in State borrowings to compensate consumption-related expenses.

Tricky scenario for investors

The present state of affairs means that this election would be a complicated one for investors to navigate the markets and formulate decisions in the weeks, months and years ahead. In the 17 August election, neither the UNP nor the UPFA is likely to win a clear majority, which equates to 113 seats out of 225. This will transcend to a tricky scenario with the party with the most seats been forced into finding a coalition partner from the range of minority parties.

The likely contenders would be the Janatha Vimukthi Peramuna (JVP) and Tamil National Alliance (TNA). Since the main two parties UNP and UPFA also includes a range of coalition partners, the likelihood and the degree of comprise on key portfolios will determine the eventual stability of the Government. Deducing the best outcome for investors will be a problem in itself as neither of the two main parties have lived up to the expectations during their terms in office nor the coalitions. Therefore, a smooth outcome for capital market investors will be hard to imagine.

Strong bonding between Executive and Govt. vital

The capitalism-friendly UNP could be considered the front runner that would be favoured by most to form the next government, as it has already been the key driver behind President Sirisena’s election to office. The strong bonding between the Executive and the Government is pivotal for important reforms to be passed to move the country towards a development-oriented path.

One such reform will be the formulation of an electoral system with a structural origin to stop corruption, crossovers and allow for the educated with development oriented policies to be elected to office. In the event of the election of a government headed by former President Rajapaksa, a situation can arise that for anything to get done both the President and Rajapaksa would have to compromise and given the context, the reaching of an agreement or anything is highly unlikely.

Conversely, the long-term bonding between a UNP-led Government and President Sirisena can also be thought of with a grey area for any analyst.

Putting investor interests first and preserving capital market integrity

For investors involved with capital markets, the duty of putting investor interests first by protecting investor interest and preserving capital market integrity should be the key focus of their hopeful government. Whether it is the UNP or UPFA, investors depend on trust and strong rule of law. This can be enforced through effective enforcement and by having a more transparent and fair system.

In addition to many global fund managers constantly highlighting the need to improve liquidity in the market place, they have also highlighted the need to have a strong system to protect minority shareholders. Therefore, electing a strong government with the propensity to enforce strong regulations to promote open and honest financial system will be at the forefront of capital market development during the next six years.

Foreign policy

Foreign policy would also need to be given serious consideration. With pending human rights allegations bought forward by certain foreign forces, Sri Lanka faces the risk of unsavoury experiences that will affect many sectors and people of the economy. Therefore the new Government should resort to diplomacy to fight against these forces.

The nature of the relationships should also be placed on an equal footing rather than favouring certain nations over the other. The present Government headed by the UNP has made significant headway in regain the trust of many nations that the previous regime had distanced them with.

A key date for this uncertainty to end will be when the Parliament opens with whomever forming the government. Until this day investors should be sensible to hold their nerve, even if the campaign period feels divergent about the ambiguity hanging over the result. The key motivation for stock market investors would be to beat the market over the next year or two and not to follow the moves of the politicians and the ambitious emotional reactions to short term news.

(The writer is the Assistant Manager – Capital Markets at Candor Equities Limited Sri Lanka. He has a BEng in Chemical engineering Honours degree from University of Nottingham, United Kingdom and a MBA from University of Colombo. He is also a Chartered Financial Analyst. He can be reached via email on [email protected]. The views expressed in the article are solely of the writer and do not constitute an opinion of the company.)