Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 15 August 2016 00:00 - - {{hitsCtrl.values.hits}}

By Lasantha Somaratne, CFA

My previous newspaper columns on the subject of monetary and exchange rate policies were focused on analysing the impact of said policies on national economy.

The first column (online link: http://www.ft.lk/article/548003/Reason-for-depreciation-of-Sri-Lankan-Rupee-in-recent-past-and-implications-to-economy) was an attempt to understand the reasons behind the movement of LKR exchange rate. Secondly, the  long-term impact of past policies on the external sector of the country was discussed (online link: http://www.ft.lk/article/550200/Effect-of-imprudent-exchange-rate-and-monetary-policies-in-past-on-SL-exports-sector).

long-term impact of past policies on the external sector of the country was discussed (online link: http://www.ft.lk/article/550200/Effect-of-imprudent-exchange-rate-and-monetary-policies-in-past-on-SL-exports-sector).

The exchange rate and monetary policies are two distinctive polices targeting two different variables though they are highly interlinked. The objectives of the monetary policy is to maintain domestic price stability by managing inflation while exchange rate policy aims to achieve stable and competitive exchange rate suitable for maintaining external competitiveness of the country. Historical evidence suggests that Sri Lanka has in some occasions mixed up these two policy tools.

Moving further on the subject, this column attempts understand the current policy framework and its appropriateness to the prevailing environment in achieving the objectives.

Tightening the monetary policy

The CBSL increased its policy rates by 50 basis points at the last policy meeting in order to combat inflationary pressure. The rate decision came as a surprise to the markets. According to a Reuters survey, a majority of analysts believed that there would be no change in the policy rates.

The simple reason, the CBSL action was timely and unprecedented in the recent history. This is a clear indication that the CBSL has committed to its core objective of maintaining price stability of the country. The immediate trigger for the action of the CBSL was adverse movement of primarily three variables; inflation, credit growth and fiscal vulnerability.

Inflation

The central banks in the world has resorted two contrasting policy actions today. The developed world is fighting against the deflation while some developing countries struggle to control the menace of inflation. The ultra-low interest rate environment in western world is a result of the battle against deflationary condition. Interest rate is a key policy tool used in controlling inflation.

In answering a question on why we should not focus on growth for a while and forget about inflation, Sir Mervyn King, then Governor of the Bank of England (BOE), explained why managing inflation is so important: “Once higher inflation becomes entrenched, it may be costly to dislodge. Past UK recessions were associated not with slowdowns in the world economy, but with attempts to squeeze inflation out of the UK economy. The best thing that we can do to promote economic stability is to avoid inflation, and inflation expectations, from becoming dislodged from the target in the first place.”

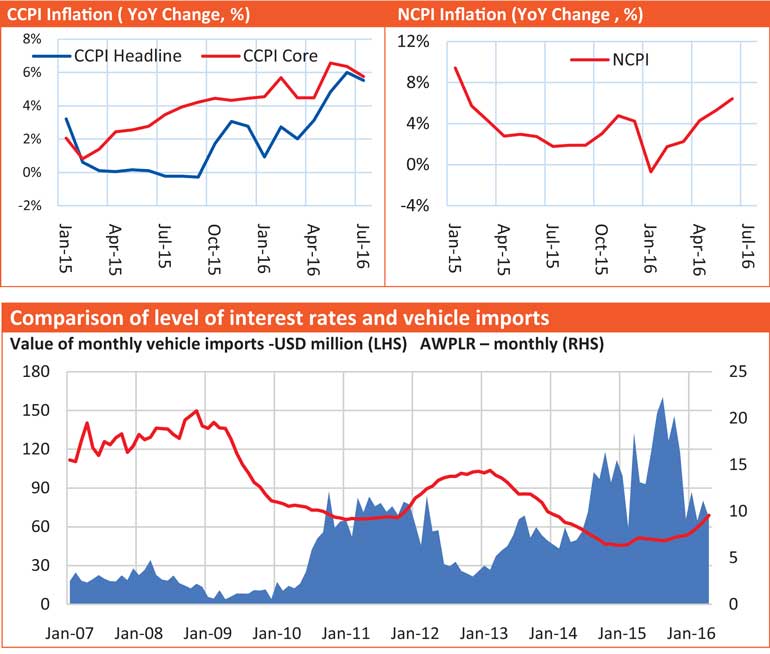

Sri Lanka has a poor record of managing inflation in the past few decades. The key inflation measures such as Colombo Consumer Price index (CCPI base year 2006/07) and National Consumer Price index (NCPI base year 2013) in the past few months has indicated inflationary pressure building in the economy.

Having understood the danger, the CBSL had allowed interest rates to adjust upwards early this year. Generally, the monetary policy works within certain lag. Observing the signs of inflation, the CBSL had decided the policy tightening in the early part of the year is insufficient to control the inflation in the economy and acted accordingly.

Fiscal vulnerability

The Government introduced broad-based Value Added Tax (VAT) reforms early this year. Introduction of such VAT reforms serves two purposes. Firstly, “revenue as a percentage of GDP” which has gradually declined over the last decade should be enhanced to a long-term sustainable level. Secondly, it is essential to cover the immediate shortfall of revenue due to increased spending (primarily salaries and interest payments). Failure in the implementation of necessary VAT reforms may result in falling short of revenue target this year. Revenue shortfall has to be met through increased borrowing, curtailment of capital expenditure or mix of both.

Need for high interest rate

The other concern the CBSL had was the growth observed in the net domestic assets (NDA). According to the latest available data; the credit to private sector had grown by 28% in May 2016. This is despite the upward trajectory of the interest rates in the local market since the CBSL has opted to switch to contraction mode early to this.

Is high interest rate bad?

Level of interest rates matters, as it is the benchmark for all the economic decision of the economy. Interest rate in the economy is the price of money, determined similar to price of any other goods. However, the CBSL can set the direction of the interest rates in controlling money supply to subsequently arrest the inflation.

Sri Lankan recent history shows that the interest rates were artificially controlled using captive sources. The CBSL manage both the public debt office and the largest provident fund of the country. Using those institutions and SOEs, the CBSL engineered artificially-controlled low interest rate regime.

Analysts argue that market determined high interest rates are better than artificially controlled low interest rates. The artificial controlled low interest rates distort economic activity and create assets bubbles, can cause severe inflation and exchange rate fluctuations.

Economists observe that the low interest rates prevailed in the past has contributed to the growth of consumption demand rather than stimulating productive investments. The credit fuelled consumption in turn affecting the exchange rate, as many of the consumer goods including motor vehicles are imported. The question arise is whether artificially controlled interest rate help to stimulate the economy in the long run. Instead it has contributed only towards creating asset price inflation.

Analysts argue that controlling inflation through the movement of interest rates is theoretical and hence should be based on research on the local economy. Despite the high level of interest rates prevailed, during the first half of the year, credit growth remained high. Economists believe that the cost of high interest rates are passed to the consumers and later contribute to the domestic inflation. Credible research on this subject is not available in the local context, hence suggested that CBSL researchers should carryout research on the effectiveness of such monetary policy action.

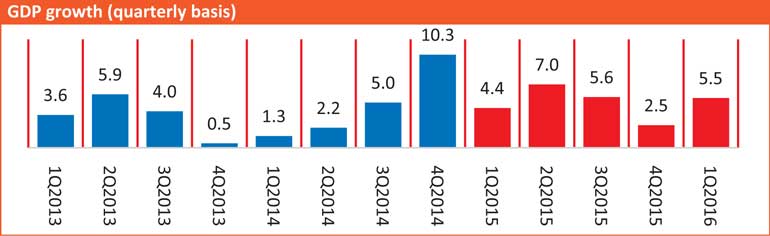

GDP growth

Along with the policy announcement, the CBSL has emphasised that the growth momentum will sustain albeit at a slightly slower rate of 5%. Though the CBSL maintained a tighter monetary policy stance in the recent past, permitting interest rate to adjust to equilibrium level, the growth of GDP in the recent quarters has stabilised. However, it is observed that the current phase of growth is slower than the regional peers since the country is in realigning phase of its growth model. The right policy framework, implemented today should support the country to achieve a long-term sustainable economic growth.

Conclusion

The monetary policy announcement informs us of the recent tighter monetary policy stance taken by the CBSL is in response to adverse development of the credit growth, building inflationary pressure and worry over the fiscal slippage due to non-implementation of critical VAT and other tax reforms. The rate hike was a surprise since the country had lived through a regime of artificially controlled low interest rate regime. The CBSL action was timely and should promote price stability as the core objective of the bank while promoting long-term sustainable economic growth.

(The writer is a CFA Charterholder and Fund Manager by profession, experienced in local and international capital markets.)