Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 13 June 2016 00:00 - - {{hitsCtrl.values.hits}}

Transshipment ports under severe threat

Transshipment ports under severe threat

Container shipping alliances are increasingly focusing on faster transit times and reliability to lure shippers. But with lines reluctant to pay higher fuel bills if they speed up vessels, services are likely to be streamlined and port calls cut, according to Drewry. The analyst said that announced changes by the 2M alliance of MSC and Maersk could quickly become the template for rival alliances. The two carriers last week outlined details of a new Asia-North Europe Network that will come into effect in the third quarter peak season.

Although the changes were subtle and branding and the number of ships and services would stay the same, Drewry said alterations to port rotations would result in faster transits and fewer port calls. One of the benefits trumpeted a couple of weeks ago by the member lines of The Alliance that shippers can look forward to next year was very attractive transit times and it seems that the 2M carriers have decided to take up the challenge and speed things up ahead of their new rivals, said the analyst.

Rather than increasing the operating speed of vessels, an unattractive cost proposition in light of bunker prices doubling in recent months, the 2M carriers have decided to reduce the number of ports served. Inevitably this means that they will lose some direct connections, but the pay-off is that transit times in surviving corridors can be reduced as more time is spent at sea. Drewry said the main reduction of port calls would be in Asia, but the network changes would boost 2M’s transit times to the key North European ports of Hamburg and Rotterdam.

Ultra larger carriers risk carrier dominance

Ultra larger carriers risk carrier dominance

A report from the Hong Kong and Shanghai Banking Corporation (HSBC) says big shipping consortia, particularly the proposed Ocean Alliance, to unite CMA CGM, Cosco, Evergreen and OOCL and the Maersk-Mediterranean Shipping Co (MSC) 2M union, stand to aggravate port congestion and break the market dominance of port operators. The HSBC said that if the new alliance receives regulatory approval, it expects ‘erosion in bargaining power versus shipping lines, particularly for transhipment ports’, though ports controlled by Cosco Pacific could benefit, reports Lloyd’s Loading List.

Bigger alliances also imply changes in peak demand and capacity challenges, said HSBC. Similar to 4Q14/1Q15, when O3 and 2M were commencing, we could see port congestion in 2017 due to the restructuring of services. The proposed Ocean Alliance, if approved by regulators, will be bigger than the 2M alliance of Maersk and MSC by fielding four of the top 10 box carriers to offer 40 services and deploy over 350 ships. 2M alliance of Maersk Line and MSC will offer 21 services and 185 ships.

We expect the alliance to be slightly positive for OOIL (OOCL) as it would be part of a bigger alliance versus its current alliance, where a number of its partners are facing financial difficulties, said HSBC. On the other hand, Hanjin and Yang Ming would be left to find alternatives, which may not be an easy task given their high leverage. However, Drewry Maritime Equity Research described the decision of Hong Kong based line OOCL to join with CMA CGM, Cosco Container lines and Evergreen Line in the new Ocean Alliance as “surprising” due to the line’s relatively limited capacity compared with the other players and its existing G6 alliance partners.

Wan Hai, most profitable container line

Wan Hai Lines surpassed Maersk Line as the world’s most profitable container line in 2015, based on operating margins, according to Alphaliner. The Taiwanese carrier earned $ 127 million before interest and tax, a 6.3% margin on its $ 2 billion revenue, just ahead of the 6% achieved by Maersk’s $ 1.4 billion EBIT on revenue of $ 23.7 billion, the industry analyst said. French carrier CMA CGM ranked thirst at 5.8% followed by Hong Kong based OOCL at 5%, according to Alphaliner’s survey of the 16 largest lines that have published full year results for 2015.

These four carriers since 2010 have consistently posted core EBIT margins at around 6% above the industry average. The disparity in the scale of operations between Maersk and Wan Hai suggests that size alone does not explain the outperformance of these carriers, Alphaliner noted. At the other end of the spectrum, several Asian carriers have continued to post dismal  results, Alphaliner noted. China Shipping Container lines was the worst performing line with a full year loss of $ 335 million and a -6.5% EBIT margin.

results, Alphaliner noted. China Shipping Container lines was the worst performing line with a full year loss of $ 335 million and a -6.5% EBIT margin.

Cosco, its merger partner, lost $ 227 million for a -3.2% margin. Mediterranean Shipping Co., the world’s second largest carrier by capacity after Maersk, is privately held and does not publish financial results. The average operating margins of the 16 carriers surveyed were only slightly positive at 0.3%, with the majority sinking into the red in the final quarter after booking profits in the first half of the year. Of the 14 carriers that published fourth quarter results, only three posted core EBIT figures while the average margins slumped to -5.9%, the worst quarterly results since 2012.

Wan Hai remained the most profitable carrier in the quarter with a sharply reduced margin of 1.2%, followed by CMA CGM at 0.6% and Germany’s Hapag-Lloyd at 0.1%. Maersk slipped to fifth, behind Israeli carrier Zim Integrated Shipping Services, with a negative margin of 2.3%. While the fall in bunker prices initially boosted the carriers’ financial performance, this effect was rapidly eroded when shipping lines forcibly passed all these cost savings on to shippers through lower freight rates.

In the second half of the year weak cargo growth and a muted peak season drove carriers to slash freight rates to non-compensatory levels. The negative trend has continued into 2016 as freight rates have continued to sink, with the China Containerised Freight Index slumping to a new record low of 646 points on 1 April.

Major Indian ports to improve productivity

The government of India, buoyed by positive reports on gate automation at Jawaharlal Nehru Port Trust, is looking to set up radio frequency identification, or RFID, technology for gate operations at other major public ports in the country. Of the other port trusts, Kolkata, Chennai, Cochin and Paradip have already awarded contracts for the procurement of new gate systems following competitive tender procedures. All the ports are expected to complete this process by the end of this year.

The automation drive is one of several ‘ease of doing business’ initiatives that the Ministry of Shipping and other authorities have implemented during the past year to alleviate congestion and reduce wait times at gateway ports. In its last World Bank survey, India ranked 130th out of 189 nations in the ‘ease of doing business’.

Worldwide container trades, lacklustre growth

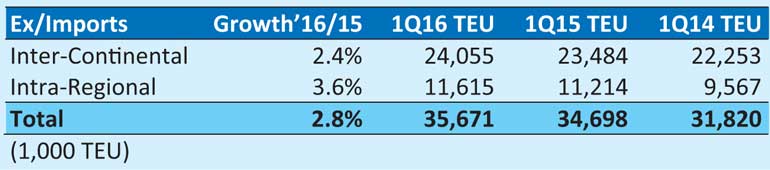

During 1Q16, global full TEU volumes increased by 2.8% year-on-year to 35.7 million TEU, according to (provisional) figures form Container Trades Statistics (CTS). While inter-Continental trade rose by 2.4% to 24.1 million TEU, at 11.6 million TEU, intra-Regional volumes were 3.6% higher.

Export container trades were between 5.8% lower (Africa) and 6.5% higher (Middle East/Indian Sub-Continent). Whereas Far East volumes went up by 2.5% and North American numbers by 4.9%, exports from Europe declined by 0.6%.

Container shipping revenues per TEU significantly low

2015 revenues per TEU for most carriers were significantly lower than those of 2014, due to the overall decline of rates. Part of the difference, although, is compensated by substantially lower fuel bills.

(The writer a Maritime Economist is a Chartered Fellow (Logistics Transport), Chartered Shipbroker (UK),

Chartered Marketer (UK) and a University of Oxford Business Alumni. He is also a Fellow of NORAD/JICA and Harvard Business School (EEP).)