Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 5 June 2017 00:01 - - {{hitsCtrl.values.hits}}

The reforms of public debt management in Sri Lanka are lagging behind in comparison to peer group countries. As a result, it  remains fragmented, outdated and less competitive; demanding modernisation in many aspects. The gaps in the public management system vis-à-vis the best industry practices are identified through a proper system analysis.

remains fragmented, outdated and less competitive; demanding modernisation in many aspects. The gaps in the public management system vis-à-vis the best industry practices are identified through a proper system analysis.

The Government of Sri Lanka has requested assistance from the World Bank for such studies. In response, the World Bank has carried out a Debt Management Performance Assessment (DeMPA) in 2015. Though we are not privy to the finding of the DeMPA due to the unavailability of the report in the public domain, indication about the typical finding of such a study could be derived from the similar publicly available DeMPA reports.

Debt Management Performance Assessment (DeMPA)

The DeMPA comprises of a set of 14 debt performance indicators (DPIs), which aim cover the complete spectrum of government debt management operations and assessment of the overall environment in which debt management operations are conducted.

The scoring methodology assesses key areas of debt performance indicators (DPIs), and assigns a score of either “A”, “B”, “C” or “D”. The evaluation starts by checking the conformity to the minimum requirement and a score of “C” is assigned if the minimum requirement are met. If the minimum requirements set out in “C” are not met, then a score of “D” is assigned. While the “A” score reflects sound practice for that particular dimension of the indicator, the “B” score is an intermediate score (in between the minimum requirements and sound practices). In reviewing reports of similar ranking countries, it could be reasonably assumed that Sri Lanka would score “C” & “D” in all DPIs, indicating the need for undertaking board base reforms in public debt management.

Though formalising the necessary institutional framework, setting up of proper coordination between fiscal policy, monetary policy and public debt management, liability management of public debt portfolio, the development and maintenance of an efficient market for government securities and establishing a risk management framework are importance steps towards a reliable public debt management system, the Medium-Term Debt Management Strategy (MTDS) is considered the central point of the public debt management. The process leading to the establishment of the MTDS shall be the first step in a broader reform process to address weakness identified through the debt management performance assessment.

Overview of the public debt management

The objectives of public debt management is to meet the financing needs and payment obligations at its lowest possible cost consistent with a prudent degree of risk. Public debt management involves the designing and implementing of a strategy for managing debt to achieve the above primary objectives while it could target other secondary objectives such as developing the domestic debt market.

The key distinctions to identify at the outset are the differences between fiscal policy and public debt management. The fiscal policy involves the government changing the levels of taxation and government spending with the aim to influence the Aggregate Demand (AD) plus the level of economic activity and finally decide the level of debt required to support the expenditure programme. Public debt management, in contrast, intends to determine the structure of the debt, cost and risk of the debt portfolio within acceptable tolerances and decide the composition of public debt.

Benefits of a medium-term debt management strategy

According to the World Bank, the Medium-Term Debt Management Strategy (MTDS) is a plan that the government intends to implement over the medium term (three to five years) in order to achieve a composition of the government debt portfolio that captures the Government’s preferences with regard to the cost-risk tradeoff. Simply, this plan intends to achieve the desired composition of the public debt portfolio. A properly executed MTDS bring about the following benefits.

Evaluating the cost-risk trade-offs: The MTDS takes into consideration the cost and associated risk of all available financing strategies in deciding the best combination of alternatives. The World Bank has developed MTDS Analytical Tool (AT) which is a spreadsheet-based application that encompass all input variables and provides a cost-risk framework to guide the MTDS decision-making process and by doing so, aims to avoid any wrong decision based only on cost.

Risk management: The MTDS provides a way of identifying and monitoring key financial risks to decide on the best strategy to deal with such risks under circumstances of limited financial choices. The MTDS facilitates the risk management function of public debt through the evaluation of alternative financing strategies and guidance on risk mitigation.

Coordination: The MTDS facilities the enhanced coordination and establishes the link between various entities and functions related to public debt including fiscal and monetary policy. It could facilitate improved communication among the key stakeholders in a systematic form. Overall, the improved coordination should help parties focus on their core objectives with clear segregation of public debt management from monetary and fiscal policies.

Other benefits: In addition to the above, a well-established MTDS helps to identify constraints affecting the debt management choices and finds ways to ease off those constraints. It further helps to reduce the overall cost of the public debt and paves the way for the development of the local debt market while facilitating enhanced relationships with various stakeholders. Moreover, a well-structured MTDS improves the governance of public debt, improves the consistency and transparency of the process.

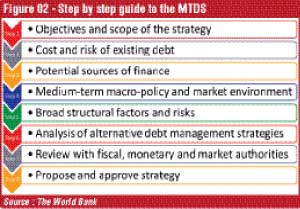

The steps in designing MTDS

Guidance Note for country authorities for developing a Medium-Term Debt Management Strategy (MTDS), prepared jointly by the Staff of the IMF and World Bank are listed out an eight step process for the formation of MTDS.

1.Step 01 is to identify the main objectives for public debt management and the scope of the medium term debt management strategy. The expected outcome of this step includes a description of the overall objectives of the public debt management and defining the types of debt expected to cover through the strategy.

2.This step intends to carry out a thorough analysis of the existing debt management strategy, the costs and risks associated with the existing debt in order to identify detailed information on outstanding debt, the debt servicing profile and description of main risk of the debt portfolio.

3.Step 3 involves the preparation of a list of existing and potential debt instruments, for both domestic and external markets including the description of their financial characteristics, along with the evaluation of the potential of annual borrowings through each debt instrument. At the end, it is expected to rank the instruments based on cost/risk characteristics.

4.Baseline projections for key fiscal, monetary policy variables and market interest rates will be identified as inputs to the MTDS formulation. In addition, clear and comprehensive set of country specific risk scenarios are to be tested to understand the main risks and constraints along with their implications.

5.Consultation with economic policy makers will continue at this stage to understand the long-term structural features of the economy that may influence the desired debt composition.

6.In order to identify and analyse possible debt management strategies, assess their performance and chose a small number of preferred debt management strategies, the activities such as the comparison of feasible debt composition, cost and cost-range implications of debt management strategies will be undertaken in the this step.

7.Upon the identification of a few preferred strategies, it is required to carry our consistency check with regards to their conformity with fiscal and monetary policies and maintaining debt sustainability in the long run.

8.Selection of the most suitable strategy and submission for approvals - this involves the documentation of the preferred strategy and next alternatives (“MTDS report”) along with a clear description of the costs and risks

Though the Central Bank of Sri Lanka has documented the Medium-Term Debt Management Strategy as a chapter in the report titled “Performance in 2014 and Strategies for 2015 and beyond”, the strategy appears to lack the depth and the comprehension required to meet the objectives of public debt management.

The MTDS should cover total debt of the Government while operationalising the objectives of the public debt management and actionable through a forward looking borrowing plan. The process leading to the preparation of the MTDS should provide necessary insights into identification of the weakness of the system. The benefits of MTDS would be realised only when measures are taken to address those weakness. The MTDS will act as a catalyst and provide the required motivation to carry forward those reforms.

The final outcome of implementation and execution of the MTDS should be the formation of a reliable public debt management system with sound practices which help to raise an optimum debt combination while minimising associated risk and cost. The experience of the countries that underwent such reforms suggest that the MTDS has increased cohesion among the key stakeholders involved in public debt management, improvement of the transparency and accountability in the system and has contributed to lower overall cost and risk of the debt portfolio.

(The writer is a capital market specialist. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)