Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 19 April 2016 00:08 - - {{hitsCtrl.values.hits}}

This is an innovative idea that came about after reading an article which was published in the BBC website way back in December 2013. I had the concept mapped right after that and wanted to join with a software developer to own the process meaning an IP. But after joining a premier IT company in Sri Lanka and having implemented many banking applications turnkey projects it transpired that this cheque imaging through mobile device needs no rocket science software development. Hence, I decided to offer my consultancy to the benefit of the public as a whole by publishing a series of interlinked articles on the same topic.

The ‘unique’ feature of this new concept is that the cheque depositor will get instant credit for the scanned cheque image within a SLA for the entire process to complete. We can estimate a time of within 30 minutes for the whole transaction to be completed and the account credited at the Beneficiary Bank Account.

UK was at that time trying to reduce the clearing time from six days to two days, whereas Sri Lanka is way ahead of making funds available in a single day clearing (T+1) at present. Similar articles can be found at: http://uk.finance.yahoo.com/news/cheque-imaging-enable-britons-pay-104208395.html or http://www.telegraph.co.uk/finance/personalfinance/consumertips/banking/10405808/Cash-cheques-without-going-near-a-bank.html.

This kept me thinking of this idea of how to design a model for cheque imaging through the phone. After a few phone calls to friends and former colleagues, I gathered the missing pieces to the puzzle.

Firstly all cheques must be printed with a security feature on both sides of the cheque. This will enable the recipient of the cheque to directly access the core banking solution of the bank concerned. The discussion of the system integration will be kept at bare  minimum until such time a presentation is made to the Central Bank of Sri Lanka or the LankaClear for their acceptance and for other obvious reasons.

minimum until such time a presentation is made to the Central Bank of Sri Lanka or the LankaClear for their acceptance and for other obvious reasons.

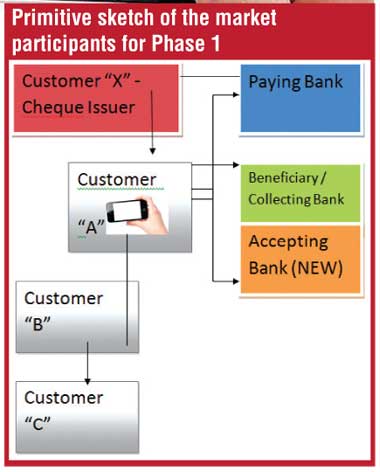

Difference from the normal cheque imaging process in the banking system currently available to this is that the introduction of an ‘Acceptance Bank’ as a new player for the clearing process and the part of collecting bank responsibilities shift from the ‘Collection Bank’ to ‘Acceptance Bank’. Further, there is an option to the holder of the cheque who did the cheque imaging to either go to the bank in which he/she/they operate the account or go to the closest commercial bank branch of their choice. If the Collection Bank and Acceptance Bank is not one and the same, the Acceptance Bank will charge a fee for their services and the risk that they take on behalf of the ‘Beneficiary Bank’ (Currently ‘Collection Bank’ = ‘Beneficiary Bank’ except for few foreign drafts).

Once the cheque is scanned, it is the duty of the holder of the cheque to physically transfer the cheque to Collection Bank or Acceptance Bank within a stipulated time period. How the payment gets transferred from the paying bank to the collection bank will be revealed in due course as well as the other cheque scrutinising activities and related matters. CRN will be issued only by the Collection Bank due to KYC complications if it’s handled elsewhere.

Just as a normal cheque, before the physical cheque is handed over, (deposited at the bank), there can be fraudulent activity or wilful transfer of the cheque to another party. As per the diagram above, assume it is the (Customer ‘B’) who comes to possession of the  cheque through an illegal manner. But if there is a subsequent innocent party ( Customer ‘C’) who takes possession of this cheque will have the usual recourse to the proceeds provided that the cheque is taken for value and without any knowledge of the discrepancies before (holder for value and holder in due course).

cheque through an illegal manner. But if there is a subsequent innocent party ( Customer ‘C’) who takes possession of this cheque will have the usual recourse to the proceeds provided that the cheque is taken for value and without any knowledge of the discrepancies before (holder for value and holder in due course).

Therefore, whilst the first scanned cheque awaits the delivery of the physical cheque to the banking system, any subsequent claimant will have priority over the first scanner. A notification to this can be sent to the first scanner but Banks are not obliged to hold the payment to the current holder of the cheque unless a notification to this effect had been communicated to the Collection Bank or Acceptance Bank.

There are a few changes required to the Bill of Exchange Act and the duties and responsibilities of the parties involved to a negotiable instrument to implement the phase 1 of the concept.

This process will make the following benefits to different stakeholders:

vNew income source for the participants based on the value to the client

Implementation schedule

Phase 1 – Only selected clients will join the process (can be implemented immediately with minimum tweaking of the BOE Act. And the current core Banking/CITS Platforms in banks)

Phase 2 – Implement across all clients (major changes to BOE Act and ability of all banks to get on board by enabling their Core and CITS systems, OCR solutions) estimated time duration of two years for full implementation.

Phase 3 – Allow non banking institutes after certification to participate (anything between one to two years of Phase 2 completion, selling the idea to other participants and aligning IT systems)

Phase 4 – Eliminate the physical cheque being moved around (based on a credit rating for the clients and how reliable the KYC, AML, etc. Major changes to the current BOE Act and court proceedings will have to be adopted)

Cheques are here to stay, but how it gets cleared will inevitably change!

Appointment will be sort from the relevant authorities to present the case in hand in due course.