Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 29 December 2015 00:01 - - {{hitsCtrl.values.hits}}

Housing Economy and MDGs

The housing sector is one of the strongest catalysts in the growth and prosperity of any country. Housing investment leverages the GDP growth through multiplier effects of forward and backward linkages of activities from house planning to construction, maintenance, manufacturing of materials to storing, trading, transports and supplies, and supplies and maintenance of utilities. It creates new employment opportunities for the every level of the labour market; from unskilled labourers to highly paid professionals. Housing revitalises regional development and equalities.

Moreover, housing investment increases the rate of homeownership which has multiple effects on the social stability. Increases in homeownership catalyses household savings and wealth, which have compounding effects on a household’s consumption and the startups of SMEs. While an adequate house itself is a basic need, it is also the central point for realisation of many other human rights – rights for voting, adequate standards of living, health, water, sanitation, education, and also for social engagements – which are considered as stimulants of inclusive and sustainable economic development and the bedrock of societal stability.

Housing finance also plays a critical role in the development process by supporting the evolvement of housing markets, financial mobilisation, strengthening the financial sector and capital markets.

Sri Lanka has been considerably successful in achieving many Millennium Development Goals (MDG)by 2015, and on-track to achieving MDG targets for most of the remaining social indicators ahead of its regional counterparts. At the beginning of the new millennium, MDGs were set by the UN at its General Assembly in New York, for which Sri Lanka was also a signatory, with the overall objective of improving the living conditions of the people, raising economic and social empowerment at community level and ultimately bringing about sustainable social and economic development to the world. MDGs are comprised of eight time-bound goals, 18 reachable targets and 48 measurable indicators, with 1990 as a baseline and 2015 as the deadline to achieve the goals.  Eradication of poverty, illiteracy, child malnutrition, gender inequality, infant, child and maternal mortality, environment pollution, access to basic amenities, access to health facilities and access to IT and communication are some of the dimensions captured.

Eradication of poverty, illiteracy, child malnutrition, gender inequality, infant, child and maternal mortality, environment pollution, access to basic amenities, access to health facilities and access to IT and communication are some of the dimensions captured.

Housing sector developments and policy reforms

Sri Lanka has realised substantial improvement in the condition of national housing over the last three decades, commencing from reforms initiated by late President Premadasa. Since1977, the Government has made an unprecedented commitment to housing and urban development. During the 35th session of the General Assembly of the United Nations in 1980, the Prime Minister of Sri Lanka suggested that the provision of adequate housing should be part of the global assault on poverty. He proposed the declaration of the International Year of Shelter for the Homeless (IYSH), which two years later was proclaimed by the General Assembly. The one million houses program of the Government constitutes one of the largest efforts so far to reach low−income families in the urban and rural sector with improved infrastructure and shelter.

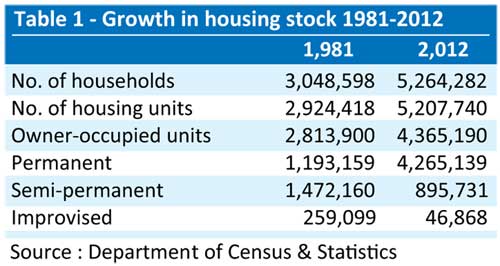

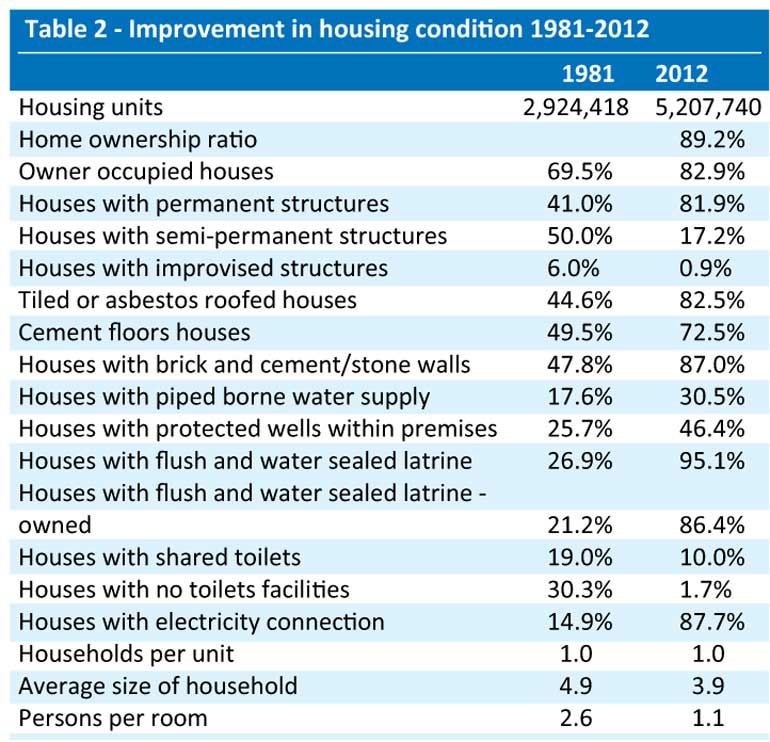

Presently, 89.2% of households in the country have an owned house, almost 99% of the households have some form of shelter either owned or rented or encroached. It is only 1% that are homeless. The country’s occupied housing units have increased from 2.9 million to 5.2 million from 1981 to 2012 achieving 77% growth within 30 years.

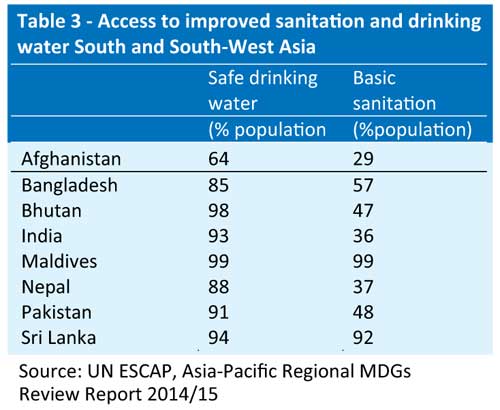

At the same time, despite regional disparities, the quality of the housing stock also has improved tremendously far ahead the regional counterparts. As at 2012, 89.2% of the population have owned houses, 81.9% have permanent structure, 30.5% have piped water supply, 86.4% have owned flush and water-sealed toilets, and 87.7% have electricity connection. Only 0.9% of the country’s housing falls into shanty/slum category.

All stakeholders in the housing and housing finance industries have contributed to this development, led by the Government with many specific initiatives and financial and fiscal policy supports. Increasing private sector participation in market housing has made a remarkable contribution, particularly in the Western Province and other urban areas. The country’s banking system has strongly fuelled this growth, by extending housing project finance and end user housing finance.

Housing has become an important part of the country’s GDP. Residential capital formation and housing related consumption expenditure has represented 6% and 12% of the GDP, over the last six years. The banking system housing finance outstanding, which was equal to 6.8% of the GDP in 2000, has grown up 10% as in 2012.

Housing and country’s MDGs

Noticeably, the housing sector development has greatly underpinned the progressive achievement of the country’s Millennium Development Goals, ahead the other countries in the region. All MDGs – eradication of extreme poverty and hunger (Goal 1), achieve universal primary education (Goal 2), promote gender equality and empower women ( Goal 3), reduce child mortality ( Goal 4), improve maternal health (Goal 5) combat HIV/AIDs, malaria and other diseases ( Goal 6,) ensure environmental sustainability ( Gold 7), develop a global partnership for development ( Goal 8), and Target 11, which aims to improve the lives of urban slum dwellers, in particular – have been directly and indirectly reinforced by the housing sector development. Improvements in drinking water and basic sanitation facilities, above the other countries in the South Asian region, have substantially influenced the health sector MDG goals and targets. Since the adoption of MDGs, UN-HABITAT has adopted a more holistic approach to the housing sector, integrating Government housing policies and programs as part of the overall development strategies to achieve the MDGs.

Even though the country has shown encouraging achievements in MDGs at national level, still there are noticeable regional disparities. Inadequate housing and infrastructure, weakness of service delivery systems and resources mobilisation to regional levels, are the main factors behind these disparities. The country should sustain the level of economic growth while enhancing equitable distribution of resources, across provinces and districts and extend development beyond the Western Province. The next attempt should be to move from the national level to MDG localisation at provincial and district levels, giving special attention to geographically-isolated and deprived regions. Improvement in regional housing can substantially leverage mobilisation of resources to regions and enhance regional growth and prosperity.

Housing need and affordability

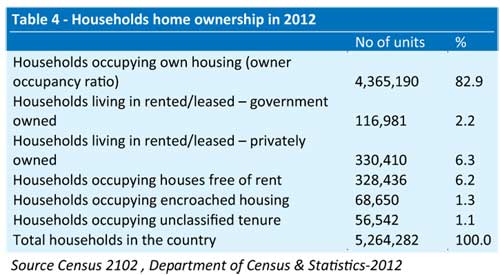

Even though the country has achieved significant improvement in housing at the national level, over 17% of households (approximately 900,000 families) are living in rented/leased, rent free or encroached housing and unclassified tenure conditions (Table 4).These families are dreaming to have home ownership. Country’s average home ownership ratio is 89.2% and the owner occupancy  ratio is 82.9%. The difference represents the rental housing market. Home ownership ratios of the Central Province (76.4%), Northern Province (63.3%) and Uva Province (85.4%) are much lower than the country average of 89.2%. Harnessing homeownership is important for household wealth creation, improving savings, consumption and SME sector development. The banking system can play a vital role by enhancing the regional home ownership and reducing regional income disparities.

ratio is 82.9%. The difference represents the rental housing market. Home ownership ratios of the Central Province (76.4%), Northern Province (63.3%) and Uva Province (85.4%) are much lower than the country average of 89.2%. Harnessing homeownership is important for household wealth creation, improving savings, consumption and SME sector development. The banking system can play a vital role by enhancing the regional home ownership and reducing regional income disparities.

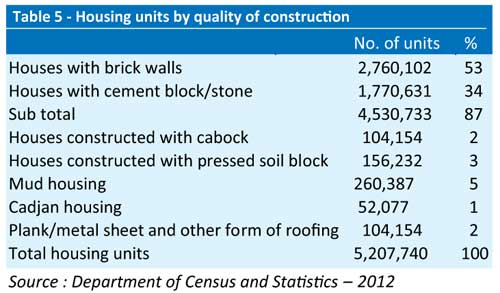

According to the census of 2012, out of 5.2 million existing housing units, 4.5million (87%) units have been constructed with some form of permanent materials such as bricks, cements or stones. The balance 677,000 units (13%) have been constructed with cabock, pressed soil block, mud or other form of less secure semi-permanent materials (View Table 5).

Whilst almost all the houses among the 677,000 units are poor in condition, partly completed, have no proper sanitary and drinking water facilities, less secure and are in poor health environment, a significant percentage (approximately 30%) of houses constructed with bricks, cements or stones are also substandard. These families (approximately 2.6 million people) are in pressing need of urgent improvements in the quality of their housing. It must be noted that over 70% of these families are out of Colombo, Gampaha and Kalutara Districts and are mainly from below-average income groups. Most of these houses do not constitute the conditions of an “adequate house” as prescribed by the United Nation under the right to adequate housing.

Furthermore, an analysis reveals that, out of the country’s housing stock, which was in 2012, 1.06 million units (20.4% of the housing stock) are over 35 years old and their maintenance cost is above average. About 35% of this old stock need replacements or improvements. Furthermore, over 76% of this old stock is out of the Colombo, Gampaha and Kalutara Districts and are occupied largely by rural households.

In the years 2009, 2010 and 2011, the country has constructed 210,782, 236,190, and 323,194 new housing units, respectively (Census 2012). These figures include super luxury apartments and partly-built low-income housing, and indicate a significant improvement in new house construction in the  recent past, which has substantially assisted in reducing the national housing backlog and new housing need annually for occupying the natural growth of population.

recent past, which has substantially assisted in reducing the national housing backlog and new housing need annually for occupying the natural growth of population.

As per the author’s estimation, the country needs approximately 50,000 new housing units yearly to shelter the natural growth of the population. Out of this requirement, around 38,000 units (95%) are needed in districts other than Colombo, Gampaha and Kalutara. The new housing requirement per annum, for the Colombo, Gampaha and Kalutara Districts, is about 12,000 units.

An analysis based on 2012 census data reveals that the estimated housing shortfall was about 66,000 units in 2012 as against 285,000 units in 1981. However, an estimation based on the new house construction trend, new houses requirement to accommodate the yearly population growth, household size and brought forward housing backlog, reveals that the country has well over 750,000 excess housing units as of today. At the same time, approximately 30% of permanent houses and about 677,000 units constructed with semi-permanent material and improvised housing, need to be improved with quality, by supporting for construction completion, upgrading, repairs, replacement and providing sanitary and other utility facilities.

Most of these houses are out of Colombo, Gampaha and Kalutara and, as per our experience, most of these households are from low and lower middle income segments involved in informal economic activities and agriculture. They are facing a great challenge in meeting costs of housing while spending on food and other essential non-food expenditure. They also face the challenge of lack of adequate collaterals to borrow from the formal banking system.

Increasing cost of construction in particular and high land prices underpinned by rapid urbanisation and increasing cost of living have made decent housing a difficult goal to reach for many. The average amount spent on housing, household equipment, maintenance, water, gas, electricity etc., across all households, has increased sharply in the last 10 years from around 15% of the households’ total consumption expenditure to over 17.5% (CBSL Annual Reports 2004 – 2014). Across all non-food expenditure, housing cost represents 19.1% of households’ monthly expenditure. The most crucial factor being, those who are earning less than Rs. 55,000 per month spend 20% to 32% of their non-food expenditure on housing. While spending on present day essentials such as health, clothing, education, communication, transport etc., the amount that can be spent on housing is sharply narrowing.

Post-2015 development agenda

The world’s post-2015 development agenda mainly focuses on an inclusive development based on the three pillars of sustainability – environmental, social, and economic. World leaders, including, President Maithripala Sirisena, adapted a new set of development goals to the world – Sustainable Development Goals (SDG) – at the 17th anniversary celebration of the United Nations, held in New York from 25-27 September, to guide the world’s development in the next fifteen years, with effect from1 January, 2016. SDGs that  comprise 17 sets of goals will replace the MDGs upon their expiration at the end 2015, continuing the effort of MDGs with a broader dimension to end poverty, fight inequality and injustice, and tackle climate change by 2030.

comprise 17 sets of goals will replace the MDGs upon their expiration at the end 2015, continuing the effort of MDGs with a broader dimension to end poverty, fight inequality and injustice, and tackle climate change by 2030.

An analysis reveals that most of these goals, the Goal 11 in particular, can largely be leveraged by a well-focused growth and expansion in the housing sector. Therefore, the next phase of the housing sector development should emphasise a broader sense of achieving an equitable growth and sustainable development in the country by leveraging the economically disadvantaged and marginalised groups with equal opportunities and with more consideration on environment.

The country needs approximately 30% of houses constructed with bricks and cement blocks walls (around 1.562 million units) and 100% of houses constructed with semi-permanent materials, immediate replacement, upgrading and repair. This is an emerging market that could be strategized with a sense of broader outcome on the people, economy and the environment. Assuming an average cost of Rs. 500,000 per unit, it will work out a construction market of around Rs. 1000 billion, approximately 10% of GDP. If the construction is spread over a period of 10 years, it can boost the GDP additionally by about 1% per annum. The potential direct and indirect jobs created by this construction would be well over 400,000 in the next 10 years. Many researchers have proven that employability of low income housing is much higher than luxury housing. The construction may consume a large volume of energy, water and other natural resources and generate a huge amount of solid waste. Concentration on sustainability aspects of the development can reduce the negative impact on the ecosystem and environment.

On the other hand, this can be worked out to be a mortgage finance market of Rs. 750 billion, which is 1.8 times higher than the total housing finance outstanding and equal to 45% of the commercial banking system total loans and advance as at 2014.

The Government should play an enabling role through policy supports, encouraging active participation of all stakeholders within a specific period and revitalising business opportunities. Research and development can play a vital role and development, promotion, dissemination and diffusion of environmentally sound and affordable housing technologies should be welcomed. It may involve significant mobilisation of resources from a variety of sources, including through enhanced cooperation locally and internationally. On the demand side, there is a major need for innovation in financial products in this market as the traditional mortgage loans and financial products cannot be the only solution, as it is in the higher end market. Financial specialists need to take a holistic approach and play a dynamic role by developing innovative capital and financial market instruments supporting capital mobilisation and hybrid housing finance products that can enhance the affordability and accessibility of the target group.

The sources of estimates and figures in this article, unless otherwise mentioned are as per the market research and analysis of the author and views do not necessarily represent that of HDFC Bank of Sri Lanka.