Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 24 August 2016 00:01 - - {{hitsCtrl.values.hits}}

The sapphire pendant in the movie Titanic had an impact on subsequent sapphire sales

Sri Lanka is renowned worldwide for fine gemstones ever since the very early days of international shipping routes and trade being  established. Just the way Paris, London and New York are known for high fashion and glamour, the Sri Lankan blue sapphire has for centuries brought about unparalleled repute to this beautiful country. Sri Lankan gem dealers, over the last so many decades, have ventured overseas and steadily developed new markets for coloured gemstones.

established. Just the way Paris, London and New York are known for high fashion and glamour, the Sri Lankan blue sapphire has for centuries brought about unparalleled repute to this beautiful country. Sri Lankan gem dealers, over the last so many decades, have ventured overseas and steadily developed new markets for coloured gemstones.

However, due to a combination of reasons including the global slowdown in economies, the Brexit and its aftermath, procedural hurdles in Sri Lanka and a lack of prudent business practices have all converged to have a devastating effect on the trade with so many small to medium enterprises on the brink of survival. We will look at an in-depth analysis of the underlying issues and explore some of the policy imperatives and other strategic measures that will have to be urgently looked at to avoid a likely meltdown, particularly of the mid-tier of the industry.

Main gemstones found in Sri Lanka include the sapphire, alexandrite, cat’s eye, padparadscha aquamarines, moonstones, etc. – amongst them the blue sapphire is the mostly widely known coloured gemstone. Generally all precious and semi-precious gemstones other than diamonds are referred to as coloured stones. Thanks to the entrepreneurship of the Sri Lankan gem traders and encouragement by the successive Governments, the trade benefited immensely from the gemstone supplies such as the rubies, sapphires and tsavorites coming from the African countries. Barring a very small proportion which ends up in local jewellery, almost every other gemstone imported to the country is eventually re-exported, after processing and value addition.

Thus the policy measures to liberalise gemstone imports to the country has certainly put paid with the Sri Lankan dealers consequently gaining significant leverage in the export markets and bringing about substantial foreign exchange flows to the country. In addition, vast opportunities were opened up for productive employment of more and more people in the trade. However, the vagaries of economic cycles in key export markets continue to render the trade highly vulnerable.

Being a player in the non-essential luxury goods sector, the gemstone and jewellery trade invariably is highly vulnerable to economic cycles particularly in key consumption markets such as the United States, Europe, Middle East, Russia, India and China. According to informal estimates from the trade, year to date exports from Sri Lanka of coloured stones are less than half what it was same period the previous year. Slowing economies in Europe, Russia, Middle East and China had already started to dent worldwide demand for gems and jewellery and the much written about Brexit delivered a much harder blow to the industry with so many international buyers shifting their businesses to a cautious mode.

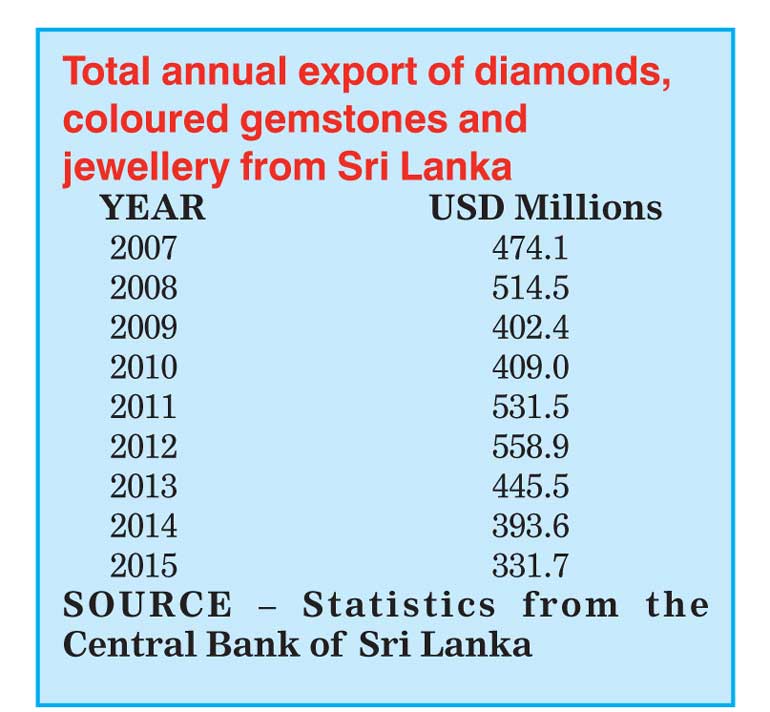

According to figures in the Industry Capability Report published by the Export Development Board (EDB), more than half the total export figures above comprise diamond exports. Diamonds are not mined in Sri Lanka – they are actually stocks coming in for cutting and re-export. Certainly it is an important source of job creation, skill transfer and foreign exchange, however, the net monetary value generation from the export of coloured stones is in fact greater.

A fine blue sapphire mined from Sri Lanka

The global scale

The global gem industry is a world of high glamour and glitter involving the super luxury brands, celebrities and uber rich. The global Jewellery industry including all Diamonds, Coloured Stones, Gold and Silver sales are estimated to be around $ 200-250 billion per annum according to latest published research data – the United States account for 26%, China 13% and India 12%of the total global consumption according to KPMG Analysis.

The global industry is of massive scale – however, despite being a very important supplier of coloured stones to the global trade, as a country, our coloured stones export figures are still negligible compared to the global scale. For instance, the Foreign Direct Investment (FDI) inflows into the diamond and gold ornaments sector in India in the period April 2000-December 2015 were $ 751.37 million, as per the Department of Industrial Policy and Promotion (DIPP) of India – India is now the largest processing centre in the world for diamonds and Indian companies like Gitanjali and Titan are already global giants in jewellery retailing. There is so much we can learn from how these Indian companies built up their operations to global scale and success.

During the time I was involved in business advisory services to the jewellery trade in the United Kingdom, we have seen first-hand the impact the economic cycles and shocks have on the business strategies and stock up plans of leading jewellers. Usually the well-organised jewellers would plan their new jewellery collections and formulate their marketing strategy for the Christmas season around late summer/early autumn. Unfortunately, this time with security concerns and fears of a deepening recession in Europe, so many jewellers are already resorting to defer their decisions on new collections.

Times of uncertainty do also push the jewellers to work with jewellery collections made out of solely diamonds and opt out of coloured stones for they find it easier to sell the diamond jewellery – these trends were quite obvious, particularly in the European markets, in the aftermath of the 2008 economic crisis as well. At the time, according to sources within the industry, nearly half the high street jewellers and other jewellery designers in England moved away from coloured stones partly due to their strategic decisions to give more weight to their portfolio of diamond jewellery. So we must clearly understand that when jewellers move away from coloured stones and tie in more funds into diamonds and diamond jewellery, it is not easy gaining them back to launch coloured stones based jewellery.

Besides, the consumer switch to fashion jewellery is so significant that companies like Pandora, who have established themselves as a successful brand in the fashion/cosmetic jewellery sector, are already multi-billion dollar operations – we just cannot afford to under estimate the extent to which these broader trends could result in further shrinkage of demand for coloured stones.

Impact on people

Successive governments in Sri Lanka have recognised the importance of this industry and introduced various supportive measures to help develop the industry. However, we must recognise that the Sri Lankan gem trade is operating in a global market and the current turbulence in global economies is poised to challenge the very survival of the trade. If we are to grasp the gravity of some of the issues we must also understand the true impact of the trade towards the commercial activity in the country.

The gem and jewellery trade engages and employs both directly and indirectly hundreds of thousands of people in Sri Lanka – most of whom, of course without meaning any disrespect, have either by choice or lack of it have stayed out of higher formal education. In other words, the trade involves people who would be shunned away by so many other sectors, nevertheless, these people contribute immensely towards trading and commercial activity in the country and by the time the gemstones are eventually exported they have done a tremendous job in generating foreign exchange as well to the country.

It must also be emphasised that most of the people engaged in the trade are highly diligent and competent in doing this particular trade. So, in effect, further tightening of the trade, be it due to pressures from the markets or Government policies, may essentially render this segment of people who make substantial contribution to the economy, unemployed and unemployable in alternate sectors.

Thanks to the training and support programmes by the NGJA, Export Development Board (EDB) and Sri Lanka Gem and Jewellery Association (SLGJA) thousands of youngsters in Sabaragamuwa, Western and Southern Provinces have found it easier to enter and take a foothold in the trade, be it through acquisition of knowledge in gemstone cutting, heat treatment and other processing techniques or jewellery design and manufacturing. According to the Industry Capability Report published by the EDB this year around 650,000 people are employed in the sector. We must emphasise once again that the industry mostly involves people who are not easily employable in other sectors and their distinctive contribution to the economy is far greater than what is reflected in the export figures alone.

With the slowdown in sales and tightening of margins and collections, the industry has already started to experience bad debts and bankruptcies in an unprecedented scale. It is crucial that we clearly understand the global dynamics of the industry and adopt an effective policy framework involving both the public institutions as well as the private businesses – essentially, we need a paradigm shift in the policy formulation and business practices in the industry.

Diamond vs coloured stones

Out of all diamond, gemstone and jewellery sales in the world, the diamond and diamond related jewellery sales amount to more than 90% of the total global sales. Rather than seeing this in anyway as a constraint, we must reflex our perspective and view this as an opportunity for we have the ability to improve the share of market for coloured stones.

The Diamond Trading Company (DTC), the marketing arm of the world’s largest diamond company DeBeers, for years and years have spent billions of dollars in promoting the use of diamonds amongst end users and effectively positioning them in the consumers’ minds. For instance, successful marketing activity in the United States has seen the share of brides receiving diamond engagement rings grow from 10% in 1939 to 80% by the end of the twentieth century. Besides, some of the largest integrated diamond jewellery companies with supply chain tie ups through the diamond Site Holders also spend large amounts on promoting the diamonds.

The Site Holders are a group of large diamond companies who are selected by De Beers to exclusively participate in their rough diamond auctions – each one of these companies is a multi-billion dollar operation. In contrast, the monies spent on promoting coloured stones is, in fact, a drop in the ocean. Obviously, we cannot afford to have marketing budgets in that scale, however, we can think of creative measures to convert more and more traders, jewellers and designers to use coloured stones.

I used to be featured as a Guest Speaker at the International Jewellery London, the largest jewellery exhibition in the United Kingdom, for a number of years – during these series, I could make a compelling case for jewellers to adopt coloured stones in their jewellery. We also made a successful case with the Prince of Wales Trust, the charity arm of HRH Prince Charles, to feature Sri Lankan sapphires in their high profile events. We can work with high profile designers to launch sapphire collections and we can also work with the Bollywood to feature sapphires in their movies – the sapphire pendant in the movie Titanic had an impact on subsequent sapphire sales and when David Beckham bought a pink diamond for his wife, the related publicity in the media did have a positive impact on sales of pink sapphires too.

Today Bollywood movies are well received all over the world from the United States through the Middle East and Australia, and certainly India and Sri Lanka as well – a successful relationship may well help alter perceptions in favour of sapphires in the minds of consumers worldwide. A consumer led demand recovery is the most sustainable strategy to hold up the value chain for coloured stones.

We need to bear in our minds that the world of diamond jewellers is huge, nevertheless the opportunity is there for us to creatively work towards converting more and more of them to adopt coloured stones in their jewellery. Should it not be the case, we also face the danger of being decimated by the scale of marketing activity of the diamond industry.

Competition from other gem centres

The Sri Lankan gem trade, as an international sourcing centre for coloured stones, has traditionally faced competition from Bangkok and Hong Kong. Consistent support from the respective governments, liberalisation of their import and export procedures and financial scale have all enabled Bangkok and Hangchou to become formidable gem centres despite the fact that almost all their stocks are in fact imported to the country. The exports of gems and jewellery from Thailand in 2006 was $ 4 billion and by the end of 2015 this figure reached $ 10.9 billion as per data compiled by the Gem and Jewellery Institute of Thailand, which is a government body.

Large scale diamond processing centres started in India within the last 40-50 years and today India is by far the largest diamond cutting centre in the world. The top-end of the Indian industry is a world class example of sophistication, financial scale and vertical integration – large players like Kiran, Rosy Blue and Jewelex are Site Holders with the Diamond Trading Company as well as being strong players in international jewellery retailing. Gems and Jewellery exports from India are estimated to be around $ 35 billion as at end of 2015.

Panyu, a small district in Guangzhou, China, was first established as a gem and jewellery centre in 1986. According to the GIA, 70% of jewellery exported from Hong Kong and 90 percent of jewellery branded and sold in Hong Kong is manufactured in Panyu – The annual jewellery output from Panyu is estimated to be in the region of $ 4-5 billion per annum.

So when we look at the empirical evidence over the last 50 years, we can notice all these new centres have emerged well after Sri Lanka actually started to sell coloured stones internationally, however, we are continuing to be relegated as a minute player in the global industry. Shenzhen in China is fast emerging as a competitive centre for coloured stones. They may well pose a devastating threat to both Thailand as well as Sri Lanka, as a supplier of coloured stones to Chinese customers as well as the rest of the world. Almost every other industry the Chinese businesses entered over the last 30-40 years, they have conquered them at the brutal expense of the existing players through relentless pursuit of cost leadership and emulation of quality standards.

These countries have developed distinct capabilities and competitive advantages not as standalone businesses but by collectively envisioning the way forward between the Government and the industry and working together for collective success. It is certainly a crucial moment we must wake up to these emerging serious threats – otherwise, the Sri Lankan industry may well turn out to be no more than a feeble supplier to these emerging gem centres.

Commoditisation

Being a homogenous product and with so many small to medium sized players, there is a persistent tendency amongst gem traders to cut prices and compete – most don’t realise that by undercutting each other on price they are actually locked in on a race to the bottom.

People worldwide buy diamonds, gemstones or jewellery with an expectation that they are a good source to store value or rather expecting that their prices will appreciate over the years. It must be noted that all along history it has been the case and appreciation in value of important gemstones has exceeded many other asset classes. However, persistent price cutting poses the serious threat of undermining this fundamental premise of price appreciation – in other words, there is the danger of pushing this much sought after luxury product to a vicious cycle of commoditisation.

A few years ago I was having a chat with a friend of mine in the trade in London who was also a Director at the Diamond Trading Company (DTC). He related a story of a high end client of DTC once taking a quote from them for a large diamond and then buying the same diamond from Tiffany’s paying a sizeable premium (despite the fact the parent company of DTC, the De Beers, being the world’s largest diamonds mining company). Such is the power of branding and we ought to recognise the importance of safeguarding the image of this product.

We must also realise that what we are enjoying in the present is image and reputation built for this wonderful product over so many centuries by the generations before us and that what we do now will sure have an impact on the future generations engaging in the trade. We must educate and nurture industry best practices so that we may avoid any irreparable damage to the industry by design or default.

Government policy

Over the last so many decades, successive governments have extended quite a lot of help to the gem and jewellery trade in the country – the current Government also has identified this industry as a priority sector to boost exports and, as we understand, the Government is more than willing to help the trade boost exports. However, there is a serious gap in the understanding between the policymakers and the industry as to the strategic measures that need to be taken. As we have emphasised above, the global challenges are massive and should we fail to get together and formulate the necessary policy measures required with a clear sense of urgency, so many thousands of people may well go unemployed in the near future.

The core underlying theme for any policy measure should be that of encouraging business scale or activity in the industry – in other words, we must make it as easy as possible to bring in gemstones into the country and similarly streamline export procedures to be as flexible and convenient as possible. Thailand realised this long time ago and their policies to fully liberalise imports as well as exports enabled Bangkok to be a vibrant centre for gemstones and rapidly reach business scale running into billions of dollars – international buyers preferred Bangkok as a sourcing centre for the width and depth of selections available, price competitiveness and the relative ease of doing business.

Diamonds, gemstones, and jewellery are historically one of the least understood sectors – the industry and product dynamics are quite complex and the world of rough gemstones is an enigma for most of the people outside the industry. Fortunately for Sri Lanka, the industry can boast of a cadre of thousands of youngsters who carry in depth expertise of rough gemstones. We must build on this accumulated talent pool as a competitive advantage of the country and encourage and help these people strengthen their footholds in the supply chains within the African countries –Unleashing this talent, within a framework of responsible business practices, may well enable a fundamental shift in the level of business activity.

It should also be highlighted that the Sri Lankan gem traders travelling to Africa for sourcing still face a lot of constraints – they cannot carry adequate hard currency to enable purchases and there are a lot of ground issues faced in those countries as well. The Government needs to strengthen diplomatic and commercial connections with some of the African countries which are quite important for the Sri Lankan trade – such as Mozambique, Madagascar, Tanzania, Nigeria, Cameroon, etc.

It must also be emphasised that most of the Sri Lankan gem traders making such visits are actually very keen to utilise every cent to buy gemstones – so whatever amounts allowed out of the country for trade purposes, by and large, will eventually return back to the country with higher gains via final exports. Removing some of these constraints and enabling better ground conditions through stronger state to state relationships are bound to increase throughput and enable far greater volumes for the trade to sustainably compete in the global market.

Exports and institutional support

The main gateway for all gemstone and jewellery exports from Sri Lanka is the National Gem and Jewellery Authority (NGJA). The NGJA office also includes a representation from the Sri Lanka Customs to facilitate exports.

There is a need for greater alignment amongst the NGJA, Sri Lanka Gem and Jewellery Association (SLGJA) and Sri Lanka Customs to make export procedures simpler, straightforward and streamlined – we must realise that whilst we continue to sit on differences concerning procedural aspects, the global competition from diamonds and other gem centres may well give us a devastating blow. It is of cardinal significance that the top teams at NGJA are strengthened with people who have had a successful track record and accomplishments in actually doing business in this trade – you just cannot expect effective policy measures from people who cannot grasp the underlying issues of the industry.

The NGJA, as we understand, is going ahead with the setting up of a 24x7 export unit at the Bandaranaike International Airport –this is a commendable step that is going to significantly to help the trade. We must also look at the logistics aspects of international online sales and contemplate a mechanism to allow easy dispatch of small export parcels at least six days a week so that the gem trade can target the world market through online sales as well.

Tourists spend on gems and jewellery in Sri Lanka is a very critical market segment for gemstones and jewellery. It is important that they are not hassled on their way out of the country when they travel with gems and jewellery purchased in the country. In today’s era of social media, one bad incident can deliver collateral damage to this important source of sales and the country’s image.

(The writer is an Executive Director at Nortonbridge Capital. He is also the Managing Director of Orofini Jewellery (www.orofini.com). In addition, Rizwan serves as an Independent Director on a number of corporate boards including listed Plcs. He can be reached on [email protected].)

Marketing activity

We also need a fundamental shift in the way the category promotions are undertaken. Participation in important trade exhibitions is a very good measure with a lot of efforts coming from the NGJA, SLGJA and EDB – however, this is hardly enough to bring about a desired change in the perception of coloured stones and thus create consumer led growth in demand for coloured stones. We need an integrated yet very effective campaign coordinated amongst all stakeholders including creative measures such as the involvement of overseas movie makers and facilitating concessionary air time from the state media which can be utilised to promote coloured gemstones and jewellery as a category similar to the category promotions originally undertaken by the Diamond Trading Company.

In addition, we should continuously work on Identifying and developing new markets for the future. Countries like Sweden, Norway, Denmark, Australia and New Zealand all have sizeable market segments conducive to promote coloured stones – however, their coloured stones intake currently are minimal. The jewellery sectors in those countries are dominated by diamonds – a successful conversion campaign to switch consumers to adopt coloured stones will augur well for opening up new opportunities.

Marketing activity in Japan helped the DTC to increase the share of brides in that country with diamond engagement rings from 6% in the 1960s to nearly 80% by the beginning of the 1990s. The DTC has already started to commit millions of dollars in marketing spend to increase the share of diamond sales in China – this is one reason for tightening market conditions for the coloured stones traders in China. Should we not undertake and sustain effective marketing campaigns to build market share for coloured stones, the all-important Chinese market also may heavily swing in favour of diamonds over time.

Industry best practices

This is an industry quite difficult to regulate given the complexity of the products, business dynamics and the sheer number of small players in the industry. Success of an industry is not necessarily reflected by the number of millionaires in that industry but by the proportion of people in the industry who make adequate financial means to enable a reasonably good life.

So it is very important that there is an integrated framework from within the industry to instill best practices amongst the thousands of players so that we mitigate the risk of collateral damage and enable sustainable business for all. Times of crises are good moments to reflect on past practices and formulate best practices to avoid recurrence of damaging business practices. We think greater engagement of the wider public involved in the trade through educational programmes, knowledge-sharing forums, etc. is essential to diffuse best practices as much as possible. SLGJA needs to contemplate broad-basing its membership so that a wider network of the trade can be brought into responsible business practices.

Disruptive change

With the convergence of a variety of unfavourable factors including the global economic slowdown, increasing marketing spend from the diamond industry and the emergence of new gem centres, this is a watershed moment for the policy makers as well as the industry to reflect and realign the industry on a sustainable growth path with formidable business scale.

We must recognise we are playing in a global market with huge scale and complex business dynamics – this is the time to bring out disruptive changes in the way we view this trade as well the way we do business in this industry. In other words, a paradigm shift is not a matter of choice but critical urgency.