Monday Mar 09, 2026

Monday Mar 09, 2026

Tuesday, 25 April 2017 00:00 - - {{hitsCtrl.values.hits}}

Advertisements were seen in super markets during the New Year festivals, offering discounts for rice though there were concerns about the escalation of rice prices a few months ago, that led the government to impose an administrative price ceiling for rice. Generally, the cost of living is a hot topic during the festive season.

Though the criticism about the high cost of living is often directed towards the Minister of Finance, the minister is not directly in charge of controlling it. The Ministry of Finance can however, indirectly influence the general price level in the economy through its fiscal policy (of the Government) which involves the Government changing the levels of taxation and government expenditure in order to influence the Aggregate Demand (AD) and the level of economic activity. Sri Lanka has been running a budget deficit  (spending is higher than the income) since independence. Historically, the Government had to rely on deficit financing options which were mostly expansionary, thus had contributed to the increase in the general price level (known as inflation) in the economy.

(spending is higher than the income) since independence. Historically, the Government had to rely on deficit financing options which were mostly expansionary, thus had contributed to the increase in the general price level (known as inflation) in the economy.

Sustained increases in the general price level of goods and services in an economy over a period of time is known as inflation. The Central Bank of the country is responsible for controlling inflation (general level of price) in an economy. The Central Bank employs monetary policy to manage inflation. The key monetary policy tool used for this purpose is the interest rate; the price of money. The Central Bank controls the money supply and thereby inflation by changing the short term interest rates, known as policy interest rates.

Sri Lanka had a history of high domestic inflation. Fiscal policy used to overshadow monetary policy paving the way for high level of inflation as seen in the first panel of Figure 01. The fiscal policy is not a policy of the Ministry of Finance; it is the policy of the Government. The Ministry of Finance is the arm of the Government in charge of implementation of the fiscal policy. The budget deficit in 2015 was higher due to the time lag in the implementation of the discretionary fiscal policies after the assumption of office by the new Government.

The continued efforts of the Government in fiscal consolidation has started yielding positive results in 2016. Tax revenue collections increased, as a result, the budget deficit shrank to 5.4% of the GDP. Despite the continued criticism, the negative impact of the fiscal policy on the monetary policy has thus begun to negate. Apart from the impact of indirect taxes though base effects on the pricing level of the economy, the influence of fiscal policy on inflation via expansionary fiscal policy continues to decelerate.

The monetary policy has been proactive during the last two years since the Central Bank of Sri Lanka (CBSL) has focused on its core function; price stability. In response to the tight external environment, the high credit growth experienced in the economy and its possible impact on the inflation outlook, the CBSL has revised upwards its policy interest rates four times since January 2015. In addition, there was increase in the Statutory Reserve Ratio (SRR) to absorb the liquidity out of the system and to curb its pressure on price. This has resulted in a steady price level in the general economy.

The CBSL monitors a reference range for inflation and appropriate policy action is initiated whenever the inflation measure tends to move outside of the said range. Apart from appropriate policy action to keep the inflation in check, the government has adopted several key measures such as administered pricing for energy and main food items to control the cost of living.

Though inflation measured by the consumer price indices remains in check, the debate continues about the disparity of the inflation measures and the general price level of the economy. There are often complaints that those inflation measures don’t reflect the true price changes in the economy. Hence, it should be appropriate to look at the price escalation of essential goods since 2015.

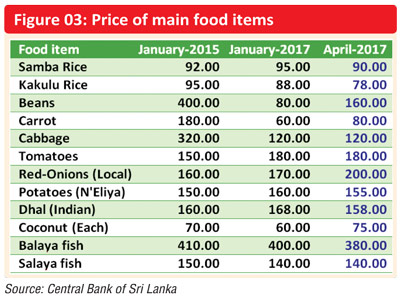

Figure 03 provides a comparison of the retail price of a set of essential food items required for day to day life. While understanding that the list is not a comprehensive list, it is a reasonable representative sample of daily essentials. The price information about key essentials contained in figure 03 confirms the inflation data.

Conclusion

The concerns about the cost of living during the festive season are not unusual as it impacts the purchasing power of the people. The monetary policy of the CBSL since 2015 had focused on its core objective of managing domestic inflation.

While there could be disparity in the inflation measures due to differences between the items contained in the basket used for inflation measurement and the perceived consumer basket, especially during the festive season, the comparison of the price level of essentials during last two years confirms that there is no serious deviation in observed price level. It appears that the criticism about the increase in cost of living under the new Government is largely unwarranted.

(The writer is a CFA

charterholder with local and international capital market experience and a former Fund Manager at the Employees Provident Fund of the Central Bank of Sri Lanka.)