Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 13 July 2016 00:07 - - {{hitsCtrl.values.hits}}

The Government of Sri Lanka (GoSL) has decided to reintroduce the Capital Gains Tax (CGT) with a view of correcting the increase in the inequality of income distribution. This decision is based on the proposal that observed that there has been a substantial

The Government of Sri Lanka (GoSL) has decided to reintroduce the Capital Gains Tax (CGT) with a view of correcting the increase in the inequality of income distribution. This decision is based on the proposal that observed that there has been a substantial  increase in private capital in the country during the last few decades.

increase in private capital in the country during the last few decades.

The GoSL has advised to draft a new CGT regime with the technical assistance from the IMF without simply reintroducing the former CGT regime that prevailed in the country until abolished in 2002.The CGT would be applicable on capital gains realised from the appreciation of capital assets in comparison to trading or business profits.

Capital gains are the realised profits on a sale of a non-inventory asset purchased at a cost lower than the realised value on the sale. The most common capital gains are realised from the sale of stocks, bonds, precious metals and property.

The GoSL aims to raise the tax to GDP ratio from the present level of 11.8% in 2016 to 14.6% by 2020. This is part of the overall reform package agreed with the IMF for the three-year $ 1.5 billion Extended Arrangement under EFF for Sri Lanka. The IMF identified six pillars including fiscal consolidation and revenue mobilisation.

Capital Gains Tax on shares

A Senior Government Minister has indicated that the GoSL is considering imposing a Capital Gains Tax (CGT) on capital gains from equities realised through share transactions of listed shares in the Colombo Stock Exchange (CSE).

The investment community seems to be worried about the imposition of the Capital Gains Tax on share transactions. Representatives from the stockbroker community have already raised their concerns that such taxes would be counterproductive.

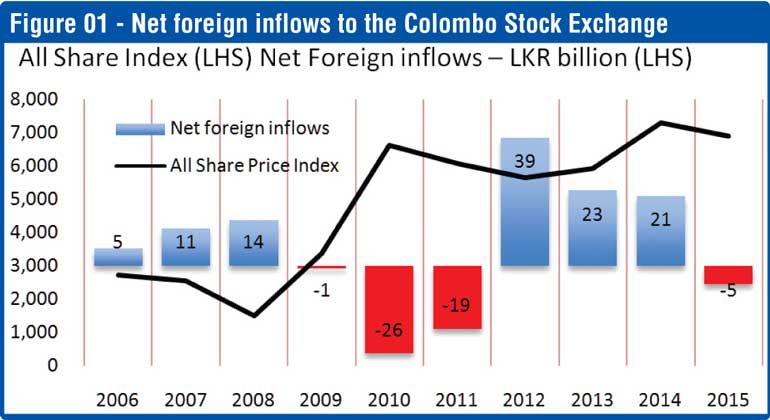

The investment community is of the view that CGT would negatively affect an already ailing stock market. Furthermore, they suggest that the CGT would make it difficult to attract foreign investors into the stock market. The stockbroker community believes that the CGT on the stock market will also include capital losses, where people will start to claim these losses, wiping out the stock market risk factor.

Market condition

The proposal for the introduction of the CGT has brought in a time period of difficult market conditions. The global investment community anticipates that the Fed (US Central Bank) will raise its benchmark Federal Fund Rate this year, causing further capital outflows from emerging markets. Sri Lanka has already experienced a withdrawal of foreign capital from the local capital market (both debt and equity).

On the other hand, our economic growth remained below 5% since 2013 while the growth forecasted for 2016 by the IMF is just 5%. Interest rates in the domestics market have picked up amidst CBSL intervention to tighten the monetary policy while exchange rates has depreciated significantly along with the other emerging market currencies.

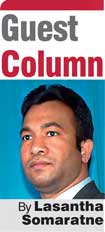

It is a challenging period to attract significant foreign investments into the local capital market due to the prevailing unfavourable local and international environment. The domestic capital market is comparatively immature and low deepening as shown in figure 02: Market Capitalisations as a percentage of the GDP. The ratio in other regional countries is higher than Sri Lanka.

Share Transaction Levy (STL)

The STL were imposed on share transactions of the Colombo Stock Exchange in 2005 through the Finance Act No. 5 of 2005. The applicable rate was 0.2% for the selleron the disposal value of the share and 0.2% for the buyer on the purchase value of the share. This rate was increased to 0.3% from 1 January 2011.

The STL is based on the transactions taking place on the stock exchange regardless of whether such a transaction makes a profit or a loss. As a result, the tax revenue has been seen fluctuating in accordance with the market turnover of the CSE. The STL is collected on a daily basis and transferred electronically to Inland Revenue Department (IRD) on regular basis. Collection of the STL is efficient and cost of tax collection and administration is minimal.

Though the STL is efficient in terms of collection despite the nature of profit or loss of underlying transaction, it fluctuates with the market turnover. Since the CGT is based on realised capital gains, the similar fluctuation in CGT collection may experience. When the share market performs better, transactions will increase and realised capital gains will also tend rise since investors start realising gains.

CGT on shares in other countries

CGT in India is a flat rate of 15% on short-term capital gains on shares listed in an organised stock exchange while no CGT is applicable on long-term capital gains. Singapore has no CGT but the profit earned by the professional funds &investors are considered as sourced income in Singapore and subject to income tax.

Capital gains in Thailand are treated as ordinary income and subjected to tax, however, capital gains paid to overseas recipient is subject to withholding tax of 15%. Indonesia has no capital gains taxes on shares. The share transactions in Indonesia are subjected to a 0.1% tax on gross transaction value. Malaysia has no CGT on gains from the sale of investments and capital assets other than land and building.

Can GoSL achieve its objectives?

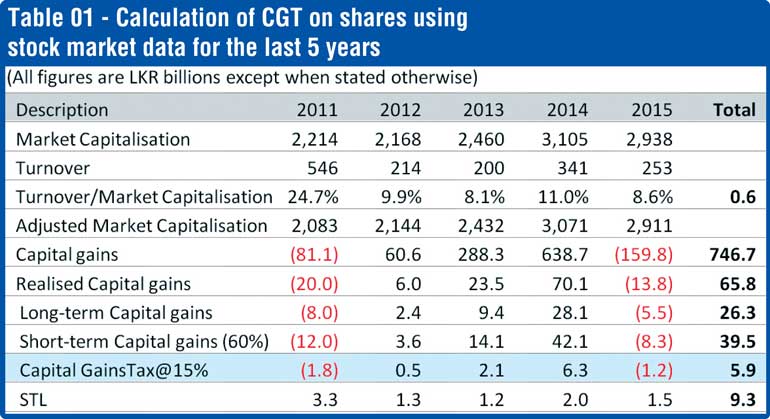

A simple model is used for the analysis of historical capital gains on the Colombo Stock Exchange (CSE) to evaluate whether the proposed Capital Gains Tax on shares would generate more income in excess of what is collected as STL. For this purpose, it is necessary to estimate likely annual capital gains from the shares market. The growth in the market capitalisation reflects the capital appreciation of the stock market.

Market capitalisation is calculated as the total value of all listed shares at the prevailing market price. However, market capitalisation should be adjusted for the cash infusion into the stock market through Initial Public Offerings (IPOs), rights issues, private placements and conversion of warrants. Though companies listed through IPOs will offer only small percentage (i.e. 20%) to the market via a share sale, the addition to the market capitalisation is much higher than the IPO value as the value of the whole company at the IPO price is added to the market capitalisation.

The value of the whole company (decided at the IPO price) is removed from the market capitalisation of the particular year to arrive at the adjusted market capitalisation. This adjusted market capitalisation should truly represent the growth of the market price (capital appreciation). The ratio of the market turnover to market capitalisation is used as an approximation for determining the percentage of realised gains.

No information on the proposed CGT framework is available yet; hence the calculation of historical CGT on shares in the CSE is performed with some restrictive assumptions. In this case, the capital gains tax framework of India is used as approximation. Capital gains in India are divided into short term (gains realised within less than a year) and long term (capital gains arising after holding period of one year). India doesn’t charge CGT on long-term capital gains while short-term capital gains are subject to CGT.

If we assume 60% of the total realised capital gains are short term, which is subjected to the CGT while balance 40% is long-term capital gains, which are exempted from the CGT. It is further assumed that the set off against the capital losses would be available. The CGT in India on short-term capital gains is a flat rate of 15%. Assuming that Sri Lanka will adopt such comparable method, the CGT is calculated for the last five years. The comparison of CGT, calculated on the above basis with the STL is given in the table 01.

Table 01 summarises the calculation of the CGT on listed shares using the data for the past five years. Though the model is based on set of restrictive assumptions on the methodology, applicable rate and the CGT regime, and the results are not encouraging. If the past provides any guide, it is worth noting that this model indicates that the CGT may fail to provide a superior alternative to the STL. A serious question arises whether the proposed CGT may be able to beat STL in terms of tax collection and fulfil the objective of the GoSL for collecting higher tax revenue from the capital appreciation in the share market.

Conclusion

The above model is based on a number of assumptions about the proposed CGT on the shares. Those assumptions have a decisive impact on the outcome of the analysis. The outcome suggests that the GoSL may fall short of realising its objective of higher tax revenue from the CGT. Hence, the GoSL needs to carry out a thorough assessment on the likelihood of collecting more revenue from the CGT than the already existing STL, considering that the negative impact it could have on the attractiveness of local capital market to prospective investors.

(The writer is a CFA charterholder and Fund Manager by profession. He was a former Fund Manager at the Employees Provident Fund (Central Bank of Sri Lanka) and Manager Alternative Investments at Hayat Invest Co in Kuwait. The writer acknowledges the contribution from Ruchira Sahan in the analysis of share market data.)