Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 23 May 2017 00:00 - - {{hitsCtrl.values.hits}}

By Jayampathy Molligoda

Central Bank Governor Dr. Indrajit Coomaraswamy at a recent media briefing has announced that he was considering floating a second International Sovereign Bond (ISB) this year if the Government is able to get the required Parliamentary approval for enhanced foreign borrowing limit.

This is in addition to the funds raised through the recent issue of ISB worth $ 1.5 billion at 6.2% interest. He also wants to pool the foreign exchange proceeds that may come from the sale of assets including the potential long-term lease of Hambantota Port to ‘China Merchant’ into a separate fund for ‘debt servicing’.

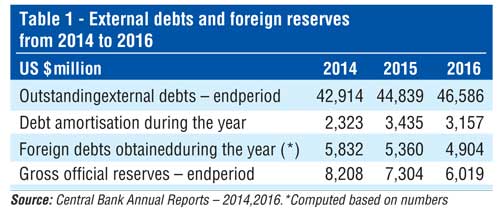

When the Unity Government came into power in January 2015, the outstanding external debt was $ 43 billion and the Sri Lankan economy was growing around 5% and a GDP of $ 80 billion at current market price. As per the latest Central Bank report, the economy has been stagnating around $ 81. 6 billion in terms of GDP at ‘cmp’ and the external debt outstanding as at end December 2016 has increased to $ 46.6 billion. In fact, the per capita GDP income has come down from $ 3,843 to $ 3,839 in 2016.

National Unity Government since September 2015

At present, there is a National Unity Government (NG) between the UNP and UPFA headed by the Executive President, whereas the Prime Minister of the said NG represents the UNP who obtained the highest number of seats at the last general elections. The Government is supposed to further devolve power to the regions through the present ‘constitution-making’ process under the concept of ‘sharing of power’.

The Leader of the Opposition, who happens to be from the TNA, predominantly a Tamil-speaking north-eastern-based party, is pre-occupied with focusing on regional issues, in particular the Tamil national (so-called) problem and other connected issues. In addition, there is an equally formidable and strong opposition movement led by the Joint Opposition (JO) of former the President representing predominantly a vast majority of the Sinhalese population. They are in the opposition in Parliament as well as participating in many extra-Parliamentary protest campaigns.

Nevertheless, some of the UPFA members whose party has not received a mandate at the last general election to form a national government have joined with UNP members to form the present Unity Government. Since then, the two parties have been at loggerheads in Government policy implementation and it has been going from bad to worse.

There seems to be no consensus reached on the constitution-making process among the UNP, SLFP and TNA MPs, leave alone the JO members. As political scenarios are fast-changing, it is unlikely that there will be consensus on power sharing between the Centre and the periphery. Further there has not been any genuine power sharing at the Centre, thus reflecting ‘true aspirations’ of the majority of the people.

Economic situation as reflected in the Central Bank Annual Report

Much has been written in the print media on the economic situation of the country. There is a serious ‘balance of payments’ issue which, in my view, has not been properly addressed. Basically, the country’s external account is in deficit ($ 1.9 billion before debt servicing) and the foreign exchange revenue from export of goods and services is not sufficient to meet the import bill and the ‘debt  servicing’ (imports were $ 19.4 Billion and debt servicing was $ 4.3 billion).

servicing’ (imports were $ 19.4 Billion and debt servicing was $ 4.3 billion).

Since liberalising the economy in 1978, successive governments have been adopting an export-led growth strategy without much success. However, the real issue lies with the fact that there is a persistent gap between the savings and investment which has to be bridged through FDIs without resorting to obtaining loans only.

It is regretful to note that FDIs were only $ 900 million for the year 2016. The Government is therefore compelled to borrow external debt on non-concessionary, commercial terms. The bottom line is the current Government continues to borrow foreign funds at relatively higher interest rates in order to retire previously-obtained low-cost borrowings.

Government debt as a percentage of GDP has increased to 79.6% by end of 2016, which includes 34% of foreign loans. However, if we take into account the overall external debts obtained by the country, it works up to 57.3% of the GDP or in absolute terms $ 46.6 billion. If we add the overall external debt of Rs. 6,785 billion (equivalent of $ 46.6 billion) to the o/s domestic debt of Rs. 5,342 billion, then the total debt works out to Rs. 12,127 billion. This, as a percentage of GDP of Rs. 11,839 billion (at cmp), is 102.4% of GDP, which is excessive.

Further, the country’s gross official reserves are now around $ 5 billion, which is sufficient only for 3.5 months of imports. These foreign reserves are not ‘earned’ but with additional foreign borrowings which includes the issue of international sovereign bonds at 6.2% as mentioned above. Although the rupee has depreciated by 13% over the last two years, the Real Effective Exchange Rate (REER) has in fact appreciated during the period, reflecting a deterioration in the external competitiveness of the country. This will affect the performance of the export sector despite having a depreciated rupee and the benefits of GSP+ concession granted by EU recently.

We also need to look at the balance needed between spending and revenues necessary to prevent the ratio of debt to annual GDP from rising. A “primary surplus” is needed to maintain the debt-to-GDP ratio. If receipts are greater than the expenditure excluding interest payments, then a primary surplus occurs. This is needed if the effective real rate of interest payable on debt (the nominal interest rate less the inflation rate) is greater than the GDP growth rate. Therefore, the fiscal consolidation alone is not sufficient to improve the economic welfare of the people. It is therefore important to balance the macro- economic fundamentals by focusing on (a) curtailing the inflation; (b) keep a close tab on the real interest rates of the banking sector; (c) whilst improving the real economic growth rates.

In the circumstances, floating another International Sovereign Bond (ISB) this year as suggested by the Central Bank Governor, in my view is not going to address the serious ‘structural issues’ in the economy. In fact, the Central Bank has been repeatedly emphasising (in their own words) the need to address these deep-rooted structural issues in the economy, which have prevented the country from maintaining a high and sustainable GDP growth rate over time. (Page 27 of CB 2016.)

Implementation snags as a major drawback

One of the major drawbacks during the last two-year period is in the delays in execution of policies and programs. It goes without saying that getting policy implementation right is critically important for ‘governance’ purposes. A simple governance structure, in my view has two functional dimensions. A more participatory style of management for policy formulation/strategic planning, whereas a more authoritarian style is needed for execution of such policies efficiently.

The immediate future scenario would be that more and more people would become dissatisfied with the Government machinery. This will lead to social unrest which makes the system ungovernable, at least the Government may not be able to undertake much-needed fiscal consolidation and other economic reforms.

Now, as a stop- gap solution to the current governance issues, a major Cabinet re-shuffle has been effected this week by the President in consultation with the Prime Minister. If we take stock of the current situation in the country, there are serious economic problems as well as socio/political and environmental issues that need to be addressed without any further delay. In my view, it is unlikely that the new Cabinet will be able to drive the economy by addressing the structural issues in order to improve the living standards of the people. It seems that the real crisis confronted with the country’s governance is a total lack of a people-oriented, visionary leadership.

Need a ‘real change’ to address structural issues in the economy:

From the above analysis, it is clear that what is needed is a more durable solution to address issues faced by the people. As stated above, the real issue lies with the shortfall in the investment required for the desired economic growth. The necessary prerequisite to enhance ‘investor confidence’ is to have political stability, thus creating a conducive environment to make investments and trade.

How do we achieve political stability?

In terms of the 19th Amendment, the presidential elections are due to be held during December 2019. As for the Parliamentary elections, even if the President decides to dissolve Parliament, it can be done only after March 2020. (Under 19A, the President cannot dissolve Parliament before four-and-a-half years from the first sitting of the Parliament in early Sept. ’15) In the circumstances, time is opportune for religious and civil society leaders to come forward and offer a possible solution calling an early Parliamentary election and forming a new government. Towards that end, they could request the President to call for an All Party Conference (APC) and consult leaders as to the course of action that needs to be taken by the political authority to find a durable solution.

The civil society members could request the APC members to seriously consider asking the Government Parliamentary members to come to some consensus among themselves so that they could dissolve the present Parliament and call for snap general elections. It is further suggested that at the next general elections, a truly national unity government could be formed by getting all the elected political party members involved in forming the next government.

In other words, all the main political parties such as the UNP, SLFP, JO, TNA, Muslim Congress and even the JVP could be in the next government, thus effectively practicing an inclusive form of governance sharing power at the Centre. The necessary constitutional amendments, if required, could be passed before calling general elections.

Conclusion

What is required now is an investment-led growth strategy and to offer economic and social benefits to people of all communities. The business community expects political stability and consistency in Government policymaking. Delays in addressing the current political issues can have significant negative impact on economic performance.