Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 18 January 2017 00:00 - - {{hitsCtrl.values.hits}}

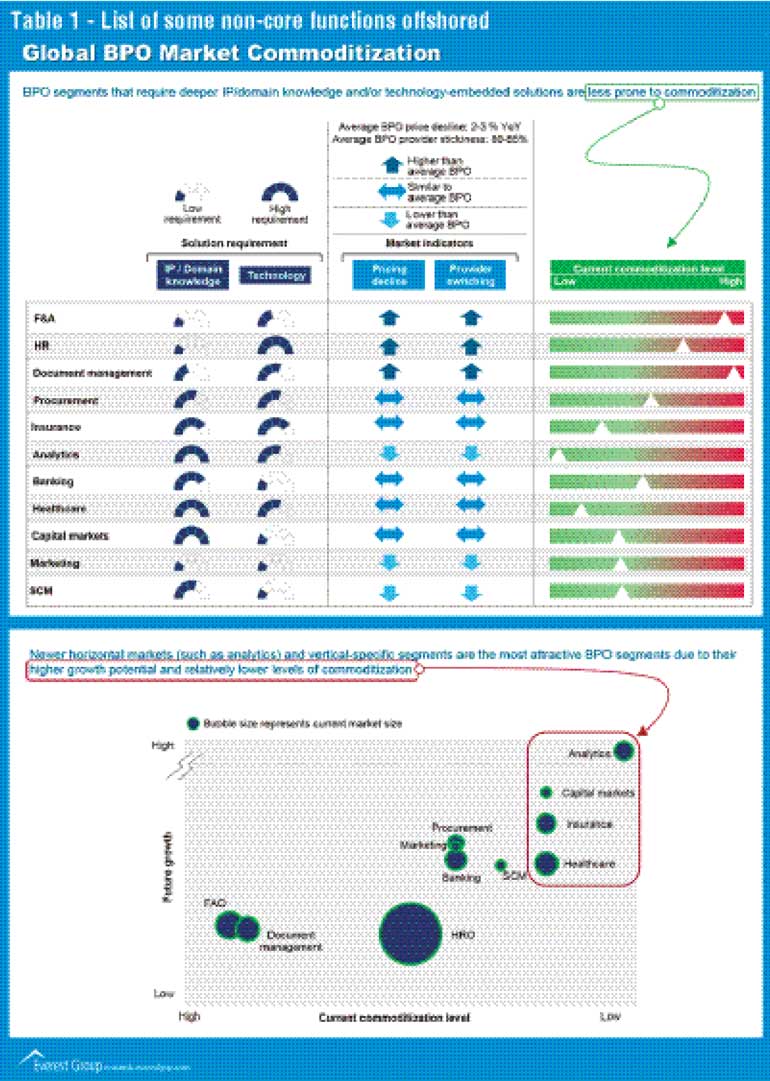

BPM or Business Process Management, FAO or Finance Accounting Outsourcing, and HRO or Human Resource Outsourcing are a few of the acronyms that getbandiedabout in relation to the Outsourcing industry. The potential growth benefits Outsourcing as an industry offers the Sri Lankan economy and its people in my view is not fully appreciated or understood from a Sri Lankan business context.

The purpose of this article is to attempt at demystifying and simplifying outsourcing as an industry and in particular provide useful insights into the world of finance and accounting outsourcing in terms of; what is outsourcing; why outsourcing is a growing industry; and; the potential opportunities outsourcing as an industry offers the Sri Lankan economy in terms of jobs and growth.

The article has been segmented into the following core areas in order to help the readers understanding and awareness of this growing industry.

As organisations evolve, the role of the finance function is being challenged and redefined. New age CFOs are challenged to drastically change their traditional finance processes and operational support models in an effort to deliver faster more accurate and more insightful analysis and reporting, whilst at the same time managing risks and reducing costs of operations.

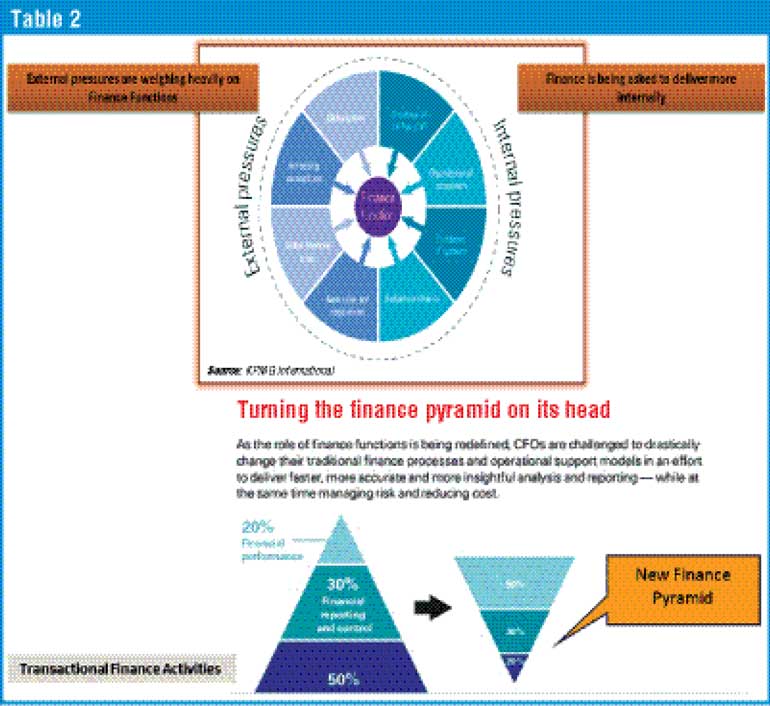

In order to address external and internal pressures as shown in Table 2, CFOs are turning to BPM service providers to help elevate these pressures. BPM offer CFOs the required change platform to facilitate the change management framework that will help facilitate the required changes to flip the traditional finance pyramid on its head.

Traditional finance pyramid is where 50% of the work undertaken by the finance team is considered as transactional/non-core in nature and therefore non-value adding with only 20% to 30% of the effort in the areas of financial performance and financial reporting respectively. BPM allows these finance organisations to offshore the transactional/non-core activities thus enabling the finance organisationto spend more time on performance management and reporting/analytics (value adding activities).

Additionally, BPM models and service providers offer CFOs and their finance organisations ways to effectively leverage and embed technology into finance initiatives, subject to developing a clear understanding of the following areas;

nfirst, the technology spectrum available and the benefits of creating a technology-embedded BPM model;

nsecond, the way technology needs to fit into the overall finance and org design and lifecycle, anchored in business outcomes; and;

nthird, application of best practices to ensure sustainability.

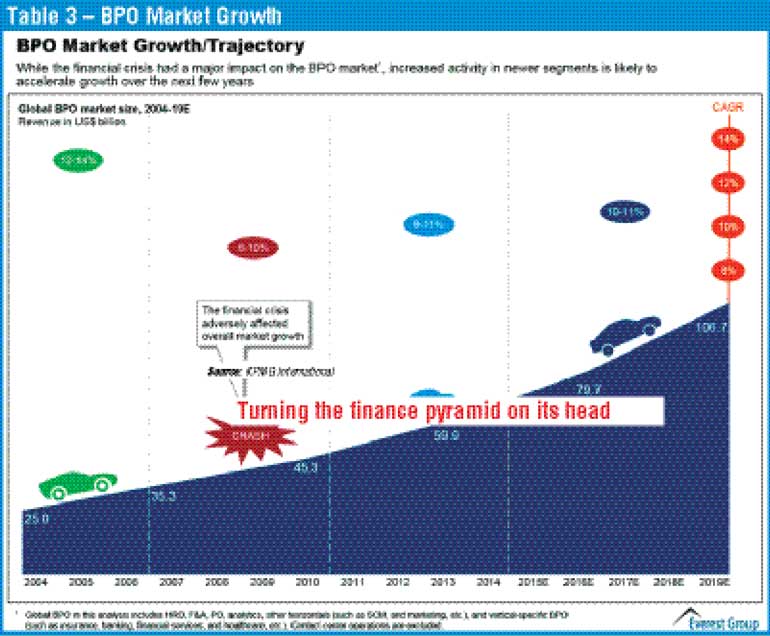

BPM as an industry has grown since the early days of mid 1990s and continues to do so as the hunger and the need for outsourcing continues to grow globally. As depicted in table 3 the industry is expected to grow to be $ 100 billion by 2020. Currently Sri Lanka accounts for less than one billion in revenue from BPO (ITO and BPM combined), clearly we have not capitalised on the market opportunity that is predicated within the Outsourcing Industry.

Over the last 25 years BPM as an industry has evolved and matured to a point where today the value proposition for outsourcing has moved away from cost savings associated with labour arbitrage to one of driving organisational transformation through elimination, simplification, standardisation,automation and digitisation of client operations.

As the industry, has evolved, so have our clients who are now looking for sustainable BPM models that can drive real change and transformation. In this context, clients are now looking to new locations outside of traditional locations such as India, Philippines and China. These locations over the last few years have seen significant growth that has also driven its operating costs through increased wages, rent and other infrastructure related costs.

Therefore, in my view Sri Lanka as a destination offers potential clients a viable alternative location that is capable of delivering high-end transactional scope of work at a significantly reduced price point. Despite some of these traditional locations like India branching out to Tier 2 locations to remain competitive at the costs of reducing quality of services, Sri Lanka offers potential clients Tier 1 Service delivery with Tier 2 pricing.

In terms of resource availability and access to high calibre resources, Sri Lanka offers the largest pool of CIMA qualified accountants outside of the UK. The abundance of accounting resources extends beyond CIMA into CA, CPA qualified accountants.

WNS Sri Lanka, the largest F&A outsourcing service provider in the country, has leveraged the access to resources along with stable infrastructure to grow its current footprint in the F&A Outsourcing world.

If Sri Lanka is to fully capitalise on its potential as a leading outsourcing location, the industry will require Government support to streamline and simplify current labour laws and enhance infrastructure.

Investment in Public Private Partnerships (PPPs) designed to create metro and regional business campuses with supporting eco systems will enable Sri Lanka as an organisation to win and deliver high end as well as transactional services at scale.

In conclusion, Sri Lanka needs to have a clear strategy designed to invest in BPM resources, infrastructure and business environment if it’s to capitalise on the projected growth opportunities the industry has to offer. As articulated in this article the size of the prize is significant with Sri Lanka as a location having a real opportunity to grab a 5 to 10 per cent market share in a 100-billion-dollar industry.This will directly result in significant job opportunities for our young folks directly employed by the industry with a further 4 to 5% growth indirectly.

In my view, I don’t think it is a question of can Sri Lanka succeed, rather it is a question of are we as a nation cognisant of the benefits the industry offers and are we ready to invest in the development of the Outsourcing industry?

[WNS (Holdings) Ltd. (NYSE: WNS) is a global Business Process Management (BPM) leader. It offers business value to 200+ clients around the world by combining operational excellence with deep domain expertise in key industry verticals, including banking and financial services, healthcare, insurance, manufacturing, media and entertainment, consulting and professional services, retail and consumer packaged goods, telecom, shipping and logistics, travel and leisure, and utilities. WNS delivers an entire spectrum of BPM services in customer interaction services, finance and accounting, human resource, research and analytics, technology solutions and industry-specific processes. More than 35,000 employees serve across 42 delivery centres located in China, Costa Rica, India, the Philippines, Poland, Romania, South Africa, Sri Lanka, UK and US.]

[Dinesh is the Managing Director/CEO for WNS Sri Lanka and is respected senior leader with a proven track record in a number of financial and management disciplines. He has a wealth of expertise and knowledge, gained over 25 years of experience in the areas of Finance and Accounting, setting-up and managing global business services, BPM, shared service centres, and all other aspects of business process management, including expertise in the areas of BPM sales, RPA transformation, Automation (pre-and post-sales), solutions, transitions and operational delivery.]