Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 27 January 2017 00:00 - - {{hitsCtrl.values.hits}}

The crucial test for Sri Lanka in 2017 would be its ability to attract good quality FDI. This should undoubtedly be a top priority for the Government. That is why policy consistency will be crucial, because, without that, no serious foreign investor will think of investing in Sri Lanka

– Pic by Shehan Gunasekara

Sri Lanka cannot go on sustaining itself on borrowed money (living on a credit card). Loans, both domestic and foreign, will have to be phased off and Foreign Direct Investments (FDI) should take their place.

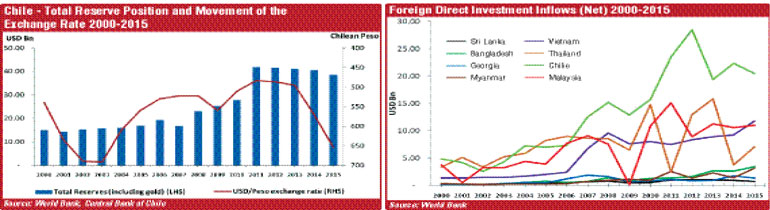

By way of comparison, while Sri Lanka attracted only $ 970 m (1.2% of GDP) worth of FDI in 2015, Georgia attracted $ 1.56 b (11% of GDP), Vietnam attracted $ 23 b (11.9% of GDP) worth of FDI, and Myanmar attracted $ 9.4 b (15% of GDP).

Therefore, the crucial test for Sri Lanka in 2017 would be its ability to attract good quality FDI. This should undoubtedly be a top priority for the Government. That is why policy consistency will be crucial, because, without that, no serious foreign investor will think of investing in Sri Lanka.

and attracting FDI

Since liberalising the economy in 1978, Sri Lanka has continuously had unsustainably high fiscal deficits, and Government revenue as a percentage of GDP has experienced rapid decline since 2006. High fiscal deficits have led to an increase in public debt with an accompanying increase in debt service costs, which in turn had contributed to further increase the deficit in the current account of public finances, forcing the Government to borrow even more to finance the deficit in its budget. This vicious cycle has been a common feature in relation to Sri Lanka’s public finances during much of the post-liberalisation period.

Moreover, on the external side, the substantial deficit in the current account of the balance of payments, which is also a common feature since liberalisation was mainly the result of import expenditure far exceeding export earnings. The Government has obtained a considerable amount of foreign loans to bridge the deficit in the current account of the balance of payments. The debt service costs of these loans have further contributed to widen the deficit in the current account of public finances, exacerbating the vicious cycle explained in the preceding paragraph.

Thus, the twin deficits (fiscal deficit and the current account deficit in the balance of payments) that has been a constant feature in Sri Lanka during the post-liberalisation period has severely hampered macroeconomic stability. During the post-liberalisation period, large budget deficits have been a common feature and reflect the failure of successive governments to exercise fiscal discipline, although the internal armed conflict which prevailed for nearly three decade beginning from the early 1980s also proved to be a severe drain on public finances.

Maintaining macroeconomic stability is vital in attracting FDI. A stable macroeconomic environment enables foreign investors to predict the course of macroeconomic variables, thereby helping them to plan out their business strategies without fear of having to face uncertainty in relation to the movement of those variables.

In Sri Lanka, the volatility of the USD/LKR exchange rate has been fairly high during the post-liberalisation period. Foreign investors do not like to invest in countries where the exchange rate risk is high. The Monetary Policy Roadmap – 2017 released by the Central Bank of Sri Lanka (CBSL) has signalled an important deviation in relation to exchange rate management from what has been practiced in the past.

The Governor of the Central Bank of Sri Lanka has emphasised the need for greater flexibility, in line with market forces, in the management of the exchange rate. The CBSL Governor has further noted that the strategy followed in the past of defending the Sri Lankan rupee (LKR) in currency markets by expending valuable foreign reserves is not sustainable. This strategy led to not only severe depletion of reserves, but also to the overvaluation of the LKR, thereby reducing the competitiveness of our exports, while discouraging foreign investment.

attracting FDI

The strengthening of institutions is vital for economic development and in attracting Foreign Direct Investments. By way of an example, institutional strengthening was implemented in Chile since the mid-1980s. These measures included improvements in the protection of property rights, strengthening of mechanisms for conflict resolution and creation of an independent Central Bank that was free from short-term political pressures and interferences. An independent Central Bank will be able to effectively execute policies in relation to maintaining price stability and financial system stability which are the core objectives of a Central Bank. Therefore, it is clearly evident that ensuring the independence of the central bank is crucial if a country is serious about achieving macroeconomic stability. (Edwards 2012: 112).

At this point it will be good to take a look at what a succession of Chilean governments have done during the last 30-40 years. They have kept inflation low and kept the fiscal accounts under control; They have encouraged competition by opening the economy and creating modern and well-functioning regulatory bodies; they have improved the protection of property rights, improved the rule of law, and reduced costs – in terms of time, bureaucracy, and red tape – of signing and enforcing contracts; they have avoided artificial strengthening of the currency; and they have improved safety and security for the population at large and for foreign investors. (Edwards 2012: 115).

When picking their investment destinations, one of the main things (if not the main thing) that foreign investors will look for is policy consistency in a country. Foreign investors don’t like to invest in countries that frequently shift their goal-posts. Indeed policy inconsistency has been cited as the main reason for the drop in FDI in Sri Lanka from $ 970 m (with loans) in 2015 to an estimated figure of less than $ 600 m (with loans) in 2016.

Foreign investors will also be very keen to know whether they could buy property in Sri Lanka. Why should a foreign investor invest in a country if that investor cannot buy property (including land) in that country without any impediments or hassle? Foreign investors should be able to buy land at least on long-term lease (maybe for 99 years) arrangements without any hassle. Nobody should fear foreign purchases of land and property? After purchasing land, these foreign investors are not going to ship that land to a foreign country. So, why worry?

Foreign investors like to invest in countries with good living conditions. These investors often come to an investment destination along with their families. So they will require good schools/universities for their children to study at. They would also want their children to have access to good quality recreational facilities including quality theme parks. Therefore, if Sri Lanka is interested in attracting foreign investors, these aspects will also have to be looked into.

Foreign investors don’t like to invest in countries beset with maddening traffic jams. They like to move about freely without any hassle. Disruptions to free movement caused by traffic jams due to mass street protests or due to too many private vehicles (including a flood of three wheelers) plying the roads will simply keep foreign investors from investing in a country.

Putting in place an efficient (cost-benefit should also be taken into consideration) public transport system and the increase in the average travel speed that it will result in will be important in attracting foreign investors to Sri Lanka as they value time and efficiency. A considerable amount of work has been done to develop the roads. Now it is up to the government to capitalise on that and come up with a well thought out and efficient public transport system.

The merits of an efficient public transport system do not require much enumeration. It will result in saving of valuable foreign exchange through efficient use of fuel while saving the time of everyone, thereby enhancing labour productivity and the standard of living of all. The public transport system in Singapore is a testimony to the benefits that will accrue to the society through an efficient public transport system. Putting in place an efficient public transport system will take time. However, the policy planners will have to set about that task with a sense of urgency.

Foreign investors don’t like to invest in countries where they have to constantly go behind numerous government ministries, agencies, departments, authorities, environmental authorities, local government authorities and provincial councils to get approval for their projects. We are reminded of the plight of a Korean investor who had reportedly visited Sri Lanka 44 times to get approval for his project and yet failing to get the required approval. He didn’t come back for the 45th time. (‘Korean investor did not come back for the 45th time’ – 26 October 2016, www.dailymirror.lk).

Foreign investors don’t like to invest in countries where the rule of law is lacking. Chile, arguably the only true success story in Latin America, managed to establish rule of law (among other things) in contrast to El Salvador, which despite putting in place a reform package very much similar to Chile, failed to establish rule of law. As a result, El Salvador couldn’t successfully attract FDI as Chile did. In contrast to Chile, El Salvador failed to implement institutional reforms. Lack of independence of the judiciary, scant rule of law, and weak protection of property rights stifled El Salvador’s efforts to promote investment. Insecurity, low credibility and an absence of the rule of law in El Salvador discouraged foreign investors. (Edwards 2012: 117-121).

Foreign investors, especially hi-tech oriented foreign investors, like to invest in countries where skilled and easily trainable labour is available in sufficient numbers. This is why education, especially technical education matters. Greater emphasis will have to be given to upgrading the standard of technical education in Sri Lanka. The country should take measures to ensure adequate numbers of scientists, engineers and managers and other skill categories required by the hi-tech industries are produced with a view to attracting hi-tech oriented FDI inflows.

Several studies (both theoretical and empirical) indicate that the absorptive capacity in the host country is crucial for obtaining significant benefits from FDI. Without adequate human capital or investments in R&D, spill-over from FDI may simply not be feasible. While integration into the global market allows developing countries to catch up technologically and to upgrade their labour force and industries, in order to take full advantage of liberalisation of trade and FDI, such policies need to be complemented with appropriate policy changes with respect to R&D, education, and human capital accumulation. [Saggi 2000: 38-39; Thomas and Wang in Woo, Parker and Sachs (ed) 1998: 235].

Policy consistency and rule of law are absolute musts in attracting FDI. In addition to these, many other facets, as outlined above, too have to be looked into with a view to attracting good quality FDI. It is only through such a multipronged and holistic approach that Sri Lanka could successfully attract quality FDI. Political will and meticulousness is required in executing such a strategy.

References

[The writer counts over two decades of experience in the field of economic research in the private sector. He has earned a BA (Hons) in Economics, an MA in Economics and a PhD in Economics at the Department of Economics of the University of Colombo. He can be reached at [email protected].]