Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 7 April 2017 00:00 - - {{hitsCtrl.values.hits}}

There is much debate about the proposed Public-Private Partnership (PPP) for the Hambantota Port. The plan is to offer the Hambantota Port through a 99-year PPP structure to a port operator; the PPP operation is valued at $ 1.4 billion and China Merchant Port Holdings Company Ltd. (CMPH) will invest $ 1.12 billion as their share in the venture, and the Government of Sri Lanka (GoSL) agrees to offer 80% of the share capital of the joint venture company (PPP Operator), established for the purpose of undertaking the development of the Hambantota Port and allied infrastructure to CMPH. The Sri Lanka Ports Authority (SLPA) will subscribe to a minority share of 20% of the venture.

There is much debate about the proposed Public-Private Partnership (PPP) for the Hambantota Port. The plan is to offer the Hambantota Port through a 99-year PPP structure to a port operator; the PPP operation is valued at $ 1.4 billion and China Merchant Port Holdings Company Ltd. (CMPH) will invest $ 1.12 billion as their share in the venture, and the Government of Sri Lanka (GoSL) agrees to offer 80% of the share capital of the joint venture company (PPP Operator), established for the purpose of undertaking the development of the Hambantota Port and allied infrastructure to CMPH. The Sri Lanka Ports Authority (SLPA) will subscribe to a minority share of 20% of the venture.

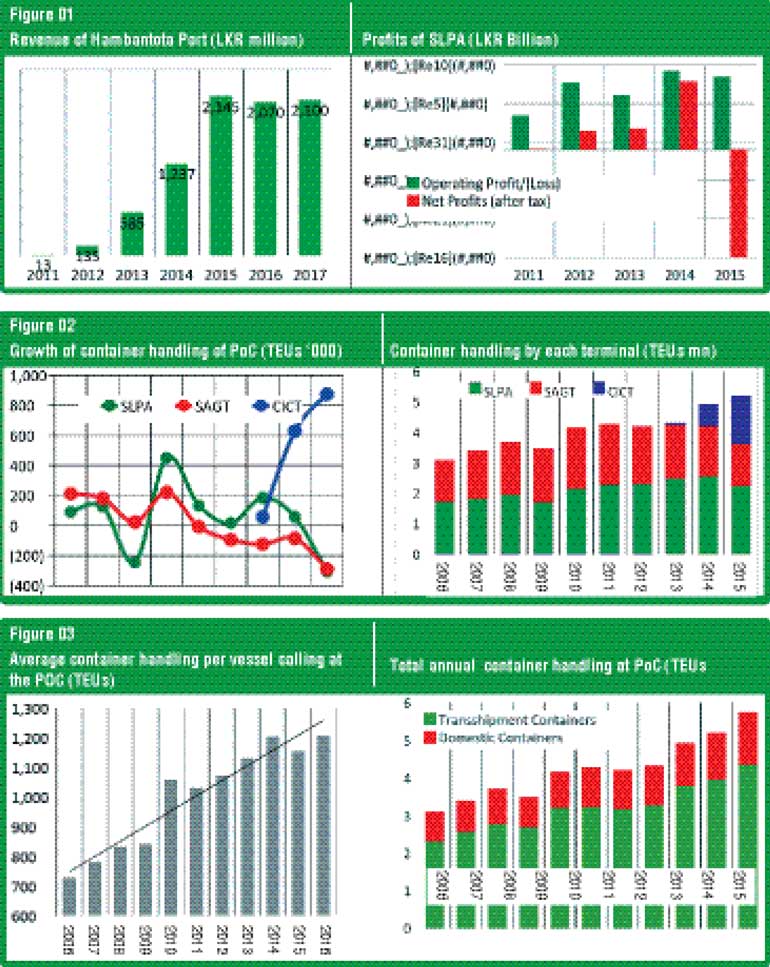

The SLPA had obtained borrowings of $ 1.271 billion for the construction of phase I and II of the Hambantota Port. With its limited scope and operations, the revenue of the port was Rs. 2.4 billion ($ 16.5 million) in 2015. It is obvious that the Hambantota Port has been constructed without consideration of a commercially feasible business model. The majority of the loans are still within their grace periods, when the above loans become due for payments, the servicing of these debt commitments will be a challenge for the SLPA as the income of the SLPA will not be sufficient enough to meet these requirements. These circumstances have led the GoSL to explore an alternative mechanism to operate Hambantota Port in a commercially viable structure.

Critics argue that the Hambantota Port should be operated by the GoSL without giving such a national asset to outsiders. To see the merits of such arguments, one should analyse the dynamics of the global container shipping industry and see whether SLPA is capable of building a transhipment hub in Hambantota Port competing with other ports for regional cargo.

SLPA operates one main container terminal; Jaya Container Terminal (JCT) within the port of Colombo (POC) while two other terminals of the port are being operated by private operators; South Asia gateway Terminal (SAGT) and Colombo International Container Terminals Ltd (CICT) with the SLPA holding a minority stake in each terminal. The Port of Colombo is a regional transhipment hub with vast majority of container boxes (nearly 75% of the total) being diverted from regional ports.

The Port of Colombo had recorded a 10.6% growth in container handling in 2016.The key driver of the growth in the recent past is from the CICT terminal which is modern and capable of handling mega container vessels with depth of approximately 20 meters. In terms of terminal efficiency, JCT, being the oldest terminal has outdated equipment being able to move approximately 25 containers (TEUs) per hour. The other two private terminals can move at a faster pace of 30-35 containers (TEUs) per hour resulting in lower vessel turnaround time. Over the years, the JCT has been gradually losing its market share to more efficient private terminals.

The global container shipping industry is highly competitive and the shipping lines are in foray to build economies of scale through  mega vessels to carry maximum cargo load. The container shipping industry operates in a hub and spoke system. The mega vessels call only at key transhipment hubs while feeder vessels feed the regional cargo to those hub points (this cargo is identified as transhipments). Main transshipment hubs in the region are Hong Kong, Singapore, Salalah port (Oman), Port Klang and Tanjung Pelapas (Malaysia) and Dubai. Such transhipment hubs have built reputations as efficient port operators with the best infrastructure, continuous improvement and innovation to stay ahead of the competition.

mega vessels to carry maximum cargo load. The container shipping industry operates in a hub and spoke system. The mega vessels call only at key transhipment hubs while feeder vessels feed the regional cargo to those hub points (this cargo is identified as transhipments). Main transshipment hubs in the region are Hong Kong, Singapore, Salalah port (Oman), Port Klang and Tanjung Pelapas (Malaysia) and Dubai. Such transhipment hubs have built reputations as efficient port operators with the best infrastructure, continuous improvement and innovation to stay ahead of the competition.

Port operations are a specialised job and a credible port operator should have the capability to attract and pull regional cargo into one location. There are mega scale port operators who have built credibility in the industry which helps attract regional cargo. To revive a port of the nature of the Hambantota Port with virtually no commercial activity surrounding the port, a highly credible port operator should operate the port and attract transhipments from the region. The proposed Kra Canal is blessing to Hambantota Port. Kra Canal doesn’t mean that the sea ports in the belt can receive business automatically. Development of Hambantota Port as a transhipment hub will remain a dream unless we build the core competencies with a reputed port operator when the proposed Kra Canal comes into operation.

The critics of proposed PPP operation for the Hambantota Port argue that the country’s debt burden in terms of Debt to GDP ratio is not worrisome when compared internationally. However, the official debt to GDP ratio excludes the very same debt obtained for Hambantota Port which is held in the books of SLPA. If those SOE debts are included, the actual Debt to GDP ratio is exorbitantly high. Current Debt to GDP ratio of the country is 76% and it is 56% for median of B rated countries while the same is 51% for median of BB rated countries. In comparison, the debt to GDP was 103% in Greece prior to the financial crisis. (More discussion on public debt, please refer my pervious article on debt burden and fiscal challenges in 2017: http://www.ft.lk/article/587692/ft)

Annual lease income

According to the proposed agreement with CMPH, the PPP operator for 99 years are valued at $ 1.4 billion. In reference to above valuation, the critics argue the value of average annual lease income is only $ 11 million. The above argument had completely ignored the time value of money. Estimated long term borrowing cost (15-20 year) for Sri Lanka would be approximately 7.5%, by comparing the secondary market yield rate of existing Eurodollar bond issued by the GoSL. Assigning a risk premium of 2.5%, a discount rate of 10% is used for calculation of time value of money.

The annual lease payment corresponding to an upfront valuation $ 1.4 billion is estimated to be $ 140 million if accounted for time value of money. It amounts to Rs. 21,002 million at current exchange rate of Rs. 151 per USD. If historical annual depreciation of LKR is applied, the value will reach Rs. 28,623 million in 10 years’ time while the same could reach Rs. 40,376 in 20 year later. This should be compared with Rs. 11 billion of stated profits earned by SLPA in 2016.

With future expansion, the phase III of the Hambantota Port includes landmass of 1,255 hectares. This land is currently idle and generates no meaningful economic benefits. The PPP operator is compelled to attract productive investments which could generate export oriented cargo to be routed through the port in addition to transhipments.

If the GoSL couldn’t make available lands for such industrial activities, the PPP operator has no way to generate the required local cargo for the port terminals. If the PPP operator could attract relocation of industrial activities to Hambantota, the Foreign Direct Investments (FDI) will create employment for locals; thereby create economic benefits and valuable foreign exchange earnings for the country.

Another argument on the debt servicing, that the annual debt service payments which is approximately $ 96 million could be saved from imports of fuel, motor vehicle and wheat. In contrary to claims by those critics, imports of motor vehicles during 2016 was $ 794.7 million while the country has spent $ 249.1 million to import wheat and maize. One needs to carefully analyse whether there is space for curtailing down such imports, giving due consideration to needs of citizens of the country for maintenance of day today life.

The operations of CICT terminal, at the PoC, which handled approximately 1.6 million TEUs in 2015, is profitable. On a similar comparable basis, Hambantota Port should handle a minimum of 4.0 million TEUs to run a profitable operation and service its debts. It is unlikely that SLPA can generate these volumes easily attracting large regional transhipments business to Hambantota Port. Large private sector investments are required for developing an industrial zone around Hambantota (i.e. Tanjung Pelepas, Malaysia). Even then, revenues for such projects will only be generated in the longer term.

In order to take advantage of our strategic location amidst changing landscape of the global container shipping industry, the development of Hambantota Port as a regional transhipment hub is important. The proposed PPP operation is a necessary step in reaching towards such a long term objective. It is worth to note that the port operation is a specialised job and only a credible port operator can build a large transhipment hub in the Hambantota Port.

(The writer is a CFA charterholder with local and international capital market experience.)