Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 26 April 2022 03:07 - - {{hitsCtrl.values.hits}}

My friend Daniel Alphonsus (previously at the Finance Ministry) listed the seven main themes of IMF intervention in Sri Lanka. He said “the themes of this final program need not be very different from the past six extended programs. But their sequencing needs to reverse.”

Daniel listed the broad things that the IMF does, and I treat it as a useful summary, not official. Daniel’s article has his own argument and you should read it, but I’ll only address these seven points here:

As noted earlier, of the two main types of IMF programs, extended facilities are the more ambitious. They last longer and are intended to rectify structural problems. When we review the six extended facilities Sri Lanka has obtained, the same themes keep propping up over the decades:

(https://www.ft.lk/columns/Sri-Lanka-s-next-IMF-program-The-program-to-end-all-programs/4-733504)

(https://www.ft.lk/columns/Sri-Lanka-s-next-IMF-program-The-program-to-end-all-programs/4-733504)

For a shared sense of what problems the IMF is supposed to solve, let’s agree that Sri Lanka has run out of foreign exchange (dollars) and this has led to catastrophic shortages of food, energy, and fuel. Protestors asking for the power cuts, fuel shortages, and food shortages to stop.

So what is the IMF solution? Whatever the problem, wherever it is in the world, they generally have the same recommendations (which is really problem number one). Since Daniel outlines their seven main themes, let’s go through them one by one.

1. Removing price controls

Daniel says the IMF would “remove price controls, especially in energy and agricultural markets, to reduce shortages and encourage production.” Given basic supply and demand, what would this mean? Prices would go up.

What would this do?

If we remove price controls on fuel, prices will go up. This won’t affect rich people filling up their jeeps so much, but a poor person with a trishaw or tractor is completely out of luck.

Same thing for agriculture, i.e. food. Prices would go up. Given high demand, producers don’t even need to produce more, and anyways, food takes time to grow. Lifting price controls would just mean immediate price gouging. What’s the customer going to do? Starve?

The problem with just removing price controls is that prices would get out of control. In its myopic focus on prices, the IMF doesn’t even consider that price controls could be there for a reason. Sri Lanka has price controls on fuel so people can power their tractors to grow food and get to work. We have price controls on food so human beings can get the basic calories to function. ‘Rationalising’ these prices would irrationally destroy the human basis of the whole economy.

How would people react?

Well, K.D. Chaminda Lakshan was just murdered by the cops recently, for protesting fuel price hikes. People are protesting because the prices are high now. How do you think they’d react when you way you want to make it worse? We would justifiably go berserk.

Nobody’s out there protesting for higher prices on food and fuel. People want food and fuel prices controlled better, and the IMF would make things worse.

An alternative

The actual answer is not blindly removing price controls. The sane alternative is to do what people want. Control prices so they can live, using strategic rationing to protect industries and the working class. To that end, Sri Lanka should ration fuel so that productive buses, tractors, tuk-tuks, and bikes can get something, and gas-guzzling cars and jeeps get told no. We also need to ration and even nationalise food production so that people don’t starve, even if fancy imported food runs out.

Price controls give you a valuable tool to control who gets protected, whereas removing them just protects capitalists and their profits. And what our people desperately need now is protection.

2. Depreciating the currency

Sri Lanka’s currency has already depreciated 65%. It was 200 to the dollar, now it’s 330. To the moon! The problem here is that Sri Lanka’s dollar debts have gotten 65% more expensive (to the point that we’ve defaulted), and dollar-denominated fuel and medicine have also become more dear.

The logic is that the old exchange rate was wrong and no one would remit dollars at this price, but now people are still not remitting dollars anyways. As investor Murtaza Jafferjee said, “There are no USD available even after a 70 percent depreciation.”

What would this do?

Like fuel hikes, this isn’t hypothetical. The rupee has already depreciated, and it has A) not solved the problem and B) created other problems. The IMF theory is that this ‘encourages exports and discourages imports’ but this is just junk psychology. Just a completely unproven theory of human motivation, unethically tested on entire human populations.

The unfortunate fact is that Sri Lanka no longer has any ability to do much about our currency. Depreciation is just happening. But it’s folly to think that depreciation is good. As Shiran Illanperuma said to me, “Devaluation drives up the cost of inputs and basically drives inflation across the board. The basket of imports tends to shift from production to consumption goods cause you focus on survival.”

This is what the IMF picks as a solution. A blunt tool like exchange rates along with blunt price increases. They just bludgeon everyone in the country with blunt instruments, which don’t even work. It makes the country easy pickings for capitalists, proudly wounding the country as a completely unproven motivational tool.

How would people react?

We have depreciation now, so look how people are reacting now. We’re pretty furious. Milk powder is unavailable, essential food is more expensive, spare parts, and export inputs are often impossible. Middle-class savings have been cut in half. People want less depreciation, not more.

An alternative

As I’ve said, this is largely impossible with pure monetary policy. What Sri Lanka needs is long-term industrial policy. The only thing that can move our currency is demand for exports, and export industries have to be planned, protected, and supported by the government to grow. This can take years, but there’s no other way out. This is what every industrialised country has actually done, as opposed to the theoretical nonsense the IMF tells poor countries to do.

If you want to encourage exports, you need to actively develop industries, as every industrialised country has done. A depreciating currency doesn’t magically produce factories. They have to be given government support, protected, and nurtured along. Again, this isn’t commie theory. This is how every industrialised country has actually developed.

As with every IMF recommendation, remember to ask cui bono? Who benefits? Does a depreciating currency benefit you? Or does it benefit local and foreign capitalists? Who do you think the IMF represents?

3. Eliminating import controls

The IMF says Sri Lanka should “eliminate import controls.” Before you remove a control, however, you should ask what was it controlling? Was it something worse?

What would this do?

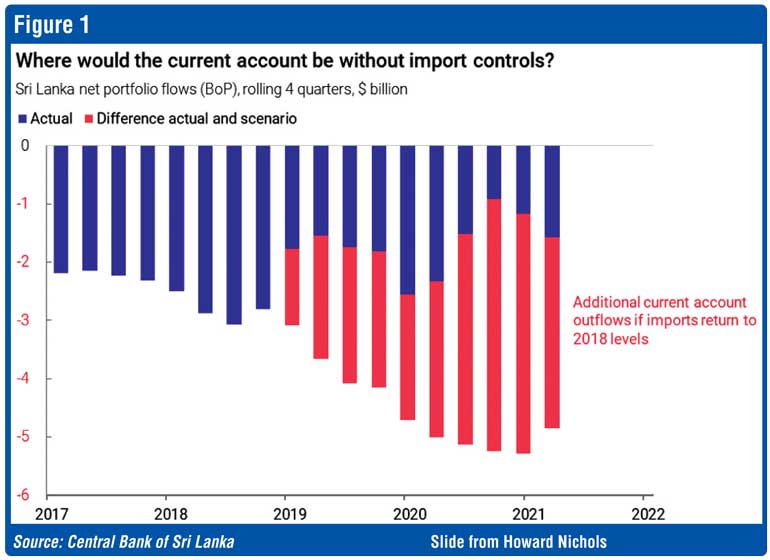

Sri Lanka’s import controls have been (unstrategically) controlling massive pressure on our dollar reserves. As the economist Howard Nicholas illustrates, without them we’d be doing even worse (Refer Figure 1).

What would happen if we just cut import controls off? Well, that pressure on our dollar reserves would explode, and we’d be in a world of hurt. Inequality would explode as well, because imports would go where the money was, without any controls at all. So dollars would go for Daimler Benzes instead of dhal.

As always, keep asking cui bono? Eliminating import controls would benefit foreign exporters and local importers, but working people and families would suffer even more. And the increased pressure on forex would hurt everyone.

How would people react?

Nobody’s out there screaming for more imports in general. They want fuel, they want milk powder, they want medicine, they want essentials. If the country removed import controls in general, none of that would be prioritised. We would have worse pressure on reserves, with even less consideration of what the people want. They would rightly be furious.

An answer

People don’t want the elimination of controls. They want things to be under control. That means lifting import controls on what the people want (like dhal, milk powder, or sanitary pads) and raising them on what the rich don’t need (luxury goods, air conditioners). This way we can raise revenue without burying working people alive. At the same time, government industrial planners need to A) come up with an industrial plan and then B) carve out exceptions for the necessary inputs. We need to use import controls to grow and protect local industry which can A) serve local consumers without putting pressure on dollar reserves and B) make products for export. In the long-term, this is the only way out of the core problem, which is that no one wants to give us forex to put in our reserves, which is how we buy imports at all. None of these are crazy commie theories. This is how every industrialised country actually developed, as opposed to the failed textbook they throw at us. Every industrialised country has and continues to have import controls, which they use as a strategic tool. Right now, Sri Lanka needs every tool we can get.

4. Privatisation and SOE cuts

As you may have noticed, the IMF calls for blunt, dogmatic cuts, with no sense of what country they’re in, what’s going on, or what year it is. As economist Howard Nicholas recently said: The IMF focuses on the wrong thing. The most important thing that the current problem relates to is the trade imbalance. Recently I had a copy of the IMF staff report on Sri Lanka, and what is incredible to me is that in 120-odd pages, they mention the trade balance only once, and only obliquely.

And this is quite staggering when I show you the problem of Sri Lanka. This for me suggests they have an ideological agenda. They’re not looking at the data, and they’re not interested in the data.”

As every Sri Lankan on the street knows, the problem is we don’t have dollars for energy, fuel, and medicine, but the IMF uses this crisis to just push its usual agenda. Every crisis is an opportunity to cut things, and privatise up the scraps. Do these cuts help the people recover? Do they cut their own countries during crisis like that? Nope. But here we are. Another opportunity for hacks to hack.

So in Sri Lanka, the IMF will call for ‘reducing budgetary support’ to state-owned enterprises (SOEs). But which enterprises? Shouldn’t some enterprises actually get more money? And is this a good time, when the whole economy is having a heart attack? Besides the obvious forex burners that is the dumb airline, what do SOEs have to do with a collapse in dollar reserves?

The IMF doesn’t get into that. The Washington Consensus since shock therapy in the 1980s has been just cut everything and hoover up the scraps. Every fire in the Global South is really a fire sale for Global Capitalism, and the IMF aren’t firefighters. They light the match.

What would this do?

Blanket cuts to state spending will just seize up the economy further. People will not get salaries, suppliers will not get paid, the whole economy will be hurt. Since the Great Depression white economists have known this, they just don’t apply the lesson to us.

During a recession in his own country, John Maynard Keynes recommended government spending on any activity. He said the government should even bury money in the ground and pay people to dig it up. This is the ‘stimulation’ rich countries give themselves, but it’s nothing but harsh austerity for us. And we know austerity doesn’t work. We’ve known since the 1930s. Economics isn’t as racist as economists. Keynes, of course, took a different view on brown people. He played a key role in the genocidal Bengal famine, stripping resources out of the South to serve the North.

“The inflation was no accident. The impoverishment was no accident. British policy was explicitly designed to ‘reduce the consumption of the poor’, as Keynes put it, in order to make resources available for British and American troops, through a ‘forced transfer of purchasing power’ from ordinary people to the military. The austerity was imposed most harshly on the people of Bengal, who fell into extreme famine, while food supplies were appropriated and diverted for military use. “In the name of the Allied cause, the policies imposed by Keynes and Churchill killed more than three million people – many times more than the total number of military and civilian casualties suffered during the entire war by Britain and the US combined. The scale of this tragedy is almost impossible to fathom. If laid head to foot, the corpses of the victims would stretch the length of England, from Dover to the Scottish borders, nearly 10 times over.

Things really haven’t changed that much to this day. Capitalism and the IMF just took over where colonialism and the East India Company left off.” (Source: https://newint.org/features/2021/12/07/feature-how-british-colonizers-caused-bengal-famine)

How would people react?

If government spending is cut, salaries won’t be paid, suppliers won’t be paid, we’re talking about millions of Sri Lankans getting hurt. Are SOEs inefficient, maybe, but that’s not our problem right now. Our problem is that the whole economy is collapsing, so we need to push more government spending out, even if it goes into a hole. We’re trying to prevent total collapse and chaos, not optimise Sathosa.

An alternative

The alternative is actually more government spending. You know, the stimulus white people keep giving themselves. Print money and pay people to farm. Pay people to install massive amounts of solar (with prioritisation of the necessary imports). Pay people to repair and expand irrigation systems. Like FDR did to end the Great Depression, we don’t need cuts. We need massive public works.

This is what a true international partner would do, and if we have a plan we do actually do have friends in Asia. But we must remember that the IMF is not our friend. They just represent international creditors and capital. They don’t care if we hurt. In fact, it’s better for them. That’s where privatisation comes in. Cheap assets for them to snatch up.

5. Firing people

Government servants did not cause this problem. They put very little pressure on foreign reserves. Their salaries are small and denominated in rupees (of course). Yet that’s what the IMF wants to cut.

Whatever problems you have, the IMF has the same solutions. Because it’s not about our problems, it’s about what rich people want. And they want these poor government servants to get fired.

What would this do?

Like cuts to SOEs, firing people would blow money out of the economy at a time when we’re desperately trying to inflate it back up.

As Keynes said it doesn’t matter if government departments are inefficient. That’s not our problem right now. The problem is that we’re crashing into our own great depression, and we desperately need money circulating.

Firing government servants does nothing for foreign reserves. It does nothing to produce export, or food, or energy, or anything we need. It’s just firing poor people and putting them on the street. It’s just some ritual sacrifice that international creditors demand, but it has no benefit to the country.

How would people react?

If we start throwing government servants out on the street, guess where they end up? On the street. If you thought protests were bad, wait till a bunch of fired, tired, and wired people show up. It’ll be even crazier, and we’d deserve it.

Whatever waste there is in the civil service, it’s in rupees, and it goes right back into this economy. Meanwhile people driving imported cars and sending their kids to school abroad call government servants a burden, and lazy. It’s rank class warfare, and complete hypocrisy. Civil servants weren’t the ones burning dollars. That’s on readers of the Daily FT.

An alternative

Public expenditure in rupees is simply not the problem. We’re having a forex crisis, not a rupee crisis. We certainly need to reorient government servants to productive work, but firing them during an economic crash is just insanity. It would just throw more people into poverty, pull more money out of an already stalling system, and we’d just crash with greater intensity.

What we need is actually more government spending, as I discussed, which has been the recipe for white people for nearly a century. We need to get more people to work. Now is not the time to be firing people. Unless, of course, you’re a capitalist and you A) don’t care and B) like having poor desperate people as a surplus labour army. Because that’s where this leads. Either wage slavery or revolution, neither of which will be pretty.

6. Reducing subsidies

According to the IMF, cash transfers are just ‘more effective and efficient than subsidies. But that’s just not true. Sometimes cash is good, but sometimes subsidies make more sense. It depends on the situation. But as always, the IMF is one size fits all, and that size is always too small to fit anybody.

This is also a solution in search of the problem. Nobody’s holding posters saying ‘More efficient cash transfers! Fuel and food subsidies are keeping people alive and the economy going. We’re supposed to pull that plug for a cash delivery system that doesn’t exist? Because what? Theory?

What would this do?

Besides Samurdhi and Mahapola (cash payments to the poor), the government doesn’t have a system for cash delivery. Instead, fuel, energy, and some food are subsidised, which is a vital input to the economy. How do we replace that working subsidy system with a cash system that doesn’t exist?

Any cash delivery system would be prone to political corruption or siphoned off in fees through private companies. It’d be a good business for some, but actually worse for the economy.

How would people react?

People would definitely protest if you cut off subsidies, and you’d be creating a huge mess for reason. Just devotion to some completely unproven theory.

Subsidies are actually inputs to the entire economy. They make everything tick. As I mentioned, subsidies are investments that feed workers, getting them to work, and run those businesses. If you myopically prioritise making the energy and agriculture sectors more ‘efficient’ on paper, you destroy the entire economy in practice. And people know this when you cut subsidies. They protest, and they’re right.

An alternative

Subsidies can be very good. Subsidies can be more efficient than cash. If you subsidise milk you know some child gets milk. If you subsidise rice you know someone gets fed. If you subsidise fuel you know some tractor tills a field. If you give cash you don’t know what happens, it could be siphoned off, hoarded, or spent on booze. I’m not saying cash transfers are bad, but they’re just a tactic, not a strategy. It depends on the situation.

In this situation, we should actually be using subsidies more. People should get a basic ration of food (a subsidy) so they can survive. Farmers and industries should get some subsidised energy and fuel. We should provide inputs in kind to get real industrial production going. The debate over subsidies vs. cash transfers is honestly pointless and dogmatic. Unlike IMF recommendations, we should do what works.

7. Increasing taxes

Sri Lanka’s tax collection is dismal and the current President made it abysmally worse. It definitely needs to be improved, but again we need to look at the situation right now.

All of the stuff that the IMF says to eliminate (price controls, import controls) is actually an immediate way to raise money, whereas tax hikes would be delayed and require collection ability we don’t yet have. I’m not saying don’t do it. Do it. Raise my taxes. But there are better ways to raise revenue right now.

What would this do?

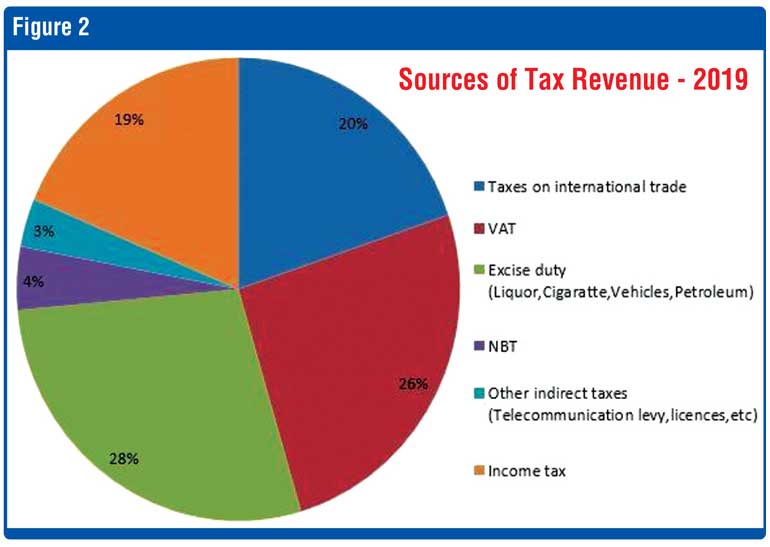

If you’re firing people, reducing spending, and generally cratering the economy with austerity, it’s unclear who you’re raising taxes on. Sri Lanka has an extremely low percentage of people paying income tax, and the really rich are slippery as eels. In the best case, this recommendation would do not much, because it’s largely unworkable (Refer Figure 2).

Most Sri Lankan taxes are collected through sin (liquor, booze, cigarettes, cars, and oil), VAT (sales tax), and import duties. The IMF wants to cut the latter, and if you increase consumption taxes, that just hits poor people. Income tax is only 19% of revenue. There’s simply not that much you can do.

How would people react?

If you increase income taxes people will ignore it because there’s no collection force (and you’re firing government servants, aren’t you?). If you raise corporate taxes OK, but corporations are tanking too. If you raise consumption taxes protests will consume you. It’s hard to see how any of this improves the situation.

An alternative

In fact, all of the stuff that the IMF says to not do are ways to raise revenue. Import controls and price controls are very direct ways to raise revenue, and they can be made progress too.

With energy, for example, you can charge ‘huge’ amounts for excessive home use. Running the ACs should cost like Rs. 200,000, while a bill of Rs. 2,000 should be untouched. This is effectively progressive taxation, collected through the electricity bill. It also reduces demand for electricity. Many birds, one stone.

Same thing for fuel. Huge surcharge for filling up a luxury car or jeep. Filling up a bus, tractor, lorry, or tuk-tuk should be cheap. This is again a progressive tax, collected at the pump, which also reduces demand.

In the longer-term, income taxes plus wealth taxes are also important. But again this is not about tax or don’t tax. It’s about the right taxes, collecting money strategically, from the right people. Leaving the poor largely untouched, but collecting from the rich, importing class that got us into this mess.

Who not what

What I hope you’ve seen running through this article is A) how actually awful the IMF recommendations are and B) who they actually benefit. The who is the most important part.

The IMF serves creditors and international capital, and the few rich people that benefit in Sri Lanka. Always headed by a European, it is a fundamentally colonial institution that preserves that (abusive) relationship through our own desperation and lack of alternatives.

Daniel calls the IMF’s recommendations ‘politically costly,’ which is just a fancy way of saying wildly unpopular and not democratically approved. People don’t like higher prices, they don’t like a weaker rupee, they don’t like losing their jobs, they don’t like losing subsidies, and they don’t like paying more taxes. All of these things the IMF calls ‘reforms’ are unpopular for good reason. The people aren’t dumb. The people should be listened to.

The logic among my class of people (the rich), however, is that ordinary people just don’t understand, but that’s just not true. It’s just common sense that raising prices, firing people, and cutting subsidies are a bad idea during a crisis. Western economics is a strange priesthood, with obscure monetary beliefs and magic ‘structural’ spells that don’t work, but which still remain dogma for the poor. It’s really a class struggle, and as Tolstoy said: “This wonderful blindness which befalls people of our circle can only be explained by the fact that when people behave badly they always invent a philosophy of life which represents their bad actions to be not bad actions at all, but merely results of unalterable laws beyond their control.

In former times such a view of life was found in the theory that an inscrutable and unalterable will of God existed… The new explanations came in the form of science: political economy, which declared that it had discovered the laws which regulate division of labour and of the distribution of the products of labour among men.”

As the (good) economist Ahilan Kadirgamar said in The Hindu: “In Colombo’s elite circles, the refrain now is that “we will have to go through much suffering before it gets better”. But, the elite will be the last to suffer as austerity will mostly hit Sri Lanka’s working people. In fact, the IMF agreement in bailing out external lenders is also bailing out the elite classes in Sri Lanka, as much of the external debt and the related projects and conspicuous consumption served them more than anyone else.

“The neoliberal technocrats are proposing to buy over people affected by austerity measures with cash transfers. However, working people are far more committed to their social welfare entitlements as evident from how they have fought hard to protect free education and universal health care over the decades. Indeed, there will be tremendous resistance to privatising state services and utilities. If anyone has to pay for this crisis, it must obviously be the wealthier classes in the country; the imposition of a wealth tax, for example on property and vehicles accumulated over the years, would be a starting point.” (https://www.thehindu.com/opinion/lead/sri-lanka-stares-at-bankruptcy-or-redemption/article65324605.ece)

As Ahilan said, “The IMF agreement in bailing out external lenders is also bailing out the elite classes in Sri Lanka, as much of the external debt and the related projects and conspicuous consumption served them more than anyone else.” As he continued, “if anyone has to pay for this crisis, it must obviously be the wealthier classes in the country.”

And yet what is obvious is obscured under mountains of very serious economic pablum. Psychological experimentation on poor, coloured populations. The experiments never work, but they keep testing us. They would actually make money by not underdeveloping us, but it’s not about that really. It’s about power. It’s like how white people used to throw coins at us. Just to watch us run.

The truth is that the IMF and its backers could forgive Sri Lanka’s debts without even noticing. But that’s not what they do. They keep us in a colonial debt trap, and tell us to fear other Asians. But look at the trap we’re really in. It sure looks pretty Capitalist and Western. As Shiran Illanperuma wrote: “In fact, predominantly Western banks, financial institutions and hedge funds, held over 40% of Sri Lanka’s external debt — in the forms of International Sovereign Bonds — in 2021. Notably, 70% of Sri Lanka’s International Sovereign Bonds were issued between 2016 and 2019 while the previous government was undertaking IMF reforms.”

The truth is that Sri Lanka could deal with our dollar problem by abandoning dollars as much as possible and trading in other currencies with our neighbours. We could ride the shifting geopolitical winds out of this storm, instead, we’re being sucked back into White Empire as it implodes.

What do we think these ‘final’ reforms are going to do? At best we’ll just kick the can a few months down the road. At worst a country that’s already suffering and on fire will absolutely explode.

If you don’t believe me, I invite you to take these seven points and go down to the protests, and present them to people on the road. Tell them you want to raise prices, devalue the currency, fire people, and cut public subsidies. Then try not to get chased down that road. That’s really what we should do to the IMF. Chase them out of the country, out of history, all the way down the revolutionary road.