Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 13 January 2023 00:44 - - {{hitsCtrl.values.hits}}

A rising interest rate environment impacts consumers alike whether they are net borrowers or net savers

High interest rates increase the cost of borrowings, reduce disposable income and thereby limit growth in consumer spending and business expansion. When the cost of money in the form of interest rates rises rapidly, growth may slow down sharply or even give way to a contraction in the economy, with the risk of business bankruptcies. With higher interest rates taking hold, borrowers should expect to pay more for business loans and consumers to pay more for medical loans, car loans, credit cards, and housing loans. Indeed, a rising interest rate environment impacts consumers alike whether they are net borrowers or net savers – the former more than the latter.

High interest rates increase the cost of borrowings, reduce disposable income and thereby limit growth in consumer spending and business expansion. When the cost of money in the form of interest rates rises rapidly, growth may slow down sharply or even give way to a contraction in the economy, with the risk of business bankruptcies. With higher interest rates taking hold, borrowers should expect to pay more for business loans and consumers to pay more for medical loans, car loans, credit cards, and housing loans. Indeed, a rising interest rate environment impacts consumers alike whether they are net borrowers or net savers – the former more than the latter.

The positive side of high interest rates are they tend to reduce inflationary pressures and cause an appreciation in the exchange rate. But Sri Lanka’s recent spike in inflation was largely driven by a manmade forex crisis from an artificially overvalued currency used to defend it, and thereby depleting its meagre usable foreign reserves. As a consequence we imported inflation. The high interest rates have hit the middle and lower class right in the belly and negatively impacting the SMEs and now the organised private sector.

Options to reduce rates

Targeted low interest rates to businesses to spur growth and the supply of goods and services, must become the overriding objective. Avoiding a reduction in consumer disposal income (rising unemployment, job losses, crop failures, labour migration) in the absence of consumption borrowing is the secondary objective, to spur demand for the goods and services, this growth spurt will generate.

Administrative measures would be the better method to achieve the former – a cap on lending rates to businesses and a cap on FD rates to all to support this. Consumption lending rates could remain at elevated levels to dampen inflationary trends. The enabling policy rates should also be lowered, though for the time being not raising them would be prudent until the market rates decline through market dynamics and when market liquidity improves. The CBSL must work with the banks every week to bring down the deposit rate by 50 to 100 bps and in tandem to bring down the lending rates to businesses. A deposit rate cap should be imposed for foreign currency as well, to dissuade exporters from holding forex deposits. This will definitely stabilise the exchange rate by boosting forex reserves, in the context of the current blanket restrictions on imports and the April 2022 debt repayment suspension on international debt.

For a start, there is a high probability that for the LKR to appreciate more exporters must convert USD to LKR. Administrative action by CBSL in enforcing the forex surrender rules, is essential – particularly with reference to the Sri Lanka Customs export declarations made by exporters and other available collateral data of export earnings. Forex retention percentages should be targeted by the export sector and applied without fear or favour. Weekly published data on export remittances received, categorised into export sector and remittance sector (overseas workers and tourism) along with aggregate surrender percentages would publicise the country’s forex challenges and push down the daily market fix rate and showcase that the LKR is appreciating. This will spur voluntary conversion by exporters, in addition to the mandatory conversions by administrative measures mentioned above.

Importantly, CBSL must bring down the market’s negative liquidity and take it to an excess liquidity position so that rates will gradually come down. At the moment according to market sources there is 200 b + negative liquidity, therefore to push down rates will be challenging. Banks who are short on LKR must be asked to give a plan to bring the shortfall down with timelines, if not it will be difficult to bring the rates below 20% levels in the next three months. CBSL should not purchase Treasuries (Tbills and Tbonds) on the primary auctions, but reissue auction deficits to the market at the weighted average yield of the auction purchases instead of mopping them up with available or printed cash. This will also stem the growth of the CBSL Treasuries stock which can be further subjected to QE by the CBSL at maturity.

Given the current inversion of the yield curve, CBSL should advise the GOSL to issue longer dated Treasuries at lower rates for a protracted period of over 12 months, at the expense of a lower or no TBill issues, giving a clear signal to the markets that lower rates are the GOSL preference. A further administrative measure by CBSL as the Regulator, to exclude primary bill/bond purchases by primary dealers for trading purposes under 12 months and for their Prop. Books. This will restrict the Treasury stock to retail holders to maturity and secondary market players.

Conclusion

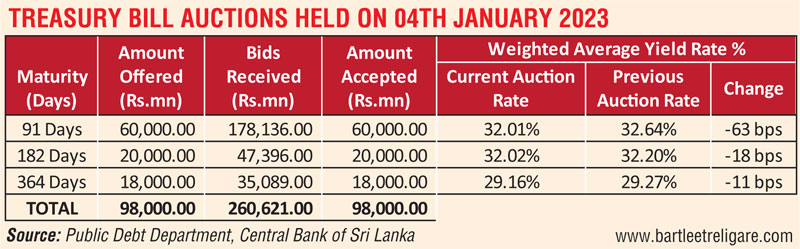

The five largest banks must manage the FD rates down and the lending rates down together and intelligently. The three months TB is the benchmark and therefore should be signalled via auctions. Certainly a warning of a lending rate cap could help. Messaging via auctions also needs to start immediately. The biggest risk for the private sector now is the unbearable high interest rates. The Government needs to focus more on debt restructuring and get an IMF deal done quickly to give confidence to the markets.