Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 16 January 2020 00:01 - - {{hitsCtrl.values.hits}}

It was heartening to note that some have read my recent book, although some feedback was critical about some of the contents. “Why do you say external current account deficit is more important than fiscal deficit? Aren’t those two linked anyway? Why do you emphasise on foreign earnings? If the fiscal deficit is not narrowed, how can the debt problem be solved?” These were some of the questions raised by knowledgeable individuals.

This is to explain my rationale further and attempt to address some of these questions.

Difference between external current account and budget deficit

Some seem to think that these two are linked and by fixing one the other could be fixed automatically. On the contrary, as of now, these two go in opposite directions. The simple reason is, Government revenue is directly linked to imports (port and aviation levy, import duties, etc.). While in contrast, export sector enjoys concessionary taxes. Therefore a surge in imports may actually reduce the fiscal deficit (difference between Government revenue and expenses) through higher tax revenue although worsen the external current account deficit (difference between imports and foreign currency earnings).

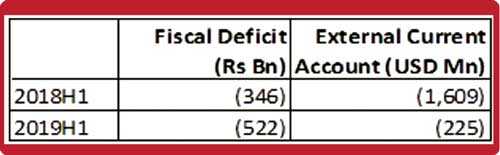

This is clearly seen in the fiscal deficit and external current account deficit in the first halves of 2018 and 2019. The sharp fall in imports due to import restriction measures have significantly contracted the deficit in the external current account in 2019. However the lower imports have negatively affected tax revenues, resulting in an expansion of the fiscal deficit.

In my view, the statistics in 2019H1 are just fine if it had happened for the right reasons. However in this case it has happened for the wrong reasons. If it occurs through a sharp rise in foreign currency earnings (which would have resulted in a higher GDP growth), it is fine. It may involve a deterioration of the fiscal deficit through incentives and expenditure related to boosting foreign currency earnings.

Instead, it has happened due to import restriction measures, which has weakened the economy, resulting in a GDP growth close to 2% and distress in many sectors. Imports shouldn’t be restricted through such knee-jerk reactions, but rather through long term measures such as shifting importers for value addition, import substitution type activities in the long run. The idea is to achieve the statistics for 2019H1 while the economy is still growing at a healthy rate of over 6%.

Link between foreign debt and external current account deficit

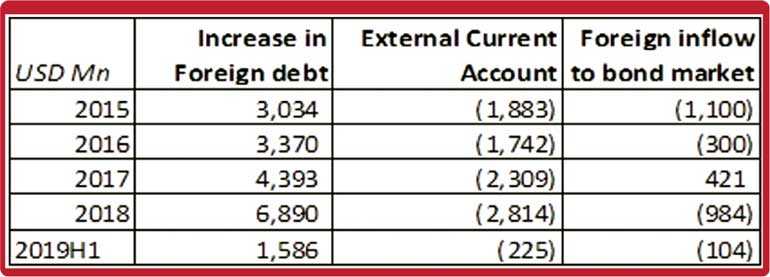

It is the deficit in the external current account (the imports being a lot more than the foreign currency earnings) that drives the foreign debt. A glance at the data shows the relationship quite clearly. The foreign inflows/outflows to/from the Treasury bond market has either eased or aggravated the need for foreign borrowings. 2015 shows this relationship quite clearly. External current account deficit was $ 1.9 billion, foreign outflows from the treasury market was $ 1.1 billion, while the increase of foreign debt was the exact addition of the two at $ 3.0 billion.

The increase in foreign debt is markedly higher from 2016-2018, mostly because the Central Bank could have been trying to boost the foreign reserves to meet the stiff foreign debt repayment obligations in 2019-2020. 2019H1 also clearly shows that as the deficit in external current account was sharply lower, the need for foreign borrowings has also been significantly less.

While there is a lot of talk about the need to repay significant amount of foreign debt in the near future, the reality is, on top of that Sri Lanka needs to borrow around $ 2 billion annually to simply finance the import bill. In other words, if import restrictions are not imposed, Sri Lanka would need to borrow well over and above the need to borrow to simply repay the existing debt.

Why foreign earnings rather than inflows to bonds and FDIs?

Prior to 2015 the increase in foreign borrowings was less as significant foreign inflows were witnessed to the Treasury bond market. Hence one could argue that inflows to the Treasury bond market and/or FDIs would also be able to reduce the need for foreign borrowings. However, unlike foreign currency earnings, sustainability of inflows to the treasury market and FDIs are uncertain. These inflows can easily reverse to be outflows depending on many external factors as we have seen frequently in the past. Some goes even further and say that an appreciation of the Rupee would lower the amount of foreign debt in Rupee terms. Letting the Rupee appreciate at times when foreign inflows occur would negatively affect foreign currency earning segments and could actually worsen the foreign debt repayment capacity in the long term.

In contrast, developing foreign currency earnings would be a more stable and sustainable solution to the debt problem. However, developing foreign currency earnings would be cumbersome and more time consuming. Still, it’s something that is essential and must be done immediately.

(The writer could be contacted on [email protected].)