Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 19 December 2017 00:52 - - {{hitsCtrl.values.hits}}

The changing landscape

The changing landscape

The famous scientist Charles Darwin has said: “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.” This undeniable truth with no exception to accountants is clearly evident in today’s VUCA (Volatile, Uncertain, Complex, Ambiguous) world where technology has become the key driver of almost everything. Although automation was begun initially in the blue-collar sector, the new developments of artificial intelligence (AI) and robotics affect not just blue collar, but the white-collar sector as well.

As per a global survey done by PWC (Workforce of The Future, The Competing Forces Shaping 2030), 37% of the executives are worried about automation putting jobs at risk while 74% are ready to learn new skills or re-train to remain employable in the future. Meanwhile the University of Oxford has said accountants have a 95% chance of losing their jobs as machines take over the number crunching and data analysis. It is in this context that many predict that accounting is a dying industry and accountants will join the list of extinct species within next 10 to 20 years.

Revisiting the definition and role

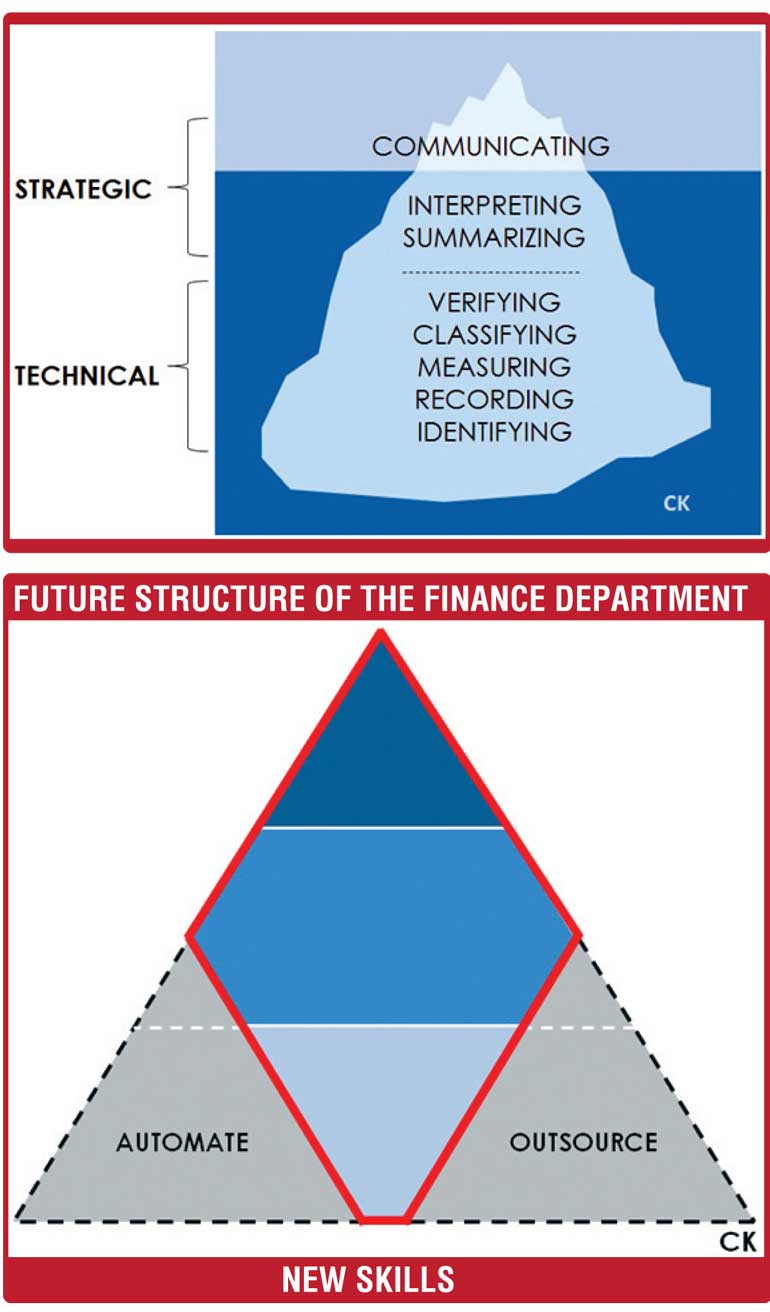

Accounting is traditionally defined as, ‘a systematic process of identifying, recording, measuring, classifying, verifying, summarising, interpreting and communicating financial information’ with the ultimate purpose of permitting informed judgments and decisions by users. If we critically look at this definition, it is evident that majority of the tasks is highly technical and can be considered as ‘home-work’ for accountants prior to communicating the information to the intended audience. As depicted in the picture, communication is the only piece the users see and the role of the accountant is mostly assessed by the users on this aspect. In terms of technological adaptation, the probability of automation is high in the technical/operational tasks relative to the strategic tasks.

One of the biggest mistakes done by the accountants, in my view, is the tendency to assess the strength of the role merely by the technical competencies or the professional qualifications; whereas the true value of an accountant is mostly measured by the users on the value created by the accountants to the organisations and the decision makers. Another myth among accounting professionals is their belief that the value addition can only be made at the strategic levels and not at the operational levels. However, the truth is, everyone in the process can actually add value in whatever the task he/she does and it only requires the mind-set of ‘value creation’ rather than merely executing the tasks mindlessly.

Paradigm shift

Although there is a threat for the role of an ‘accountant’ owing to the increased tendency for automation, one cannot simply conclude that the business world can survive without ‘accounting’. Hence, the key is to understand why the ‘accountant’ is becoming obsolete and how to remain relevant in the long run. Traditionally accountants used to spend a lot of time in operational activities such as identifying, classifying and recording transactions which in today’s context require the least amount of human intervention due to automation. Finance function used to protect an organisation’s financial integrity and shareholder value as the gatekeeper of a single version of the truth about business performance.

However, the greatest challenge today is that the finance function is tasked with measuring and delivering contextual information from across the business that goes beyond the revenue and cost data that boards have historically craved, given that finance has a much broader and more demanding set of stakeholders and a constantly evolving business landscape. This means that not only is measuring and reporting revenue and P&L increasingly difficult, but also is not a comprehensive method for understanding how the business generates top and bottom line results. As such, if finance is going to be a true business partner, it must evolve beyond the traditional profit/loss view to help the broader business refine existing business models and generate new revenue. This requires a shift from an accounting focus on revenue and costs to one that is more insight based and contextual driven.

The new structure of finance department

The new structure of finance department

With the operational level functions of Finance department are largely getting automated, finance departments will require a smaller team in the operational level and more people in the middle doing value addition (analysis, interpretations, MI). There is also an increasing trend of outsourcing the routine operational activities and this phenomenon is evident in the Sri Lankan context as well specially among large conglomerates. As a result I believe that the typical pyramid structure will be transformed into a different shape where the middle level becomes larger than the operational layer as far as the people architecture is concerned.

As the shape of the department is changing there is also a need to invest more on new areas and technology within the middle layer. Setting up new divisions such as a Decision Support Unit (DSU), Data Analytics Unit (DAU), Innovation Unit, AI and Technology Unit, etc. will be desirable. It is vital that the leaders identify these shifts and ensure that the recruitment and capacity building within the finance department is done accordingly, while also striking the balance between the machines and humans.

Technology – friend or foe

Automation is typically seen as a threat to any job as it tends to eat a good chunk of a job role making the human redundant partially or completely. The same is true for the accountants as well and arguably, automation is certainly not a friend of accountants. However, a group of finance professionals has responded in a survey that the value of finance function will increase due to automation. 72% of the respondents have said finance function becomes even more important within the organisation and 71% has said automation allows them to become more involved with business units. Further, 69% of the respondents have said they will have significantly more time available for higher value work. This clearly explains how accountants can leverage the merits of technology in elevating their role to a more value crating one rather than being mere number crunchers. However, the said value creation is possible only if the accountants possess the desired competencies to complement the technology.

One senior financial executive has told CFO Magazine: “Finance is IT. They are no longer separate items. Without IT, you can’t do finance.” In an era where rear-view mirrors are of little use, digital puts real-time information sharing and decision making a possibility. As shareholders and the media react almost instantaneously to financial performance, it is desirable that organisations are geared to provide spot-on predictive analysis, which is possible only through digital means.

Desired skills for tomorrow’s accountants

The ability to prepare financial statements and being conversant with accounting standards will no longer be treated as strategic value adding competencies, as the same is considered to be fundamental skills of an accountant, similar to the ability to drive for a driver. Therefore, the accountants are expected to acquire and demonstrate a range of competencies to support the desired role of the finance function and to remain relevant and indispensable.

To thrive in this age of hyper-change and growing uncertainty, it is now an imperative to learn a new competency; how to accurately anticipate the future to ensure that finance function is adding value to build the future of business beyond just accounting for the past. According to a survey done by EY, 57% of the respondents have said that building skills in predictive and prescriptive analytics is critical for the future finance function. In the same survey 67% of the respondents believe that improving business partnering between finance and the business is a major priority. This is a vital aspect as most of the accountants today lack the people skills as they put greater focus on building the technical competencies and stay in their comfort zones.

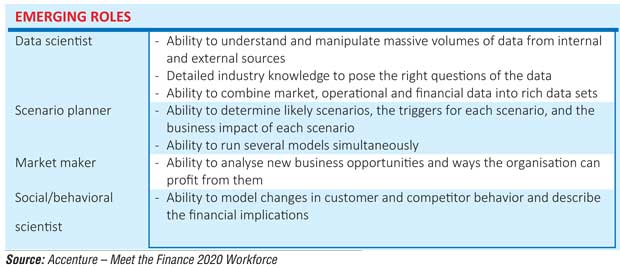

I believe tomorrow’s accountants are required to acquire strategic capabilities (such as anticipating future, seeing the big picture, decision making under uncertainty) people skills (such as relationship management, emotional intelligence, team-working, negotiation) and be tech savvy on top of their technical accounting competencies. In addition to these existing skills the future accountants are expected to have new skills to discharge the duties of their emerging role. Accenture has published a few emerging roles of accountants and related skills as seen in the table.

Role of the educational and professional accounting bodies

It is important that the academic institutions such as universities and professional accounting bodies take proactive measures to review the existing curriculums and ensure adequate provisions are there to build the overall character of an accountant beyond knowledge and technical competencies. Leveraging more on the technology in imparting knowledge and offering flexibility in terms of exams, continuous professional development as well as facilitating greater interaction with mentoring for the students and members would be desirable to uplift the demand and recognition for academic and professional qualifications.

Future accountants will increasingly need education in digital technology including cloud computing, AI and use of big data with the skills to provide more all-inclusive corporate reporting, which tells less about the numbers and more about the narrative of the organisation specially to non-finance executives and other stakeholders. The curriculums should be developed to cater to the future needs rather than just benchmarking the current realities.

While I duly recognise the ongoing efforts by professional accounting organisations and academic researchers, I still feel there is a significant gap in research that deals with the changes that will impact accountants and professional accounting organisations. Future research should drive industry collaborations and collaborations between inter-disciplinary academic researchers in order to reveal the desired competencies for the future accountants and craft possible strategies to address the gaps.

While I duly recognise the ongoing efforts by professional accounting organisations and academic researchers, I still feel there is a significant gap in research that deals with the changes that will impact accountants and professional accounting organisations. Future research should drive industry collaborations and collaborations between inter-disciplinary academic researchers in order to reveal the desired competencies for the future accountants and craft possible strategies to address the gaps.

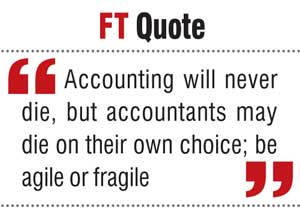

Finally, I must reiterate that accounting will never die as it’s the art and science of tracking, driving and monitoring organisational performance. However, as explained above, the accountants must get out of the traditional rear-view reporting performance mode to driving outcome mode while acquiring new skills specially those complement with the technological advancements to remain relevant and indispensable. This, in my view, is largely in the hands of the accountants, although the academic and professional bodies do have a role to play in facilitating the infrastructure. I would, therefore conclude that accountants may die on their own choice; where they have to choose between being agile or fragile.

(The writer, FCA, FCCA, ACMA, FMAAT, MBA(Fin), B.Sc.Accy.(Sp.)1st Class Hon., is a Chartered Accountant, Thought Leader, Management Consultant and a Corporate Trainer. He can be reached via [email protected].)