Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 29 March 2022 00:22 - - {{hitsCtrl.values.hits}}

The cause for Sri Lanka’s foreign exchange crisis is something that could be understood by anyone. It’s not something to be commented on only by economists, experts and the like.

The cause for Sri Lanka’s foreign exchange crisis is something that could be understood by anyone. It’s not something to be commented on only by economists, experts and the like.

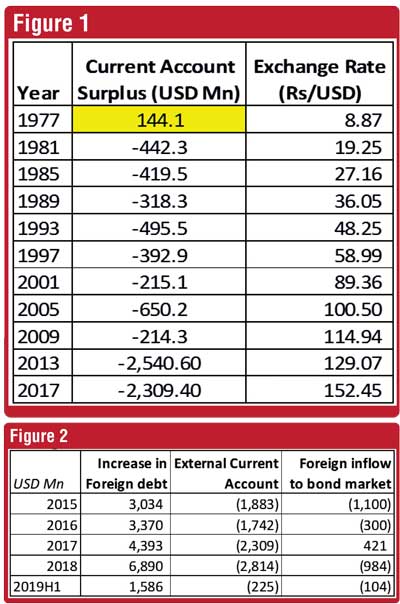

The root cause

To put simply, Sri Lanka has been buying more goods and services from the rest of the world, compared to what it sells to the rest of the world. Around $ 2 billion every year (the average over the last 5 and 10 years), which is effectively financed through foreign debt. Figure 1 and Figure 2 present tables reproduced from our articles “Understanding the fate of the Rupee” in 2018 (https://www.ft.lk/Opinion-and-Issues/Understanding-the-fate-of-the-rupee/14-662146) and “Why foreign earnings could solve the debt problem” in 2020 (https://www.ft.lk/Columnists/Why-foreign-earnings-could-solve-the-debt-problem/4-693639).

This has been happening since 1978, which is the primary reason for the high foreign debt burden. While the earlier loans were at concessionary rates, the latter ones were at market rates, as the country’s economy passed the threshold level and the concessionary rates were no longer available. When one doesn’t live within its means, it’s not sustainable. Somehow, we have managed to go for 44 years, which means the problem has become a crisis now.

Wipe out the external current account deficit immediately

What needs to be done immediately is to wipe out this deficit on a day-to-day basis, i.e., live within our means. Hence the annual import bill has to be brought down (on average) by $ 2 billion p.a. What needs to be essentially imported and not imported has to be understood carefully, rather than a simple devaluation of the Rupee. We have gone from one extreme (artificially keeping Rupee strong) to another (completely floating the currency).

In other words, the imported items need to be prioritised. And this needs to be monitored monthly to ensure implementation. Figure 3 presents the composition of the national import bill in 2021. It was exceptionally high at $ 20.6 billion (28.5% increase from 2020), which means it has to be actually slashed by $ 3 billion in 2022.

Out of these items what should be prioritised? First and foremost is to ensure all foreign earnings sectors function smoothly as if they get affected, we would be forced to curtail imports even further. Hence all types of raw materials, equipment needed for foreign earnings segments have to be imported. This also includes availability of fuel and power. There can’t be queues for fuel and hours of electricity interruptions. Secondly, medicines and intermediate goods required for all other industries need to be imported as much as possible. The rest, have to be either curtailed or even eliminated.

Therefore, the import bill for Food and Beverage and Non-Food Consumer Goods which was around $ 3 billion in 2021 should be brought down to $ 2 billion in 2022. The import bill of around $ 4.5 billion in 2021 for Machinery and Equipment, Building Material and Other Investment Goods should be brought down to $ 2.5 billion. It is a crisis. Surely, we can survive without imported milk powder, apple and cheese (tourists don’t come here for those). And delay building and maintenance of roads, and other infrastructure development projects by two years.

These undesirable items should be curtailed through taxes, outright banning and restricting rather than a simple devaluation of Rupee. Devaluation of Rupee has sent the prices of essential imports higher as well creating another problem. As the undesirable items have also taken a part of the foreign reserve pie, it has crowded out the import of essential items. Therefore, it would be necessary to clearly carve out the undesirable items, and in the process bring the Rupee towards 250 per USD and make the essential items more available.

Isolate the foreign debt problem

Isolate the foreign debt problem

Make no mistake, the above is a short-term solution and no way a permanent solution. Import restrictions are certainly not sustainable. We need to execute a long-term plan so that gradually these import restrictions could be lifted.

Although it’s a short-term measure, what the above exercise does is, it isolates the foreign debt servicing problem. In other words, we live daily within our means, without a requirement for foreign debt. With that in place, we could address the problem of servicing foreign debt with a stronger hand – or have more power in negotiations with lenders. And we do need to service the debt. It’s appalling to note that some are even recommending default. What we need to do is to restructure or reschedule the debt, but certainly repay the foreign debt and keep the unblemished track record intact.

We need foreign funds to service the existing debt. Whether it’s in the form of foreign investments or foreign debt, it would only come if there’s a practical plan which gives the confidence to the lenders or investors that their monies would be returned with an acceptable gain in the future.

The long-term plan

Such confidence could only be given if there’s a strong plan to boost the national foreign earnings in the long run. How could this be done with the Government having no capacity to invest in the short run?

This is something we have spoken about repeatedly over the last several years. Two articles on the subject are “Changing foreign trade policy for an economic miracle” (https://www.ft.lk/Opinion-and-Issues/Changing-foreign-trade-policy-for-an-economic-miracle/14-664791) and “A different National Export Strategy” in 2018 (https://www.ft.lk/Opinion-and-Issues/A-different-National-Export-Strategy/14-660793).

Geo-political strategy and foreign policy at the heart of solution

To put in a nutshell, we desperately need a prudent geo-political strategy and a foreign policy, aimed at addressing the above. The “non-aligned foreign policy” has not got us anywhere in terms of economic development and we need to be aware of the foreign policies adopted by countries that successfully developed their economies over the last several decades. While “non-aligned policy” by itself may not be imprudent, what we have experienced so far is a “non-engaging foreign policy”, as we have not actively sought what we need from any foreign nation in the geo-political divide. We have just been getting what they have offered us, and given in return what they wanted from us.

We need to be clear – we need one thing – we need a country or countries who will buy goods/services from us. And not garments and tea and the likes. But value added and technological products/services. If they are not willing to buy, they should provide technologies so that we could provide such products/services at international standards. The country and countries that provide us these should be our allies. We need to align ourselves decisively with those countries (our economy is too weak to have high ideologies such as “non-aligned”). If both sides of the geo-political divide are willing to provide that, we could remain non-aligned! This is easier said than done, and actually something we should have done years or decades ago. But it has to start now.

We may manage to source $ 2-3 billion from India and China in the near future, which would give us a breathing space of 3-6 months. We need to strike a deal with one or two countries along the above lines within that period, which would send a strong positive signal to foreign investors and lenders (including IMF and rating agencies). We certainly should not waste the $ 2-3 billion due shortly, and act if the crisis is solved. If we do that, the crisis would be much worse three months down the line.

Track record of IMF

Track record of IMF

The main solution to the crisis that is heard today is, IMF. And the reason for the crisis is blamed on the tax cuts introduced in late 2019. These two go hand in hand, as the most recent engagement with IMF around 2017-2018 involved tax increases. Yet, the issue being addressed there is the Government revenue being well short of its income. And not the issue of imports being far greater than exports, which is what we have discussed above (and which is the primary reason for the foreign debt).

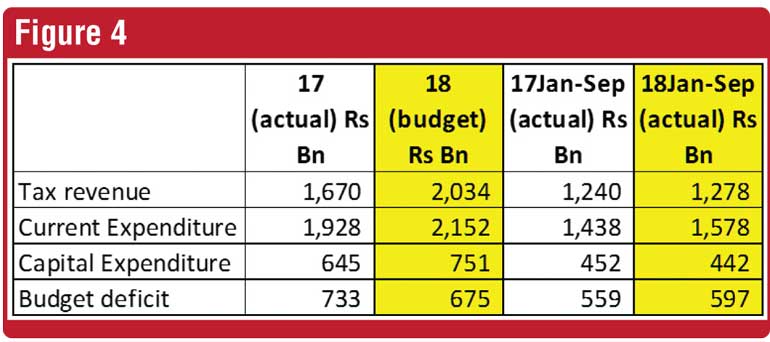

We have written on this topic as well previously – “Are we focusing on the wrong deficit?” in 2019 (https://www.ft.lk/Opinion-and-Issues/Are-we-focusing-on-the-wrong-deficit/14-670904) and “Data exposes faulty IMF advice” in 2018 (https://www.ft.lk/Opinion-and-Issues/Data-exposes-faulty-IMF-advice/56-667611). A table from one of these articles is reproduced in Figure 4.

This shows the fiscal data (government revenue versus expenditure) in 2018, when the IMF program was in place. Taxes had been increased via a new Inland Revenue Act and the budget deficit was expected to reduce. However, the data shows the increase in tax revenue was marginal (less than 3%) in 2018, while the budget deficit has expanded (by close to 4%), despite cutting down on capital expenditure (by over 6%)! In the meantime, the GDP growth was steadily coming down from 5% in 2014 and 2015 to 3.6% in 2017 and 3.3% in 2018. The deficit in the external current account also worsened from around $ 1.9 billion in 2014 and 2015 to $ 2.3 billion in 2017 and $ 2.8 billion in 2018. Weakening economic growth has reduced the tax revenue, contrary to the expectation of IMF recommendations!

Hence, neither this program was able to improve the fiscal situation nor it improved the external balance of payment issue (the need for foreign debt). Yet, the economic growth was coming down, which became an added problem.

The dangers of IMF

This is the danger of IMF intervention. Their recommendations are predominantly on improving Government revenue. The only advise on the external balance of payment issue is usually to float the currency and let market forces determine the exchange rate. There are number of cases in the recent history where IMF programs have been criticised for making matters worse in many countries.

What one needs to understand is, IMF would only put forward a standard set of guidelines. IMF has no in-depth knowledge of every single country’s competitive advantages and the pillars on which the system is kept stable, etc. That should be best known to the particular country. In any case, it is a lender who would only be concerned about how to ensure the money is recovered. When a business borrows, does it ask from the bank how to run the business? Hence, it is almost impossible for IMF to devise the ideal solution for any country, and the same applies for Sri Lanka.

A blind implementation of such recommendations could send Sri Lanka into an economic depression as it is already on the verge of an economic recession with the steep rise in prices. The repercussions could be severe in the social and political fronts as well.

This is not to say that we shouldn’t approach IMF. In fact, we should. There are sections of lenders, rating agencies who would take comfort and confidence in IMF involvement. But the key aspect is to negotiate strongly. To put forward the long-term plan ourselves and get their confidence and not the other way around.

Fiscal discipline – secondary goal

Fiscal discipline – secondary goal

Although secondary in importance, fiscal consolidation also should materialise over time for a sustainable development of the country. In that sense, it is clear that the government expenditure cannot be higher. Therefore, public sector salary increases are out of the question at this point in time. Such increases could only be funded by further tax increases and depreciation of Rupee, which would be an added burden to the cost of living of the non-public sector. Also, infrastructure development needs to slowdown (as mentioned earlier) and the Government expenditure needs to be curtailed as much as possible.

However, tax increases should be avoided unless they are directly targeted at the richest 5% of individuals. Tax burden of the lower and middle classes should not be increased. The cost of living is high as it is, with inflation heading past 20% and even if Rupee is at 250 per USD. Import restriction measures and the inevitable rise in interest rates would add further stress on a significant segment of the population. In fact, whatever concessions to the public could be given best by not increasing taxes applicable to the bottom of the pyramid and by keeping the Rupee a bit stronger (which should be possible by carving out undesirable import items). The prevailing concessions for foreign earnings segments should also continue as it’s crucial that these segments thrive and many more are attracted to these segments.

We have discussed prudent fiscal strategies in the past, including in “Budget – Lessons from success stories” in 2019 (https://www.ft.lk/Columnists/Budget-Lessons-from-success-stories/4-673955). At best what we should do is to maintain the overall fiscal deficit at the current level in the short-term. It is not practical to expect to narrow it in the short-term while we look to narrow the deficit in the external current account.

Who created the crisis?

As mentioned at the very beginning, the foreign exchange crisis has its roots since 1978. The more recent policy errors were from the start of the pandemic.

Understandably, the pandemic was an unprecedented challenge. Even the stronger economies are currently facing challenges caused by the pandemic, in the form of rampant inflation and higher interest rates. The war in Ukraine and crude oil price surpassing $ 100 per barrel are not within our control as well. Yet, the strict island-wide curfew imposed in 2020 March for two months was unbearable for the economy considering the state it was in, at that time. At the time there were almost zero deaths from COVID-19.

In three articles exactly two years ago, I reasoned out the need to open up the economy (https://www.ft.lk/Columnists/Sri-Lanka-s-sovereignty-how-many-lives-is-it-worth/4-698886). The curfew triggered Rs. 5,000 and Rs. 10,000 giveaways, a loss of income for many and loss of tax revenue to Government due to economic inactivity, stresses in businesses which were passed on to banks, etc. A very basic estimate of cost to the economy from the island-wide curfew of those two months would be at least in the range of Rs. 200-300 billion (over $ 1 b). Only much later did we realise the more prudent way of locking down targeted areas, even when we had increasing COVID-19 deaths.

More policy errors occurred thereafter as well. The Government sector salary increases were unaffordable to say the least. Almost a complete relaxation of import controls in 2021 (after the restrictions were placed in 2020) meant a flooding of imports (past $ 20 b in 2021). Some sort of control could have saved close to $ 1 billion. The ill-advised, abrupt stoppage of chemical fertiliser and the artificial defence of Rupee at Rs. 200 since August 2021, are the other notable policy errors in the recent past.

Export heroes

To sum up, while we urgently execute short term measures to address the immediate situation, it is paramount that we don’t delay the long-term solution mentioned earlier. A boom in value added, technological exports may not succeed without a sound geo-political strategy and a foreign policy.

Simultaneously, it is important to give the recognition to the right people. We are a country that talk of heroes – war heroes, medical heroes, etc. But the ones who could solve this foreign exchange crisis are the export heroes. Of course, we need to give due recognition to the traditional exporters of garments and tea. But the elite heroes of the future would be the ones who would get Sri Lanka linked to the global technology value chains. It is time that our mindsets change from only making our children to become doctors and lawyers, to become these technological trailblazers. Then and only then, Sri Lanka will have a bright economic future.

(The writer could be contacted on [email protected].)